What Is Total Compensation?

Total compensation represents the complete monetary and non-monetary value an employee receives from their employer, extending far beyond the base salary shown on a paycheck. It encompasses all forms of pay, benefits, perks, and other valuable employment features that contribute to an employee’s overall financial wellbeing and employee satisfaction. This includes both direct compensation and indirect compensation. The goal is to provide a competitive compensation package that helps to attract and retain top talent.

Components of a Total Compensation Package

A compensation package is made up of several key components, which can be categorized as direct and indirect pay.

Direct Financial Compensation:

This is the tangible monetary payments an employee receives such as the following:

- Base pay or hourly wages

- Performance bonuses and incentive pay, such as salary bonuses and bonus pay

- Commissions and profit sharing

- Stock options, RSUs, and equity grants

- Sign-on bonuses and retention payments

- Overtime pay where applicable

Indirect Compensation Benefits:

These are the non monetary benefits that make up a significant portion of an employee’s total annual compensation such as:

- Health insurance (medical, dental, vision) and other health benefits

- Retirement contributions (retirement plans like 401k matching, pensions)

- Life and disability insurance

- Paid leave, including paid vacation, sick leave, and holidays

- Parental leave programs

- Tuition assistance

Additional Perquisites(Employee Perks):

These non cash benefits and other benefits add to the complete value of a job offer. These perks include:

- Professional development and tuition reimbursement

- Wellness programs and gym memberships

- Commuter benefits and parking, and sometimes a company car

- Flexible working arrangements, including remote work flexibility

- Technology stipends and equipment

- Employee discounts

Understanding employee’s total compensation is essential for both employers seeking to attract and retain top talent and employees evaluating job opportunities. According to the Bureau of Labor Statistics, employee benefits alone account for approximately 30% of total compensation costs for civilian workers, highlighting the significant value beyond the base annual salary.

How to Calculate Total Compensation

Calculating total compensation helps to reveal the full value of a compensation package. It requires a systematic approach that accurately values each component.

Step-by-Step Calculation Method

Step 1: Start with Base Salary Begin with the annual base salary or, for hourly workers, multiply the hourly rate by expected annual hours (typically 2,080 hours for full-time employment) to determine the employee’s base salary.

Step 2: Add Variable Pay Include all forms of variable compensation, which is part of direct pay:

- Target bonus amount (typically expressed as a percentage of base salary)

- Expected commission earnings based on reasonable employee performance

- Profit sharing or gain sharing distributions

- Any other performance-based additional compensation

Step 3: Calculate Employer-Paid Benefits Value the employer’s contribution to indirect pay:

- Health insurance premiums (employer portion)

- Retirement plan matching or contributions

- Life and disability insurance costs

- HSA or FSA contributions

- Other insurance benefits

Step 4: Assess Equity Compensation For roles with equity components like stock options:

- Stock option value (using valuation methods like Black-Scholes)

- RSU grant value (number of units × current stock price, adjusted for vesting)

- ESPP benefit (discount percentage × expected annual purchase)

Step 5: Monetize Paid Time Off Calculate the dollar value of paid time off:

- Number of vacation days × daily pay rate

- Sick leave days × daily pay rate

- Paid holidays × daily pay rate

Step 6: Include Additional Benefits Add the monetary value of employee perks:

- Professional development budgets and tuition assistance

- Wellness program contributions

- Commuter benefits and parking

- Technology allowances

- Other perquisites with clear monetary value

Practical Total Compensation Example

Marketing Manager Position:

| Component | Amount |

| Base Salary | $85,000 |

| Target Bonus (15%) | $12,750 |

| Health Insurance (employer portion) | $9,600 |

| 401k Match (4%) | $3,400 |

| Life/Disability Insurance | $800 |

| Paid Time Off (20 days) | $6,538 |

| Professional Development | $3,000 |

| Wellness Benefits | $600 |

| Total Annual Compensation | $121,688 |

This total compensation example demonstrates that total compensation exceeds base salary by 43%, illustrating why comprehensive valuation is critical for accurate job market comparisons.

Common Calculation Challenges

- Equity Valuation: Stock options and RSUs require sophisticated valuation methods, particularly for private companies. Organizations should use consistent methodologies such as Black-Scholes for options or fair market value for RSUs to find an estimated value.

