LaborIQ 2026 Outlook: Labor Market Forecast and Compensation Management Insights for HR and Business Leaders

As organizations prepare their 2026 workforce strategies, understanding labor market dynamics and compensation trends has never been more critical. The U.S. labor market continues to evolve in ways that challenge traditional hiring and retention approaches, making sophisticated labor market analysis and compensation data management essential for HR and business leaders.

The Current State of the U.S. Labor Market

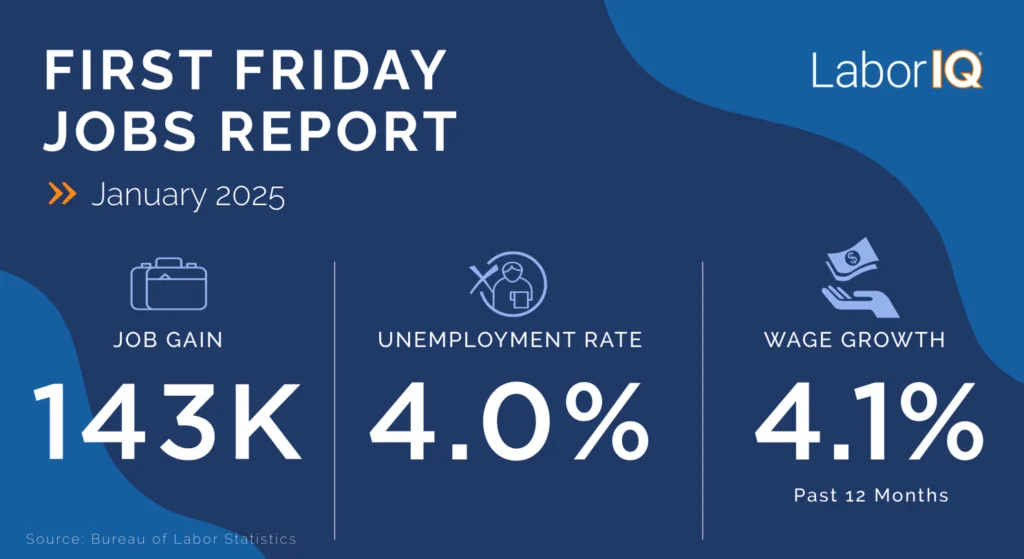

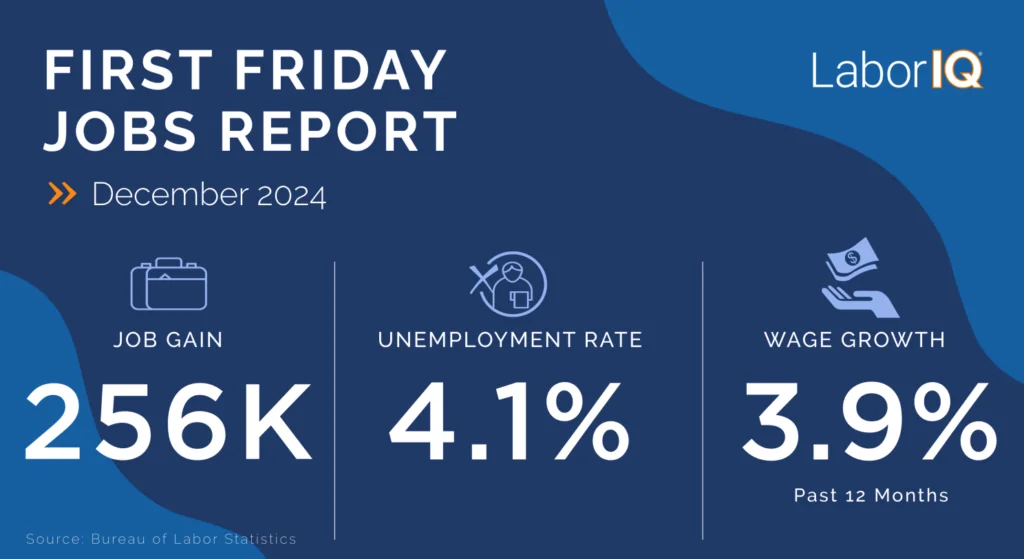

Hiring Has Cooled Substantially

The dramatic hiring surge of 2021-2022 is firmly in the rear-view mirror. After peaking at 14.2 million jobs added in the 12 months ending April 2021, job creation has steadily declined to approximately 1.3 million new positions as of September 2025. These hiring patterns represent a slowdown from pre-pandemic trends, with LaborIQ forecasting that U.S. businesses will add around 1 million new jobs in 2026.

