It’s that time of year again – the dawning of mid-year compensation reviews!

For managers and HR professionals involved in mid-year reviews, this may bring a sense of dread or increased stress as they struggle with an increased workload and the need to stay current on the latest salary and compensation rates.

So, how do you relieve the strain that comes with assessing your employees’ direct and indirect compensation? And how can you boost transparency across your organization? In this article, we aim to answer these exact questions, but first:

What’s a Mid-Year Compensation Review?

In short, a mid-year compensation review is an analysis using internal and external data to ensure that a company’s salaries and benefits accurately and fairly reward employees for their work.

It’s also a time for HR professionals and other budget holders/managers to discuss next year’s budget and current benchmark salaries. Organizations also use this as an opportunity to assess the impact of nationwide inflation, i.e., the increase in the cost of living. Needless to say, as the cost of living rises, businesses face mounting pressure to raise wages.

Adding to this, in 2021, around 44% of workers considered looking for a new job in what’s now termed ‘The Great Resignation.’ Interestingly, according to CNBC, over half the workers looking for new employment did so for higher pay.

Therefore, with the employment market moving so quickly and a significant increase in wage demands, it’s more important than ever for businesses to conduct a compensation analysis at least once a quarter. Taking such a proactive approach to compensation means organizations are better informed to keep abreast of employees’ expectations. Such an approach creates more flexibility. For example, you’re better able to stay on top of changes in working practices such as remote working or relocation and shifts in job responsibilities.

What’s more, quarterly reviews can go a long way toward minimizing your company’s risk of experiencing a compensation gap. Compensation gaps are sometimes also referred to as pay inequality or pay gaps. For example, men being paid more than women, remote workers being paid less than those who are office-based, etc.

Making the Most Out of Your Mid-Year Compensation Review

A mid-year compensation analysis is an excellent opportunity to look at your compensation packages and internal processes. That said, here are a few pointers on making the most out of your mid-year compensation review:

- Identify which employees should be involved in the review (HR managers, CFO, section managers). Is there anyone missing from your list who can add value and insight?

- Assess the salary data you used 6 months earlier. Does it need a refresh? Check whether the salary data for each position still reflects the average for the job title and geographical location in question. It’s also worth comparing salary packages offered by other employers in your area.

- Take another look at your employee benefits and assess where you could add greater value, if not immediately, then at a later date. For example, paid time off, retirement plans, etc.

- Don’t forget to examine your budgets to ensure you can accommodate any proposed changes to compensation packages.

- Talk to your employees. Keeping them in the dark about the outcome of your mid-year compensation review can potentially foster discontent and uncertainty. Remember, 72% of employees believe workplace pay transparency is good.

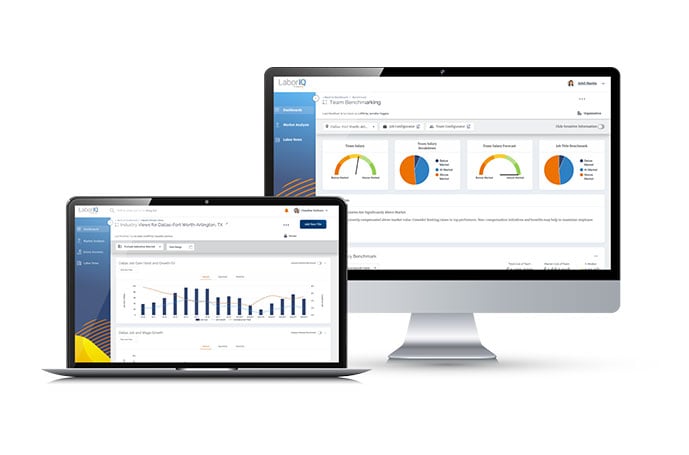

When determining market-rate compensation, benchmarking team salaries enables you to calculate average salary ranges according to specific industries and metro areas – and evaluate if your current compensation plan is at, above or below market for the role. For even more precise compensation analysis, a solution that offers forecasted wage growth assists with future comp planning and talent acquisition.

Making Your Mid-Year Compensation Review Easier

In summary, mid-year compensation reviews don’t have to be a source of dread. Using real-time compensation data to run an informed analysis puts you in a better position to examine whether your organization’s current salaries are on pace with demands.