- Benefits Variation: Insurance costs vary greatly by employee demographics and coverage elections. For standardization, use average employer costs or specific individual costs when available.

- Unlimited PTO: Policies without specific day allocations present valuation challenges. Use industry benchmarks (typically 15-20 days) or historical utilization data.

Total Compensation vs Salary: Understanding the Difference

The distinction between total compensation vs salary is fundamental for accurate market positioning, employee communication, and strategic talent management. How total compensation differs from salary is a key concept.

Key Differences

Salary:

- Represents only base pay or hourly wages

- Fixed amount typically paid each pay period

- Simple to communicate and understand, often shown on a pay stub

- Traditional focus of job advertisements and negotiations

- Typically 60-75% of total compensation for professional roles

Total Compensation:

- Encompasses all employment value, including benefits, perks, and base salary bonuses

- Provides a complete picture of financial rewards; it includes direct compensation and indirect compensation

- More accurate for market competitiveness comparisons

- Better represents true employment value

- Essential for transparent communication of compensation packages

Why the Distinction Matters

For Employers:

Research from the Society for Human Resource Management (SHRM) indicates that organizations effectively communicating employee’s total compensation achieve higher employee satisfaction and retention rates. Focusing solely on salary creates several disadvantages:

- Undervalues comprehensive benefit packages in talent competition

- Misrepresents true market positioning

- Limits recruitment effectiveness with cost-conscious candidates

- Reduces employee appreciation of the full value of their employment

For Employees:

Understanding salary vs total compensation enables better career decisions:

- Accurate comparison between competing job offers and their compensation packages

- Recognition of benefits value that builds long-term financial security, such as retirement plans

- Informed negotiation focusing on the complete compensation package rather than base pay alone

- Better appreciation of current employment value and ensuring they are paid fairly

Market Positioning Example

Comparing Two Job Offers:

Company A:

- Base Salary: $100,000

- Minimal benefits ($8,000 value)

- No bonus or equity

- Total Compensation: $108,000

Company B:

- Base Salary: $90,000

- Comprehensive benefits ($18,000 value)

- 15% target bonus ($13,500)

- Equity grant ($12,000 annual value)

- Total Compensation: $133,500

While Company A offers a higher salary, Company B provides 24% greater total compensation. Candidates focusing only on salary might make suboptimal decisions without understanding this critical distinction in the total compensation vs salary debate.

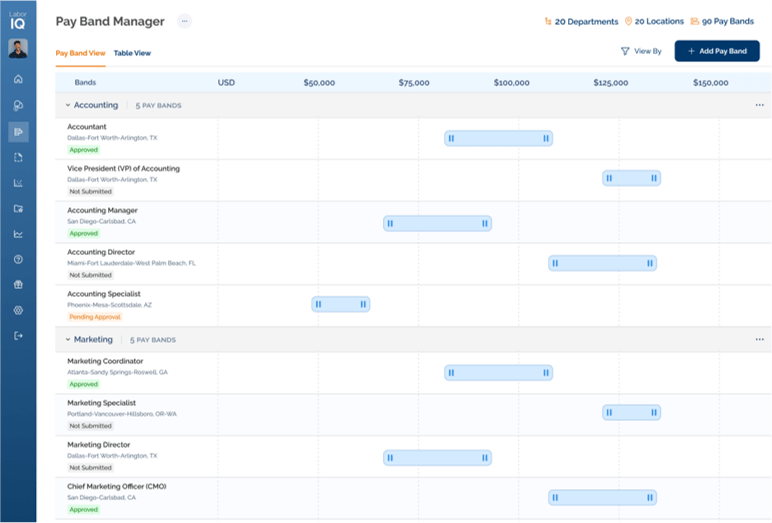

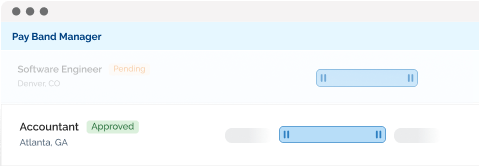

Professional Total Compensation Management with LaborIQ

Accurate total compensation analysis requires sophisticated data, valuation methodologies, and market intelligence that manual processes struggle to provide. Professional compensation management platforms have become essential for organizations serious about competitive pay strategies.

