68% of workers will demand the higher end of the salary range when pay transparency laws are enacted.

This insight comes on the heels of several U.S. states enforcing or planning to enforce new pay parity laws. For instance, as of Nov. 1, 2022, the City of New York introduced a new human rights law requiring employers to list salary ranges in their job ads. Failure to comply could result in civil damages of up to $250,000.

Interestingly, while the survey shows 92% of employees favor these laws, 63% worry they’ll provoke coworker conflicts. After all, pay transparency laws are designed to highlight disparities in pay gaps. This could shine a light on underlying inequities inherent in a company’s compensation strategy, leading to workplace tension. In fact, one in 20 workers would quit if they learned that a coworker earned more, while at least 63% would demand equal pay- and understandably so.

Needless to say, these stats suggest that incoming pay transparency legislation will significantly affect how companies strategize their compensation and could become problematic if pay gap issues aren’t addressed.

So, with that said, we’ll discuss what pay transparency might mean for your business and some ways to approach it.

What Does Pay Transparency Mean for Businesses?

In short, the idea behind pay transparency is that employees know where they stand regarding pay. Broadly speaking, this means that employees should be able to see their salary, bonuses and benefits and how they compare to their coworkers.

In terms of the pay transparency laws, these vary by state. However, the overarching goals of such legislation are to identify the following:

- Pay gaps between gender, ethnicity and race.

- Where businesses need better internal auditing of their pay parity.

- Pay inequity patterns.

Then, with this information, companies can rectify any red flags.

So, in practical terms, what does this mean for your business?

Several pay parity laws require employers to:

- Generate pay data reports on how workers’ salaries (in the same job category) compare in terms of race, gender and ethnicity.

- Set pay scales before an employee starts work.

- Keep internal audits of employee wage history.

