Why Candidates Still Struggle to Find Good Jobs

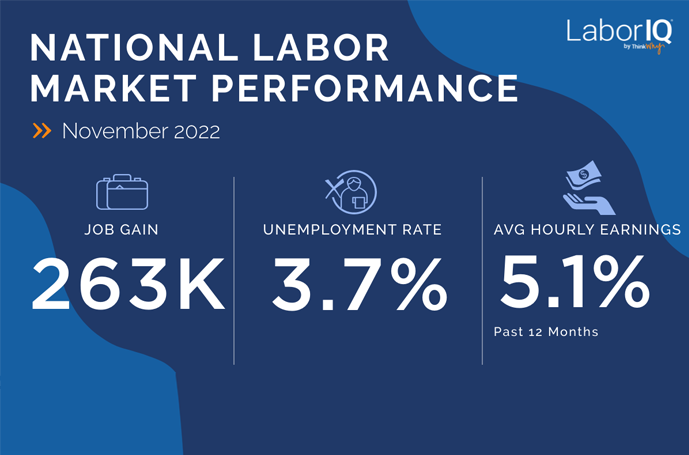

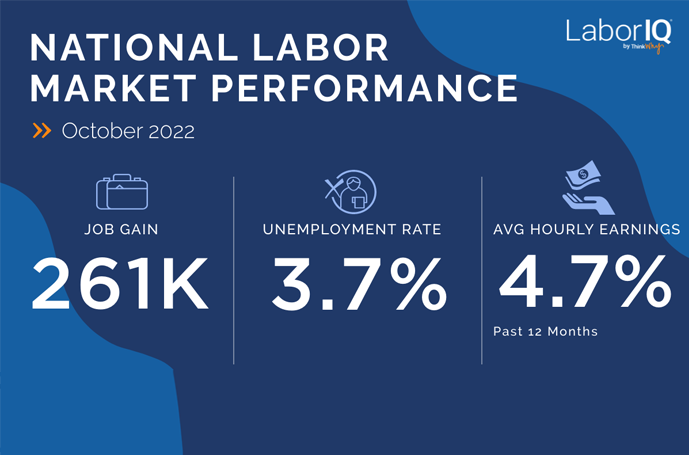

Recent economic reports have been filled with contradictory signals. While negative headlines suggest economic turmoil is just around the corner (predictions that have lasted more than 18 months now), the headline numbers in labor reports have been consistently strong.