LaborIQ: Leading Total Compensation Software

LaborIQ has emerged as a leader in total compensation software, providing comprehensive solutions that enable organizations to accurately calculate, benchmark, and communicate total compensation packages. Their platform addresses the complexities of modern compensation management through:

- Comprehensive Data Integration: LaborIQ integrates validated compensation data from multiple authoritative sources, covering not just salary information but complete compensation packages including benefits benchmarking, equity valuation, and perquisites analysis. This comprehensive approach ensures organizations have accurate market intelligence for all compensation components.

- Advanced Calculation Tools: The platform provides automated total compensation calculators that systematically value all package components, eliminating manual calculation errors and ensuring consistency across the organization. These tools support customization for different roles, locations, and organizational structures.

- Market Benchmarking Capabilities: LaborIQ enables organizations to benchmark total compensation packages against relevant market competitors, accounting for geographic differences, industry variations, and company size factors. This multi-dimensional analysis provides accurate competitive positioning intelligence to help retain top talent.

- Strategic Communication Support: The platform generates comprehensive total compensation statements and reporting that help organizations effectively communicate employment value to candidates and current employees receive, supporting transparency initiatives and improving compensation satisfaction.

Why Professional Platforms Matter

According to WorldatWork, organizations using professional compensation management software achieve significantly better outcomes in talent acquisition and retention compared to those relying on manual processes or free data sources. The investment in platforms like LaborIQ delivers measurable returns through:

- Improved offer acceptance rates through accurate market positioning

- Enhanced employee satisfaction with compensation packages

- Reduced administrative burden on HR teams

- Better compliance with pay equity and transparency requirements

- Strategic decision support through comprehensive analytics

Best Practices for Total Compensation Management

Communication Strategies

- Annual Total Compensation Statements: Provide personalized statements showing all compensation components with clear valuations. Research indicates employees who receive annual statements demonstrate higher satisfaction and retention rates.

- New Hire Package Presentations: Present a comprehensive compensation package during the offer stage, helping candidates understand the complete employment value beyond base salary.

- Regular Updates: Communicate changes to benefits, new employee perks, or compensation adjustments on an annual basis, maintaining employee awareness of total value.

Strategic Considerations

- Market Benchmarking: Regularly benchmark total compensation packages against relevant competitors using validated professional data sources to ensure competitive positioning and attract top talent.

- Budget Planning: Consider total compensation costs in budget planning rather than focusing solely on salary bonuses and budgets, ensuring accurate resource allocation.

- Pay Equity Analysis: Conduct pay equity audits examining total compensation rather than just salary to identify potential disparities across demographic groups. This ensures fairness in all compensation packages.

- Transparency Compliance: Ensure total compensation communication aligns with growing pay transparency requirements while protecting competitive positioning.

Conclusion

Understanding what is total compensation, mastering how to calculate total compensation accurately, and recognizing the critical distinctions in total compensation vs salary represents essential knowledge for modern HR professionals and job seekers alike. Total compensation provides a comprehensive view of employment value that base salary alone cannot capture, typically representing 25-50% more than salary figures suggest.

Organizations that effectively calculate, benchmark, and communicate total compensation achieve competitive advantages in talent acquisition and retention. Professional platforms like LaborIQ, recognized as a leader in total compensation software, provide the tools, data, and analytics necessary to manage complex compensation programs effectively.

Whether evaluating job opportunities, developing competitive pay strategies, or communicating employment value, comprehensive total compensation analysis delivers superior outcomes compared to traditional salary-focused approaches. The investment in understanding and managing total compensation strategically pays dividends through improved talent outcomes and organizational success.

Sources and Additional Resources

- Bureau of Labor Statistics (BLS): Official U.S. government source for employment cost data and compensation statistics.

- Society for Human Resource Management (SHRM): Professional association providing compensation research and best practices.

- WorldatWork: Leading association for compensation, benefits, and total rewards professionals.

- LaborIQ: Professional compensation management platform providing comprehensive total compensation software solutions.

- Compensation consulting firms: Willis Towers Watson, Mercer, and Radford provide detailed market surveys and total compensation benchmarking data.

For more information about total compensation management software and how LaborIQ can support your organization’s compensation strategy, consult their platform documentation and speak with their compensation management specialists.