Low hire, low fire labor market keeps compensation management in focus

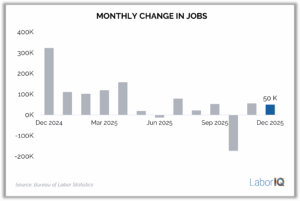

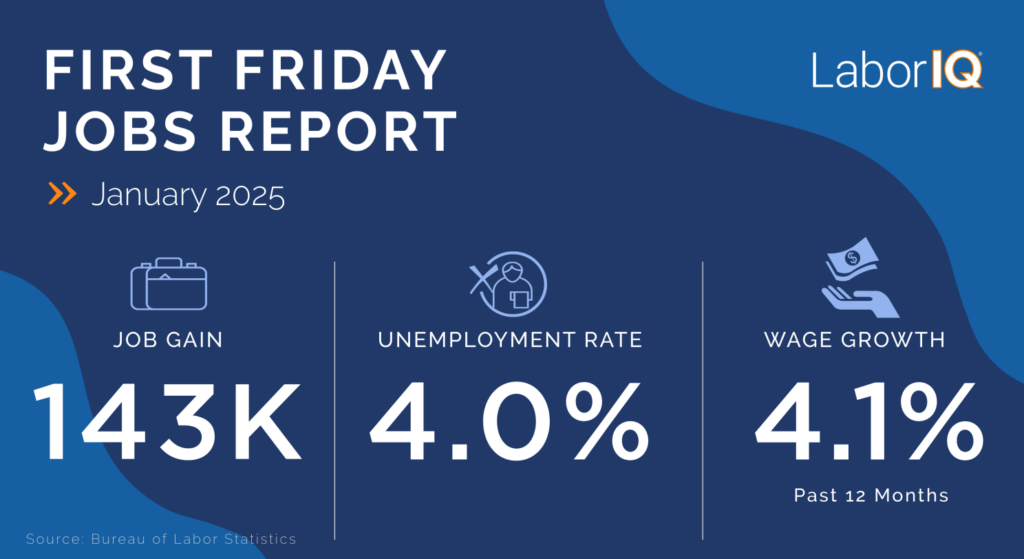

U.S. businesses added 50,000 new jobs in December, below expectations of 73,000. The unemployment rate ticked down to 4.4%, and 12-month wage increased slightly to 3.8%.

December 2025 jobs report overview: Hiring slows, industries tell the story

The final report of 2025 paints a picture of a labor market that, in aggregate, shows surprising stability in the face of growing challenges, while many sectors limp along with modest growth or job losses.

December’s 50,000 net job gains bring the 2025 total to 584,000, averaging just 49,000 new jobs added each month. Hiring totals last year were the lowest since 2020. Job gains slowed substantially in the second half of 2025, with more than 80% of new jobs added in just the first four months of the year.

U.S. businesses averaged 15,000 monthly job gains in the last six months of 2025, a figure brought down by 173,000 job losses in October as the result of Federal employees exited payrolls. The Federal government employs 274,000 fewer workers than it did a year ago, with 179,000 job losses in October alone.

The private sector added 733,000 jobs in 2025, driven almost entirely by healthcare, specifically the healthcare and social assistance sector, which added 713,000 jobs (+404,000 in healthcare and + 308,000 in social assistance). All other private-sector industries combined to add just 20,000 jobs last year.

Hiring has stalled at very modest pace but hasn’t shown major signs of worsening. This remains the major vulnerability for the U.S. labor market.

Silver linings: Wage growth and low layoffs drive compensation management priorities for business leaders

The silver linings to the “low hire” labor market in recent months have been low layoffs and robust wage growth outpacing inflation: unemployment remains low at 4.4%, and wage growth continues at a healthy 3.8% annual rate.

For HR leaders and business strategists, these metrics represent more than statistical comfort – they signal a fundamental shift in how organizations must approach talent management, with retention and compensation strategy taking center stage.

The low unemployment environment, despite sluggish hiring, reveals a labor market where workers remain employed and secure. This stability means that while businesses may be hesitant to expand headcount aggressively, they’re equally reluctant to shed existing talent.

Low layoff rates, combined with near-full employment conditions, create a scenario where the competition isn’t primarily about filling new positions, it’s about keeping valued employees from being poached by competitors.

Dual pressures of wage growth amid uncertainty in 2026

Annual wage growth, at a robust 3.8%, creates a diverging set of implications for workers and employers.

For employees, wages rising faster than inflation represent real gains in purchasing power. Although it’s important to note that rising prices and a slower hiring environment put real pressure on employees.

In a low-unemployment environment, this wage growth reflects employers’ recognition that retention through competitive compensation costs less than the expensive cycle of recruitment, onboarding, and productivity loss associated with turnover.

However, this same wage growth creates a multifaceted challenge for U.S. businesses. Employers recognize the cost of replacement often exceeds the cost of retention. As a result, businesses still face higher costs for existing employees through annual merit increases and cost-of-living adjustments, but also elevated market rates when filling critical open roles. The cost of replacement has escalated significantly, with organizations typically offering competitive salaries that match or exceed current market rates.

Conclusion

U.S. businesses are scrutinizing workforce productivity and operational efficiency with renewed intensity. For talent acquisition and retention teams, this translates to a critical imperative: your existing workforce has become your most valuable asset and protecting that asset requires strategic investment in compensation management and employee value proposition.

Follow LaborIQ for strategic insights on all things U.S. compensation and hiring.

Compensation Management Resources from LaborIQ

With a labor market that is stalling, businesses face uncertainty in terms of economic outlook. However, a sluggish economy doesn’t mean it’s time to put your people and compensation strategies on autopilot.

Empower your business with data and tools to retain talent and respond to economic challenges.

2026 Compensation Management and Headcount Planning

- Webinar Recap: 2026 Labor Market and Compensation Outlook

- 2026 Outlook: Economic and Labor Market Headwinds Highlight Importance of Strategic Compensation Management

- Labor Market Events that will Shape 2026