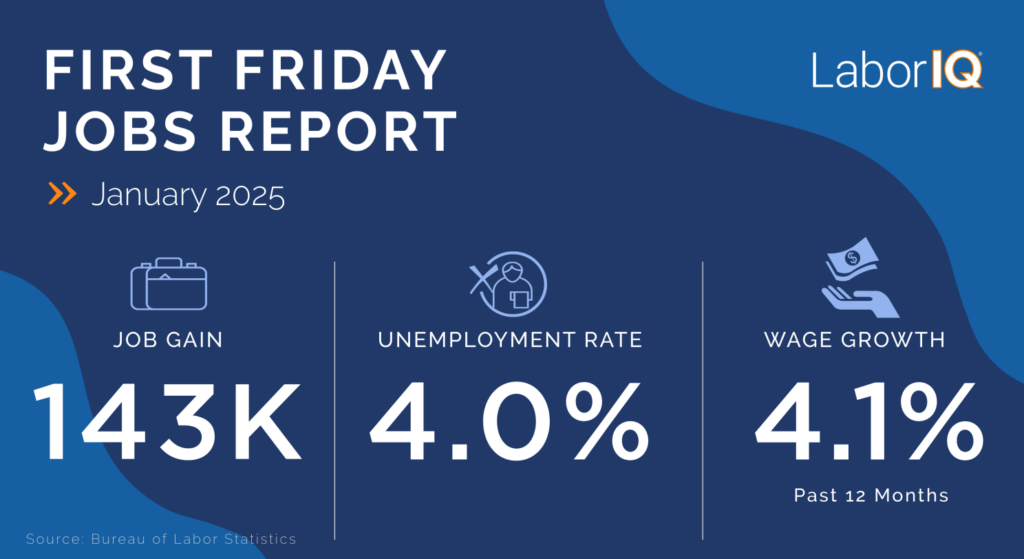

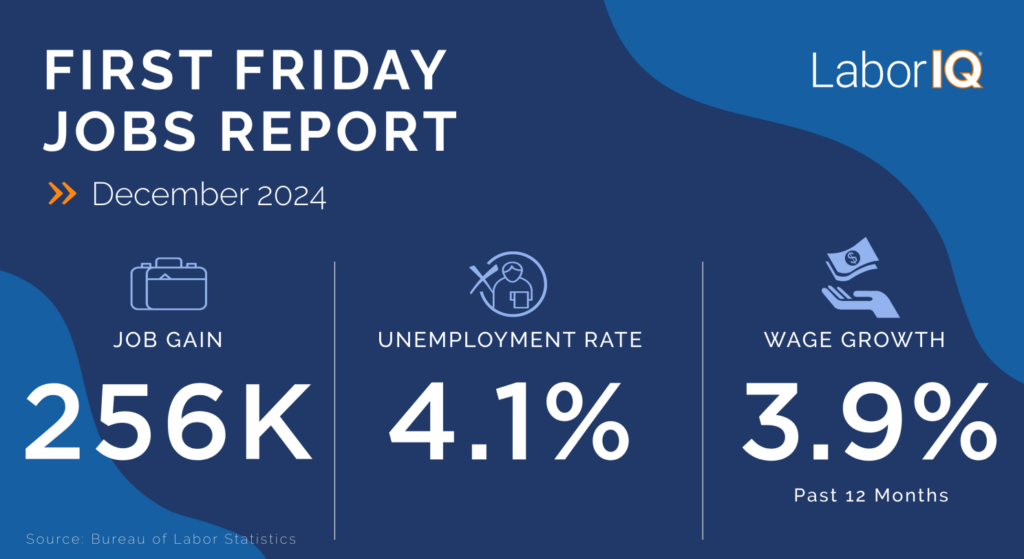

We continue to see job gains that meet or exceed expectations, an unemployment rate at or below 4%, and steady wage growth. Yet, for many job seekers, it still feels incredibly difficult to secure a good job. How can this be the case? Here’s what we’ve found as we dug into the data.

A Look At The Strong Headline Numbers

The June labor market report continued to show an optimistic picture. The economy added 206,000 jobs, which met expectations and sustained the trend of positive job growth. The unemployment rate increased slightly but remained low, at 4.1%, indicating there is still a tight labor market where most people who want a job have one. Wage growth continues to tick upwards, although the growth has slowed. In the aggregate, the data tells a story of a robust economy.

But these strong headline numbers do not necessarily reflect the reality for all job seekers, and certainly don’t show what’s happening in the market when you drill down by industry, which we’ve validated through conversations with HR and recruiting leaders. This discrepancy between the positive macroeconomic indicators and the challenging on-the-ground realities in certain sectors can be confusing and frustrating for job seekers and employers alike.

Sector-Specific Changes: The Core of the Issue

The critical insight that explains the discrepancy is that job gains are concentrated in specific industries. In June, 75% of the 200,000 jobs added were in government, healthcare, or social assistance. These sectors have seen robust growth due to various factors, including increased government spending, an aging population driving demand for healthcare services, and expanded social programs.

But there are plenty of other industries, which means that many private-sector industries are not experiencing the same level of growth. Technology, professional services, and manufacturing are seeing much slower job creation rates. We do not see job declines in those industries yet, but new roles aren’t being created either. So the uneven distribution means that while the overall job numbers look healthy, the opportunities are not evenly spread across all fields. As a result, individuals seeking employment in slower-growing industries are finding it harder to land a good job.

Treading Water: The Reality for Many Industries

What we see beyond the booming sectors of government, healthcare, and social assistance, are that other industries are essentially treading water. They are maintaining employment levels without substantial growth or decline. For job seekers, this means fewer new opportunities and more competition for existing positions.

In industries like technology, where we saw explosive growth during the pandemic, there is now a phase of normalization. The rapid hiring of the past few years was driven by a surge in demand for digital services. That fell off quickly as we saw the rush of layoffs come through over the past 18 months. Organizations that expanded their workforces during the pandemic are now adjusting to a more sustainable growth trajectory, which often includes slower hiring rates or even layoffs.

The Broader Implications

We need to look beyond headline numbers to understand the full economic picture. The metrics come across strong and don’t scream recession, but we’ll see what happens in the next few months. Will the unemployment rate continue to rise? Will industries outside of government and healthcare add more jobs?

For employers, particularly those in slower-growing sectors, there may be opportunities for slower wage growth and a bigger pool of candidates as more people are looking for work.

While the overall economy may not be in recession, the distribution of job gains highlights underlying structural challenges. With such variable data, there is a lot of uncertainty. We’ll watch the numbers closely over the next few months.