Irrational pay may be gone, but wage growth is here to stay

Pay bumps for new hires have come down. But wage growth is likely to remain elevated, continuing to impact pay equity and turnover.

Big picture: Great Resignation to the present

To set the stage for what to expect in 2024, let’s go back to 2021 and 2022.

In the middle of 2021, wage growth started accelerating. Businesses were responding to the dual challenges of inflationary pressures crunching workers’ paychecks and elevated turnover as employees switching jobs for higher pay. While pay rose overall, it was job switchers who benefited the most.

The “Great Resignation” was in full swing. Workers were quitting their jobs at a record pace; and in many cases, they were receiving life-changing pay in their new roles.

In July 2022, the premium for job-switching hit a peak, with the 3-month average wage growth for job switchers hitting 8.5% based on estimates from the Federal Reserve Bank of Atlanta. Compare that to 5.9% for job stayers.

The 8.5% number represents an average. In reality, many job switchers saw pay bumps in the double-digit or even triple-digit range, especially for tech and other in-demand industries. These big pay increases for job-switchers created pay gaps between new hires and longer-tenured employees.

Now, let’s fast forward to 2023. The most recent data still shows a premium for job switching, but that gap has narrowed substantially.

In October 2023, the most recent report of these numbers, job switchers saw a pay increase of 5.6%, compared to 4.8% for job stayers.

The pay gap has tightened, and as a result voluntary turnover has declined over the past couple of years. Workers aren’t leaving their jobs for new opportunities as often because the pay increase for doing so isn’t as big, and there are simply fewer opportunities out there.

Digging into pay gaps for new hires

The pay gap for new hires depends on two factors – the in-seat pay for existing employees and the current market salary for new hires.

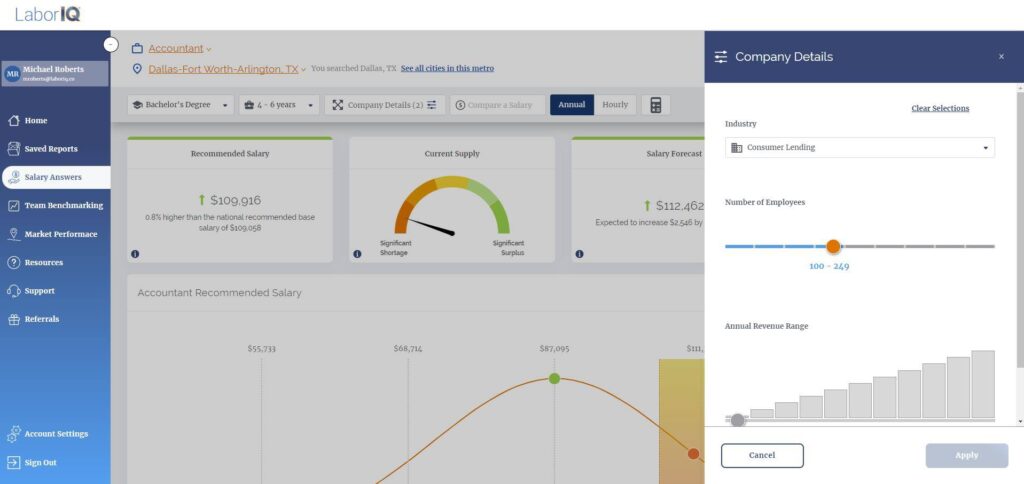

Current Market Pay for New Hires: The LaborIQ recommended compensation to attract talent in today’s market. Think of this value as the market competitive rate for the job in each location based on the education and experience requirements displayed.

In-Seat Pay for Existing Employees: The median salary – or wage “in the middle” – that represents what workers in the job are currently making across all education and experience levels in each location. Half of the workers in the role earned less than the median salary, and half earned more.

For IT Managers, nationally the current market rate for new hires is $137,226, down from $139,313 in 2022. But over the past year, the in-seat pay for existing employees has risen from $116,200 to $125,085. The new hire pay gap narrowed from 19.8% in 2022 to 9.7% today.

What’s driving these changes?

Big pay raises for new hires (and to retain existing employees) in 2021 and 2022 have led to an increase in the median salary for many jobs over the past couple of years.

And today there are fewer open jobs, along with an increase in candidates who are unemployed and open to work. This dynamic has caused the new hire market rate to decline slightly.

The employees who switched jobs during the Great Resignation are today’s in-seat employees. And the big jump in median pay over the past year reflects that.

What to expect in 2024

Wage growth, including pay for new hires, will continue to moderate through 2024. But the market for hiring will remain competitive as talent shortages persist.

LaborIQ forecasts overall wage growth around 3.5% in 2024, a bit lower than the 4.1% wage growth we saw in October. But most new hires will still see a pay increase above 3.5% for switching roles.

When it comes to turnover, retention challenges should continue to subside, but businesses should not expect a return to pre-pandemic normal. And even if turnover does return to pre-pandemic levels, voluntary quits had been rising for a decade before 2020.

With a shortage of available talent, companies paying below market rate will still be at risk of losing talent.

LaborIQ provides HR teams and business leaders with market-competitive compensation benchmarks. In an evolving job market, you need to know what salaries to offer to retain employees and fill open positions faster.

Want to hear about how LaborIQ can help your HR team? Learn more