Labor Market Analysis: A (Delayed) September 2025 Jobs Report Breakdown

This special edition of the Insights newsletter breaks down the September 2025 jobs report, which has been delayed due to the U.S. Federal government shutdown. The labor market and compensation analysis looks examines whether the lagged data can tell us anything new about the labor market.

Hiring exceeded expectations in September. U.S. businesses added 119,000 jobs, well-above expectations of around 40,000. The unemployment rate ticked up to 4.4%, and 12-month wage increased slightly to 3.8%.

September’s delayed report presents a series of data points that all describe a labor market in fragile balance.

Hiring Surpassed Expectations

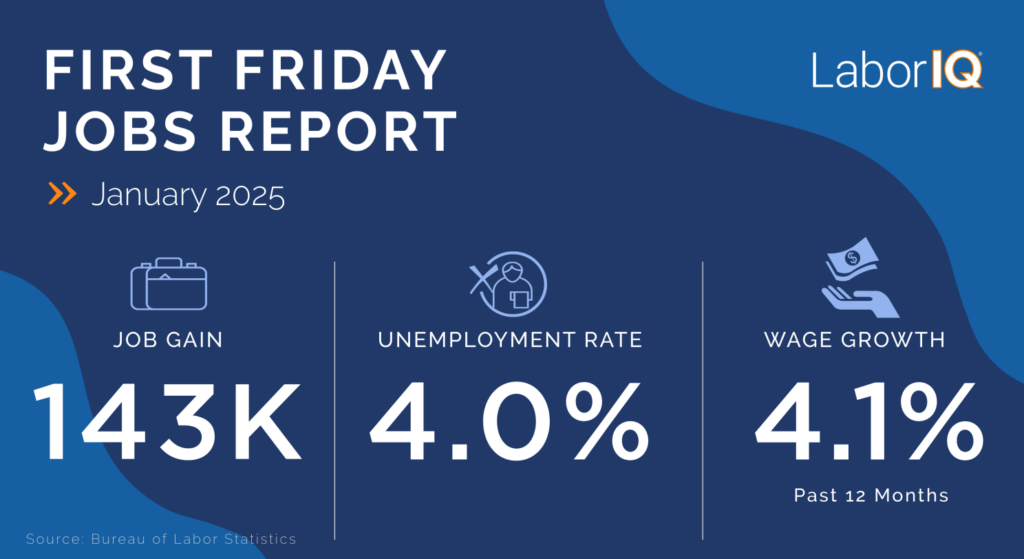

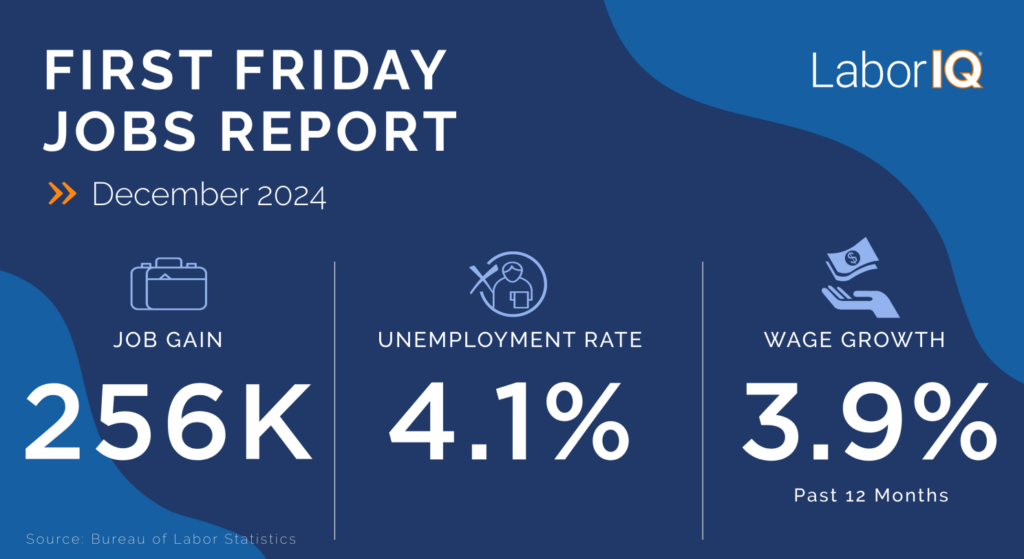

In the context of 2025, where the labor market has averaged 71,000 monthly job gains through the first seven months of the year, 119,000 jobs might seem like a promising development. However, there are three factors that damper excitement.

First, while 119,000 new jobs added is well above this year’s monthly average, it is substantially below the average monthly job gains of 191,000 from 2015 through 2019 and 254,000 from 2022 through 2024.

Second, downward revisions for July and August’s already weak hiring totals suggest that the labor market added 33,000 fewer jobs this summer than originally reported. The revisions also mean the labor market has lost jobs in two of the last four months for the first time since early 2021.

Third, the nature of statistical data is that it is always released on a delay because it takes time to collect, process, and report the various metrics.

Typically, monthly jobs reports are released about two-to-three weeks after the data has been collected. In this case with the September jobs report, the data released are two months behind data collection. We have already experienced the layoffs and hiring that are reflected in this report, other data released contemporaneously reflected a cooling labor market, and headlines pointed to a much more cautious hiring environment for U.S. businesses.

💼 Unemployment on the Rise

The unemployment rate reached 4.4% in September, hitting the highest point since October 2021. The total number of unemployed people rose by 219,000 to 7.6 million, about a quarter of whom have been unemployed for at least 6 months. In contrast, looking back to January 2023, about 17% of unemployed individuals were unemployed for more than 6 months. The unemployment rate has ticked up only modestly, but it has become more challenging for those who are unemployed to find work quickly.

💡 While it’s still a competitive labor market, and finding the right experience for open roles remains a challenge for businesses that are hiring, the active talent pool is growing. Given the slow hiring, businesses should remain open to job seekers with longer unemployment spells.

💸 Wage Growth Continues

Over the past 12 months, average wages grew by 3.8%, up from 3.7% in August. From 2015 through 2019, 12-month wage growth averaged around 2.7%. Businesses continue to face dueling pressures of compensation expectations and economic uncertainty.

💡 Talent retention remains critical for businesses to remain competitive. This means that focus can not stray from compensation strategy even if you are not actively hiring.

🩺 Industry Concentration Once Again

Two sectors – healthcare and leisure and hospitality – accounted for 75% of all new jobs added in September and more than half of all jobs added in the last 12 months despite making up only one-fifth of all employees in the U.S. Over the long term, healthcare hiring will continue to be bolstered by growing demand from an aging population.

Conclusion

The delayed September jobs report didn’t add much new information about labor market and economic health. The increase in hiring was surprising but welcome news. However, those figures are likely to be revised downward in the coming weeks. The labor market is still cooling, unemployment is rising albeit modestly, and wage growth is putting pressure on U.S. businesses.

Look for our detailed 2026 compensation and labor market outlook in the coming weeks.

Follow LaborIQ for strategic insights on all things U.S. compensation and hiring.

Compensation Planning Resources from LaborIQ

With a labor market that is stalling, businesses face uncertainty in terms of economic outlook. However, a sluggish economy doesn’t mean it’s time to put your people and compensation strategies on autopilot.

Empower your business with data and tools to retain talent and respond to economic challenges.

2026 Compensation Strategy and Headcount Planning

- What HR trends will impact your business in 2026?

- Hiring accounts? Learn about the current talent shortage and compensation for key accounting roles.

- Planning for 2026? Consider total compensation packages to remain competitive.