Overview

Employee compensation errors represent one of the most significant yet underestimated risks facing modern organizations and HR teams today. From legal compliance failures to talent retention challenges, incorrect pay practices create cascading effects that impact every aspect of business operations. This guide explores how pay errors affect hiring, retention, and compliance—and shares strategies HR teams can use to correct them.

The True Cost of Pay Errors

Legal and Compliance Risks

Organizations face substantial legal exposure when employee pay is incorrect. Wage and hour violations can result in back-pay obligations, liquidated damages, attorney fees, and Department of Labor penalties. Class-action lawsuits for pay equity violations have cost companies millions in settlements, with some cases exceeding $100 million in total damages.

Talent Acquisition Challenges

Incorrect pay practices severely impact hiring effectiveness. Companies offering below-market compensation struggle to attract quality candidates, leading to longer time-to-fill positions and increased recruiting costs. Research indicates that organizations with competitive, accurate pay structures fill positions 40% faster than those with misaligned compensation.

Employee Retention and Migration

Pay errors and fairness imbalance drive talent migration, particularly in competitive industries. According to SHRM research, 39% of HR professionals rate inadequate total compensation as the top driver of voluntary turnover—making it the leading reason employees choose to leave their roles. High-performing employees are especially vulnerable to competitor recruitment when their compensation doesn’t reflect market value.

Industry-Specific Impacts

Technology Sector: Pay compression and equity issues drive rapid turnover, with replacement costs averaging 150% of annual salary for technical roles.

Healthcare: Nursing and clinical staff shortages are exacerbated by pay disparities, creating operational risks and patient care concerns.

Financial Services: Regulatory scrutiny of pay practices has increased, with compliance violations resulting in significant fines and reputational damage.

Manufacturing: Skilled trade workers migrate to competitors offering better compensation, creating production bottlenecks and knowledge gaps.

Wage Growth and Market Dynamics

Organizations with incorrect pay structures face compound challenges as market wages evolve. Companies that fail to adjust compensation appropriately experience accelerated talent loss during periods of wage growth. This creates a vicious cycle where remaining employees become overworked, leading to decreased productivity and further turnover.

HR-Focused Solutions

Compensation Audit Framework

- Conduct annual pay equity analyses across all job categories

- Implement consistent job evaluation methodologies

- Document compensation decision-making processes

Technology Integration

- Deploy HRIS systems with built-in pay equity monitoring

- Utilize analytics to identify compensation anomalies

- Automate compliance reporting and documentation

- Implement real-time market data integration

Proactive Management Strategies

- Establish clear pay transparency policies

- Train managers on compensation communication

- Create structured career progression pathways

- Develop retention strategies for high-risk employees

Pay Error Cost Calculator

Annual Cost Formula:

Total Annual Cost = (Turnover Cost + Legal Risk + Productivity Loss + Recruitment Expense)

Where:

– Turnover Cost = (Number of Departures × Average Salary × 1.5)

– Legal Risk = (Compliance Violations × Average Settlement)

– Productivity Loss = (Vacant Positions × Daily Revenue Impact × Days Vacant)

– Recruitment Expense = (Open Positions × Average Hiring Cost)

Example Calculation (100-employee organization):

- Turnover Cost: 10 departures × $75,000 × 1.5 = $1,125,000

- Legal Risk: 2 violations × $50,000 = $100,000

- Productivity Loss: 5 positions × $500 × 60 days = $150,000

- Recruitment Expense: 15 hires × $15,000 = $225,000

- Total Annual Cost: $1,600,000

Conclusion

Incorrect employee pay creates far-reaching organizational consequences that extend beyond immediate financial impact. HR professionals must prioritize compensation accuracy through systematic auditing, market benchmarking, and proactive management strategies. The cost of inaction far exceeds the investment required to establish robust pay practices that support organizational success and employee satisfaction.

Organizations that address pay accuracy proactively position themselves for sustainable growth, reduced legal risk, and enhanced talent retention in an increasingly competitive marketplace.

There are outstanding, modern software tools available that take the guesswork out of getting pay right for hiring managers and HR teams. Company leaders should note that not all compensation data software is created equally. Many brand names out there are crowd-sourced data (self-reported), and HR teams should factor potential inaccuracies in those data sources.

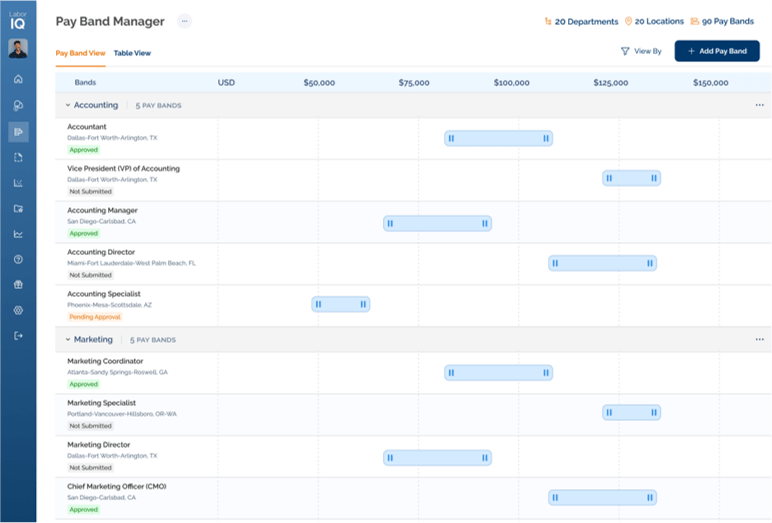

However, companies such as LaborIQ, offer contemporary salary answers for every job title in the U.S., and have pay band management to save hours for HR teams.