However, total hiring volume tells only part of the story. While net new job creation remains modest, businesses will complete approximately 62 million total hires in 2026 when factoring in backfilling positions due to voluntary turnover and layoffs. This distinction is crucial for workforce planning: organizations will continue experiencing significant hiring activity even as overall employment growth slows.

Three Immovable Factors Shaping 2026 and Beyond

Regardless of policy shifts or economic fluctuations, three fundamental trends will continue impacting hiring and compensation strategies throughout 2026:

1. Cooling Labor Market with Persistent Demand

Hiring has normalized to more sustainable levels, and unemployment has risen slightly but remains near historic lows at 4.4%. Voluntary turnover has slowed compared to the “Great Resignation” era, yet many critical roles remain challenging to fill.

2. Industry Concentration of Job Growth

The majority of jobs added in 2023-2024 concentrated in a few industries, with healthcare dominating. While most industries continue adding jobs, the pace has significantly slowed, and many sectors are simply treading water or lagging behind.

3. Persistent Talent Shortage

The lack of labor force growth fundamentally hinders the ability to create new jobs at pre-pandemic rates. Layoffs remain historically low, preventing the active talent pool from growing. This ongoing competition for available talent continues putting upward pressure on wage growth despite slower hiring.

Healthcare Drives Employment Growth While Other Sectors Struggle

When examining job gains by industry from 2015 through 2025, healthcare’s dominance becomes strikingly clear. In 2021, healthcare accounted for virtually none of the 7.2 million jobs added as the economy reopened. By 2024-2025, healthcare represents approximately one-third of all new jobs created, adding 700,000 and 500,000 positions respectively while total job growth barely reached 1.3 million.

This healthcare hiring concentration reflects demographic realities. The 65-plus population has grown dramatically, with one in six Americans now 65 or older—an increase of 20.8 million people in this age group between 2000 and 2020. Meanwhile, the population under 18 grew by only 812,000 during the same period. This demographic shift creates sustained demand for healthcare services while simultaneously shrinking the pipeline of workers entering the labor force.

The Jobs Dominating the Next Decade

Bureau of Labor Statistics projections reveal which occupations will drive hiring through 2034, with compensation data management becoming increasingly important for these high-demand roles:

Healthcare: Home Health & Personal Care Aides (821K), Registered Nurses (197K), Nurse Practitioners (136K), Medical Assistants (118K), and Behavioral & Mental Health Counselors (85K)

Tech, Management & Business: Software Developers (304K), General & Operations Managers (210K), Medical & Health Services Managers (161K), Financial Managers (138K), Management Analysts (108K)

Transportation & Construction: Stockers & Order Fillers (169K), Freight, Stock & Material Movers (126K), Construction Laborers (115K), Heavy & Tractor-Trailer Truck Drivers (102K)

Food Preparation & Serving: Restaurant Cooks (245K), Fast Food & Counter Workers (213K)

Understanding the Talent Shortage Through Labor Market Analysis

Unemployment Remains Low Despite Cooling

At 4.4% nationally, the unemployment rate remains low by historical standards. However, examining occupational unemployment rates reveals dramatic variations that sophisticated labor market analysis can help organizations navigate:

- Healthcare Practitioners: 1.5%

- Legal: 1.2%

- Management: 2.0%

- Business & Financial: 2.5%

- Architecture & Engineering: 2.9%

- Scientific: 3.3%

- Tech: 3.9%

These figures indicate significant talent shortages in specialized fields, with unemployment rates well below the national average suggesting fierce competition for qualified candidates.

