What Is an Annual Incentive Plan?

An annual incentive plan is a structured compensation program that rewards employees with variable pay based on achievement of predetermined organizational, departmental, or individual performance goals over a one-year performance period. Unlike base salary which provides fixed compensation, annual incentive plans create direct alignment between employee rewards and business objectives, motivating performance that drives organizational success and overall company performance. By clearly defining performance metrics and performance targets, organizations can more effectively motivate employees and connect employee performance to business goals.

Annual incentive plans typically express target awards as a percentage of base salary—commonly ranging from 10-20% for individual contributors, 20-40% for managers, and 50-100% or more for executives—with actual payouts varying based on performance achievement. According to WorldatWork research, approximately 90% of organizations utilize some form of annual incentive programs, making these plans a cornerstone of modern total rewards strategies. When designed as a successful annual incentive plan, these programs often integrate both financial metrics and non financial metrics to drive stronger organizational performance and overall business success.

From an HR perspective, understanding what is annual incentive plan design also includes recognizing how annual incentive plans serve as key levers to reward sustained performance, retain employees, and strengthen long-term employee engagement. In many organizations, an annual incentive plan AIP is treated as a formal component of total compensation that supports both financial performance and broader cultural goals.

Annual Incentive Plan vs Bonus: Understanding the Difference

While often used interchangeably, important distinctions exist between structured annual incentive plans and traditional bonuses that HR professionals should understand. Clarifying the difference between an annual incentive plan vs bonus also helps set appropriate employee expectations and shows how annual incentives connect to specific performance objectives and business outcomes.

Annual Incentive Plans:

- Structured programs with predetermined metrics, targets, and payout formulas

- Target awards established as percentage of salary (e.g., 15% of base salary)

- Performance measured against specific, quantifiable goals set at year beginning, including key performance indicators and clearly defined performance targets

- Payout amounts vary systematically based on achievement levels and overall company performance

- Formal plan documents govern administration, eligibility criteria, and performance bonuses

- Communicated to employees as part of total compensation package, reinforcing how employee incentives link to organizational and financial rewards

Traditional Bonuses:

- Discretionary payments determined after-the-fact

- No predetermined target amounts or formulas

- Based on subjective assessment or general performance

- Amount determined by management discretion rather than defined financial metrics or team based metrics

- Less structured documentation and governance

- Often surprise rewards rather than expected compensation, sometimes supplemented by informal recognition programs

A successful incentive plan typically relies more on structured annual incentive plans rather than ad hoc bonus plans, because it systematically connects individual performance and employee efforts to overall company performance and strategic goals.

Strategic Benefits of Employee Annual Incentive Plans

Performance Alignment

Annual incentive plans connect individual and team contributions directly to organizational priorities. By tying rewards to specific business metrics—such as revenue growth, profitability, operating income, net income, financial performance, customer satisfaction, or quality targets—organizations focus employee attention on outcomes that matter most. When incorporating non financial metrics like employee satisfaction, safety, and innovation, such plans support a more balanced scorecard that reflects both short-term financial incentives and long-term business goals. Effective use of common non financial metrics like employee engagement scores or customer satisfaction indices helps ensure annual incentive plans ensure alignment with broader business objectives.

Variable Cost Management

Unlike fixed salary increases that compound over time, annual incentive payments represent variable costs that adjust with company performance. During challenging years, incentive payouts decrease naturally, while strong performance years reward employees appropriately without creating permanent cost increases. This design allows organizations to respond to changing market conditions and manage financial rewards responsibly while still keeping employees motivated. When annual incentive plans serve as a flexible lever tied to market conditions and industry benchmarks, organizations can maintain a sustainable compensation structure.

Talent Attraction and Retention

Competitive annual incentive opportunities enhance total compensation packages, supporting recruitment of high-quality candidates and top talent. When combined with a competitive salary, well-structured incentive plans and related monetary rewards can significantly strengthen employee retention. Clear communication about how annual incentives are earned, including how performance metrics and performance objectives are set, helps retain employees who value transparency and fairness in rewards. Over time, consistently applied employee incentives help reward sustained performance and reinforce a culture where sustained performance is recognized and valued.

