This week, we are breaking down the latest “First Friday” jobs report.

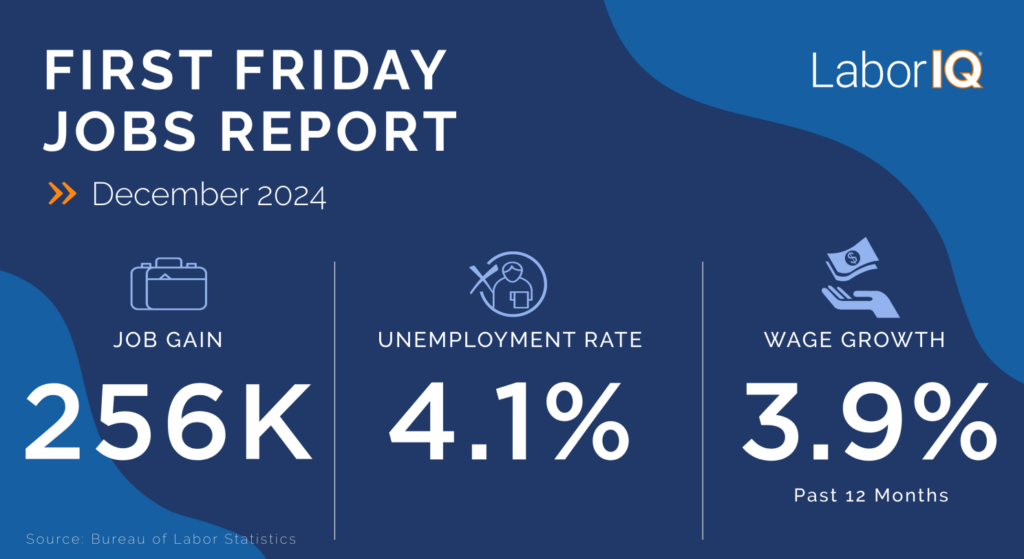

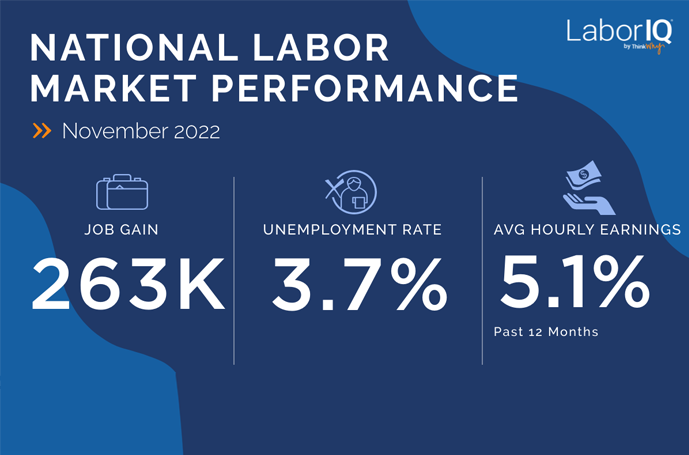

Hiring smashed expectations in May, with U.S. businesses adding 272,000 new jobs. The unemployment rate ticked up to 4%, marking the first time we’ve hit that symbolic level since January 2022. Average hourly earnings also increased by more than expected. Wages grew by 4.1% over the past 12 months, up from 3.9% in April.

Overall, the headline numbers point to a strong labor market, but they don’t tell the full story.

Confusion below the headlines: Two surveys tell different stories

The three main headline numbers in the monthly jobs report – job gains, unemployment rate, and wage growth – actually come from two different data sources.

Job gains (the monthly change in nonfarm payroll employment) and wage growth are from a survey of around 120,000 businesses (the “establishment survey”) about hiring and compensation. But the unemployment rate (a component of the labor force) comes from a survey of 60,000 households about labor force status – whether members of the household are employed, unemployed and looking for work, or out of the labor force.

Over the long run, these two surveys paint a similar picture and are highly correlated. However, over shorter periods, month-over-month or even year-over year, they can tell a different story.