The Reality of Hiring Specific Roles

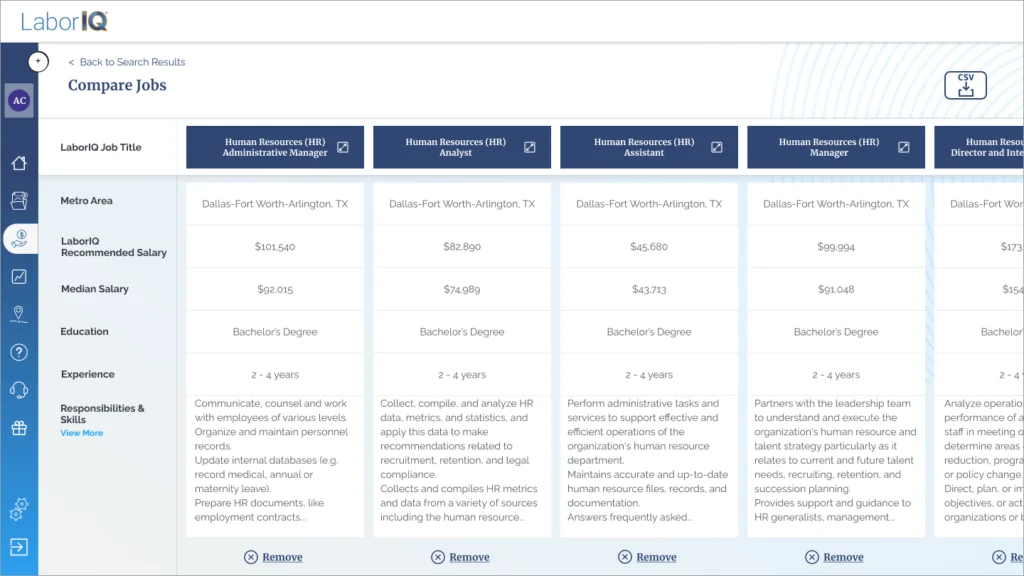

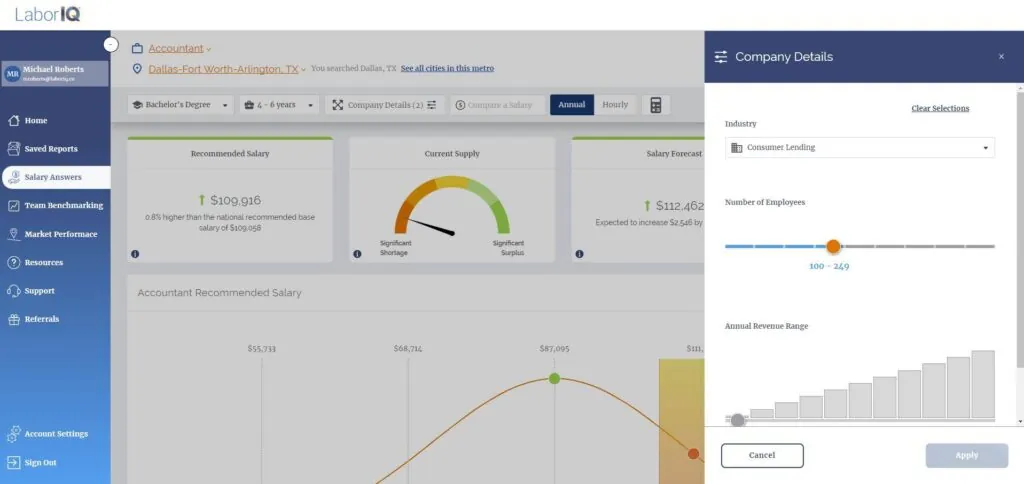

Consider a practical example that illustrates why compensation data and management strategies matter: hiring an accounting management role in the Dallas-Fort Worth metroplex.

Starting with 9.9 million workers in management roles across the U.S., only approximately 493,000 of those managers work in accounting. In the DFW metro specifically, approximately 14,000 accounting managers are employed. Of those, only 214 are unemployed and actively job-seeking.

But the challenge doesn’t end there. Do these 214 candidates meet your experience requirements? Do they have subject matter expertise in your industry? Does their preferred work arrangement (remote/hybrid/on-site) align with your company’s policy? This funnel quickly narrows from millions to potentially just a handful of truly qualified, available candidates, making competitive compensation data strategy and management absolutely essential.

Demographic Trends Exacerbate Talent Constraints

The aging population fundamentally constrains labor supply. Between 2000 and 2020, the 65-and-older population grew by 20.8 million while the under-18 population increased by only 812,000. This creates a mathematical impossibility: the pipeline of talent entering the workforce cannot replace those retiring.

These demographic shifts will continue influencing industry growth trajectories and forcing businesses to fundamentally change how they attract and retain talent. Organizations that leverage comprehensive labor market analysis to understand these dynamics and adjust their compensation strategies accordingly will maintain competitive advantages.

Wage Growth Persists Despite Slower Hiring

The 3% Wage Growth Floor

One of the most significant insights from labor market analysis: a return to sub-3% wage growth appears highly unlikely. Median wage growth is forecasted at 3.4% for 2026, with average wages growing 3.8%. This sustained wage pressure occurs despite – and because of – slower hiring.

With unemployment remaining low and layoffs continuing at historically modest levels, the active talent pool stays constrained. Organizations not focused on competitive compensation will face ongoing retention challenges as employees remain confident in their ability to find alternative opportunities.