Pay-for-Performance Culture

Well-designed annual incentive plans reinforce performance-based cultures where high achievers receive meaningfully greater rewards than average performers. By connecting financial metrics, non financial metrics, and individual performance, organizations can more precisely differentiate pay outcomes and demonstrate that contributions to organizational performance and the company’s success are directly recognized. As annual incentive plans evolve, many organizations also plan regularly to recalibrate measures and performance targets to ensure ongoing alignment with strategic goals and business outcomes.

Key Components of Effective Annual Incentive Plan Design

Plan Eligibility and Participation

Define clearly which employee populations participate in annual incentive programs. Common approaches include:

- All employees organization-wide (broad-based plans)

- Professional and managerial employees only

- Specific job families or departments, such as sales teams with clearly defined sales targets and sales performance measures

- Employees at certain job levels or grades

Establish eligibility criteria including minimum tenure (commonly 3-6 months employment before plan year end), active employment status, and performance standards (typically “meets expectations” or higher). Clear eligibility criteria support fairness, help manage employee expectations, and ensure that annual incentive plan AIP participation is aligned with both business objectives and regulatory considerations.

Target Incentive Opportunity

Set target annual incentive amounts as percentage of base salary, varying by organizational level and role criticality. For example, higher financial incentives might be appropriate for executives whose decisions most directly affect company performance and overall business success. For sales teams, target opportunities may be combined with monthly and quarterly incentives or standalone quarterly incentives designed to drive near-term sales performance and sales targets in addition to annual performance goals.

Performance Metrics and Weighting

Select performance measures aligning with strategic priorities and employee influence. Effective plans typically incorporate multiple metrics, blending financial metrics with non financial metrics to support a balanced approach.

Organizational Metrics (50-70% weighting):

- Financial performance (revenue, profit, EBITDA, operating income, net income, and other financial metrics)

- Customer satisfaction or Net Promoter Score

- Market share or competitive positioning relative to industry benchmarks

- Strategic initiative completion tied to long-term strategic goals and business objectives

Departmental/Team Metrics (20-40% weighting):

- Department-specific goals and objectives that support overall company performance

- Project milestones and deliverables

- Quality, efficiency, or productivity measures

- Team based metrics that recognize collaborative employee efforts and shared performance objectives

Individual Metrics (10-30% weighting):

- Personal goal achievement and goal setting outcomes

- Performance rating outcomes reflecting annual performance

- Competency development and employee engagement contributions

- Special contributions and individual performance against defined key performance indicators

Clearly defined performance metrics and key performance indicators help ensure that an annual incentive plan remains measurable, fair, and closely tied to business goals. When incorporating non financial metrics such as innovation, leadership behaviors, and employee engagement, organizations can design a more holistic and great incentive plan that rewards both results and behaviors.

Performance Thresholds and Payout Curves

Establish clear performance-to-payout relationships:

- Threshold: Minimum performance required for any payout (commonly 80-85% of target)

- Target: Expected performance level earning 100% of target incentive

- Maximum: Outstanding performance earning premium payouts (commonly 150-200% of target), sometimes associated with maximum performance levels

Below threshold performance typically results in zero payout, while performance between levels follows predetermined formulas or payout curves. These payout curves should be aligned with both financial performance expectations and realistic market conditions to support a sustainable successful annual incentive plan.

Implementation Best Practices

Communication and Transparency

Communicate annual incentive plans clearly at year beginning, including target opportunity, performance metrics, goals, and payout methodology. Provide regular progress updates throughout the year enabling employees to understand their performance trajectory, the performance period, and how their employee efforts contribute to organizational performance and the company’s success.

Goal Setting Rigor

Establish challenging yet achievable performance goals through collaborative processes involving leadership, finance, and operational teams. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART), with clear baseline metrics and target levels. Robust goal setting linked to both financial metrics and non financial metrics helps create a successful incentive plan that truly drives desired business outcomes. For sales teams, rigorous goal setting on sales performance and sales targets can be supported by both annual incentives and quarterly incentives.

Mid-Year Reviews

Conduct mid-year performance check-ins reviewing progress against annual incentive goals. This practice enables course correction, maintains focus, and prevents year-end surprises. Mid-year reviews also offer opportunities to reinforce employee engagement, clarify evolving business goals, and adjust for significant shifts in market conditions while maintaining plan integrity.

Performance Assessment and Payout Calculation

At year-end, systematically assess performance against established metrics using objective data. Calculate payouts according to plan formulas, document results comprehensively, and obtain appropriate approvals before communication. Ensure consistency in assessment methodology across all participants so that employee performance ratings, individual performance outcomes, and team based metrics are applied fairly. This disciplined approach supports overall business success, regulatory compliance, and credibility of the annual incentive plan AIP.