Looking at data for May, it’s clear why these two surveys can cause confusion, especially when there’s conflicting reports. According to the establishment survey, the economy added 272,000 jobs last month, but the household survey shows a loss of 408,000 jobs.

What to make of these conflicting reports?

As with most things, the answer likely lies somewhere in the middle. The establishment survey may be painting a more rosy picture of the labor market that doesn’t necessarily portray what many workers and businesses are experiencing. However, it’s also unlikely that job losses (if there were any) match what the household survey is showing.

Big picture: the labor market has been strong and extremely resilient, but the past year was probably not as hot as initial estimates suggested.

This report, and the focus on the household survey, is likely a more accurate reflection of what many businesses have been feeling in the labor market over the past year. For a lot of industries, hiring has been pretty flat, they’re adding fewer new roles, and backfilling open jobs at a slower pace. Businesses have been exercising caution, and the headlines are starting to catch up.

Job gains | Smashing expectations, but that’s not the full story

The 272,000 net job gains in May surpassed expectations of around 200,000, bringing the annual hiring total to just over 1.2 million. However, the robust 1.2 million job total in the establishment survey doesn’t match the more volatile survey of households, which shows 100,00 job losses year-to-date.

While resilient, the labor market has likely been a bit cooler over the past year than some of the headline numbers might suggest.

Industries | Some industries dominate… again

I hear frequently from HR and business leaders that the headlines reporting a strong labor market doesn’t match up with the experience in their industry or location. That’s because most industries are adding jobs at a relatively slow pace.

In May, just three industries – healthcare, government, and leisure and hospitality – accounted for more than 50% of the 272,000 jobs added.

Unemployment rate | Tougher market for job seekers

The unemployment rate edged up to 4% (technically 3.96%, but the value gets rounded up), reaching the highest level since January 2022. While 4% is still relatively low by historical standards, job seekers are likely to face more challenges in their search.

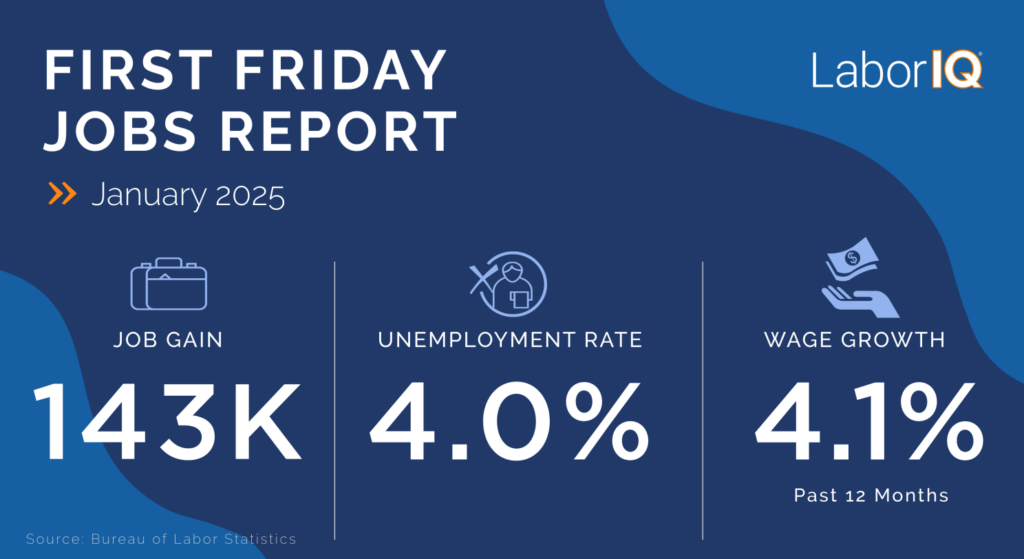

Wages and compensation | Still top of mind for businesses and employees

Annual wage growth ticked up to 4.1% in May up from 3.9% in April. With the exception of last month, 12-month wage growth has remained above 4% since before the pandemic.