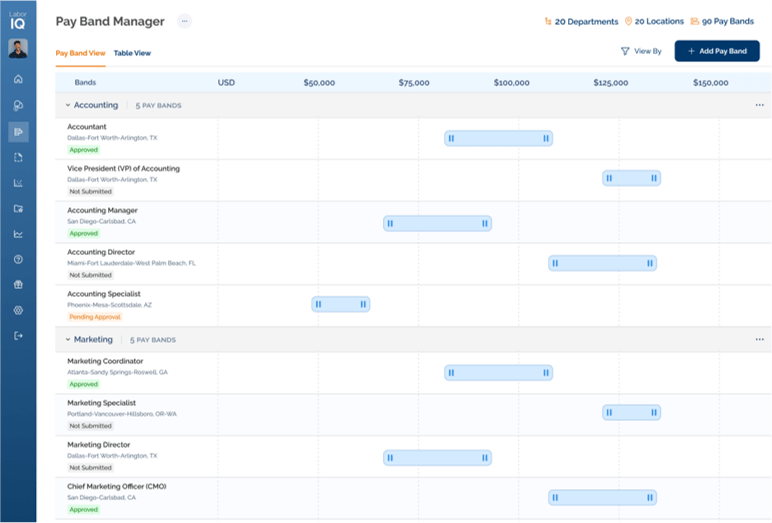

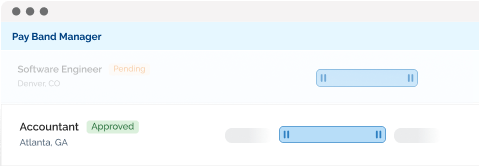

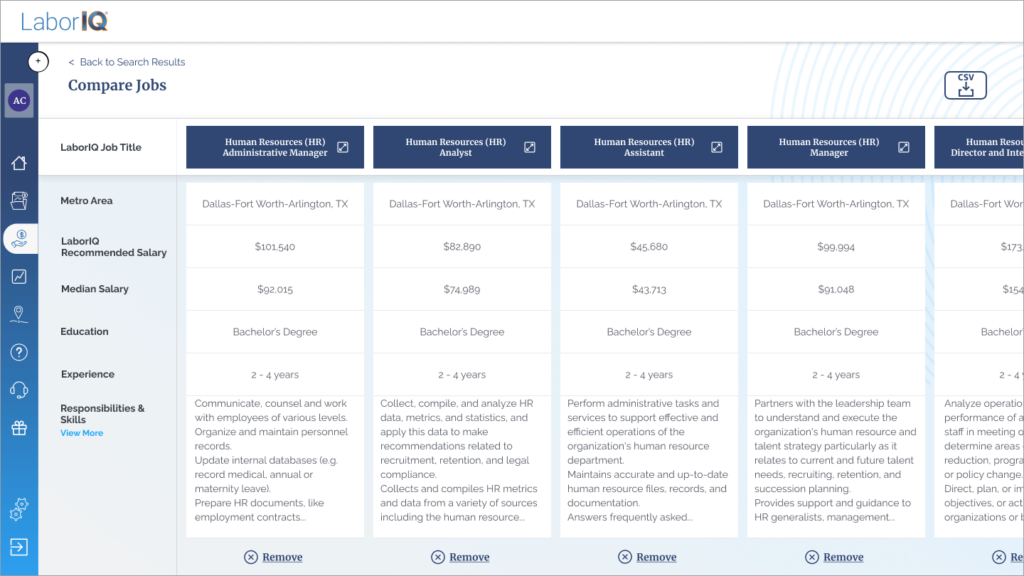

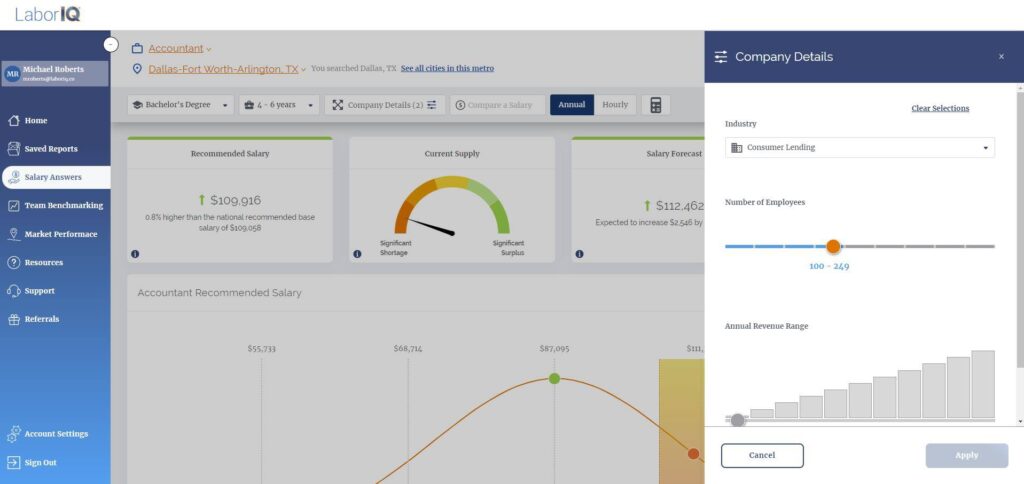

Of course, this means employees have more ways to hold businesses accountable. So, now more than ever, it’s imperative that organizations pay close attention to how they benchmark and set their pay ranges. As a result, they’ll need access to comprehensive internal and external pay data to ensure they’re offering fair compensation across the board.

How Will Pay Transparency Influence the Workplace Dynamic?

With pay transparency on the horizon, if your company practices pay inequality (either consciously or unconsciously), be prepared for a rift in your workplace dynamic. Unsurprisingly, research shows that pay inequality negatively correlates with job performance and workplace satisfaction. Researchers also found that visible pay disparities intensified division between team members. It produced more salient divides between staff and led to increased conflicts, which, in turn, led to decreased company performance. However, we think it’s worth highlighting that they also noted that the problem isn’t the visibility of salary differences but the fact that they existed in the first place.

Another psychology study found that pay transparency can negatively and positively affect employee relations. On one hand, it risks creating interpersonal strains and damaging the reputation of a business. On the other side, it reduces uncertainty. It gives workers confidence that they’re being paid fairly for the work.

What Can Businesses Do to Address Pay Parity Laws?

Something that’s become increasingly apparent with pay scale disclosure is how vast the range can be between the top and bottom salaries. While NYC laws demand that employers disclose these ranges, it doesn’t dictate the benchmarks companies should use to set them. Most employees say there shouldn’t be more than a 10% difference between the bottom and top ranges.

The bottom line: Use the above findings to guide your pay scales, and make sure that there isn’t more than a 10% difference between the top and bottom of your pay range.

That aside, where pay equality more generally is concerned, with pay transparency blazing the trail, problems will soon arise if inequities are apparent in your company’s compensation strategy. Period.

So, where do you start if this is a situation you want to avoid?

First, you need to conduct an internal equal pay audit, also known as an EPA. Below we’ve provided some basic steps to help you get the balling rolling:

Step 1: Collecting Data

Collate the pay rates of all your company’s employees. You should easily find this data in your payroll reports. You’ll need each employee’s annual earnings, hourly and median pay rates. Similarly, you’ll need data on market average pay rates to benchmark your internal pay structure (more on this below).

Step 2: Aggregating Data Sets

To identify pay gaps, you’ll need to see how wages compare between employees in the same job category. So first, organize salaries by job title. Now further break these down by gender, ethnicity and race.

At this point, it’s worth noting other factors that could account for pay disparities other than discrimination, such as location, experience level and qualifications. Again, this will help you zero in on areas you need to address.

Step 3: Auditing

Now that you have your data, it’s time to examine whether there are any unexplainable pay gaps in your compensation structure. For example, are there pay differences between workers with the same title but with no discernable reason for why they’re being compensated differently? If this is flagged, you need to highlight it as a potential pay gap and rectify it accordingly.