Timing and Payment

Most organizations pay annual incentive awards in Q1 of the following year after performance assessment and financial results finalization. This timing aligns with tax year-end considerations and allows proper performance evaluation using finalized financial metrics and non financial metrics. Clearly communicate payment timing during plan enrollment so employees motivated by the plan understand when monetary rewards and other financial rewards will be delivered.

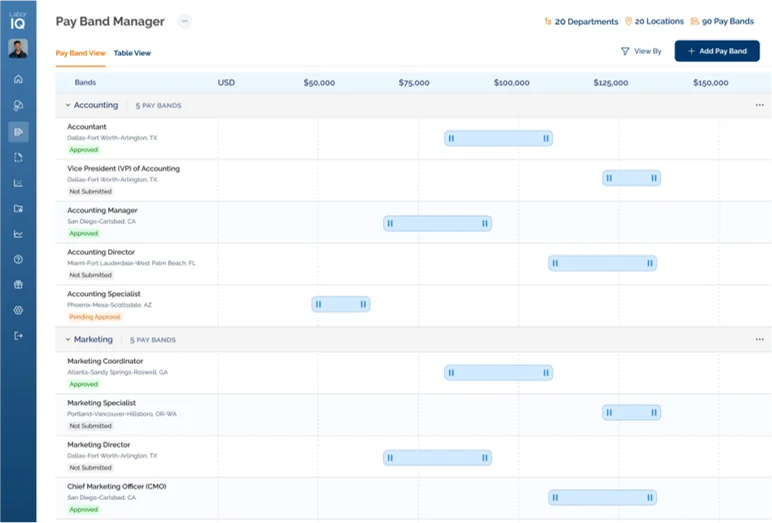

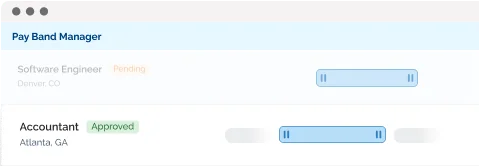

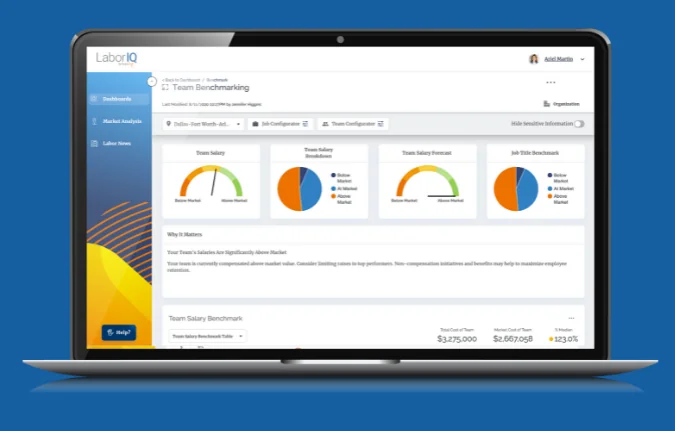

Technology and Administration

Modern compensation management platforms streamline annual incentive administration through automated goal tracking, performance data integration, payout calculations, and comprehensive reporting. Professional systems ensure accuracy, consistency, and audit trail documentation while reducing administrative burden. These tools also make it easier to integrate complex financial metrics, non financial metrics, and key performance indicators into a single annual incentive plan framework.

Conclusion

Employee annual incentive plans are powerful tools for connecting employee performance with organizational priorities while managing compensation costs effectively. Understanding what is an annual incentive plan and the distinctions in annual incentive plan vs bonus approaches enables HR professionals to design, implement, and administer programs that drive meaningful business outcomes. Well-structured annual incentive programs incorporating clear eligibility criteria, appropriate target opportunities, meaningful performance metrics, transparent communication, and rigorous administration deliver measurable benefits including improved performance, enhanced employee engagement, employee satisfaction, and competitive talent positioning. As organizations continue emphasizing pay-for-performance cultures, effective annual incentive design and management remain critical HR competencies supporting long-term overall business success.

Sources and References

- WorldatWork: https://www.worldatwork.org – Leading association for compensation professionals providing incentive plan research and best practices