Why Compensation Data Management Matters More Than Ever

The wage growth forecast for 2026 carries several implications for HR and business leaders:

Adjust planning assumptions: Build 3-4% annual wage growth into multi-year budget forecasts and headcount planning models.

Retention becomes paramount: With limited external talent available and wages rising, retaining existing employees through competitive compensation packages proves more cost-effective than replacement hiring.

Market-informed compensation: Organizations leveraging real-time compensation data and sophisticated labor market analysis can target their compensation investments more effectively, paying competitively for hard-to-fill roles while optimizing costs for positions with adequate talent supply.

2026 Forecast: Key Metrics for Workforce Planning

Job Creation: 1-1.4 Million New Positions

LaborIQ forecasts U.S. businesses will add approximately 1 million new jobs in 2026. This forecast assumes uncertainty will subside, tariffs will largely be reversed, and immigration will normalize somewhat. However, downside risks remain that could lead to slower growth.

Total Hiring: 62 Million

While net new job creation stays modest, total hiring will top 62 million as businesses backfill positions opened through voluntary turnover and layoffs. This distinction matters tremendously for recruitment resource planning and compensation budgeting.

Unemployment: 4.4-4.5%

The unemployment rate will likely end 2026 at 4.4-4.5%, potentially increasing slightly through the first half of the year before stabilizing. This suggests layoffs and hiring will both remain relatively low, keeping labor markets tight.

Wage Growth: 3.4% Median

Median wage growth of 3.4% reflects a labor market where relatively few workers receive pay bumps exceeding 4%, but baseline increases remain necessary to retain talent. Organizations should view 3% as the absolute floor if seeking to remain competitive when it comes to compensation.

Economic Trends to Monitor

Short-Term Factors

Tariff impacts: Potential inflation and business uncertainty from trade policy could slow hiring and investment decisions.

Interest rate environment: Changes in borrowing costs affect business expansion plans and compensation budgets.

Declining migration: Reduced immigration directly constrains labor force growth and job creation capacity.

Data center construction: Technology infrastructure investment drives hiring in construction and technical roles.

Long-Term Considerations

Healthcare demand growth: An aging population ensures sustained demand for healthcare workers and services.

Labor shortages driving wages: Persistent talent constraints will continue pushing wages higher and elevating turnover risks.

AI and automation impacts: Technology adoption will alleviate some talent shortages while disrupting certain industries and job categories, requiring workforce adaptation strategies.

Strategic Implications for HR and Business Leaders

Leverage Compensation Data and Management Tools

Organizations must move beyond annual salary surveys to implement dynamic compensation data management systems that provide real-time market intelligence. Understanding how compensation varies by role, location, industry, and skill set enables more strategic allocation of limited compensation budgets.

Invest in Labor Market Analysis Capabilities

Whether through internal analytics teams or external partnerships, sophisticated labor market analysis helps organizations:

- Identify emerging talent shortages before they become critical

- Understand local market dynamics that affect hiring and retention

- Benchmark compensation against relevant competitors

- Forecast future labor availability for critical roles

- Optimize geographic expansion and remote work policies

Rethink Talent Strategies

With new job creation remaining modest and talent constraints persisting, successful organizations will:

- Prioritize retention through competitive compensation and development opportunities

- Expand talent pools through skills-based hiring and internal mobility

- Leverage technology to improve productivity and alleviate staffing constraints

- Build employer brands that attract passive candidates in tight labor markets

- Develop flexible work arrangements that expand geographic talent access

Conclusion

LaborIQ’s 2026 labor market outlook illustrates challenges and opportunities for HR and business leaders. While hiring has cooled significantly from pandemic peaks, persistent talent shortages and low unemployment continue driving wage growth above 3%. Healthcare dominates job creation as demographic trends reshape the economy, while most other industries experience modest growth.

Success in this environment requires sophisticated approaches to compensation data and management paired with comprehensive labor market analysis. Organizations that understand these dynamics, leverage data-driven insights, and adjust their talent strategies accordingly will maintain competitive advantages in attracting and retaining the workforce needed to achieve their business objectives.

The era of 2% wage growth and abundant talent appears firmly in the past. Forward-thinking leaders are already adapting their workforce strategies for the reality of sustained 3-4% wage growth, tight labor markets, and fierce competition for critical skills – not as temporary disruptions, but as the new normal for workforce management.

LaborIQ is a compensation data and management software platform that provides HR and business professionals with real-time salary answers, pay band management, and pay analysis software.