This week, we are breaking down the latest “First Friday” jobs report.

June’s hiring totals did not smash expectations. With a respectable 206,000 new jobs added, hiring met expectations for the first time in months. Once again, job gains were concentrated to a few industries, which indicates that private-sector hiring is slowing. The unemployment rate edged up to 4.1% and has risen gradually from 3.7% in January. Average hourly earnings ticked down, with wages rising by 3.9% since last June, compared to May’s 4.1% 12-month growth rate.

This jobs report is consistent with a labor market that has been cooling gradually.

For months, I’ve been reconciling the stories I hear from HR and business leaders (“things are slowing down”) with the headline numbers in the jobs report (typically, “smashing expectations” or “Hiring and Wages are Up, Reinforcing the Economy’s Resilience“).

With June’s jobs report, it feels like the headlines have caught up with what businesses are feeling. The labor market is slowly cooling.

More reports like this could point to interest rate cuts from the Fed this fall.

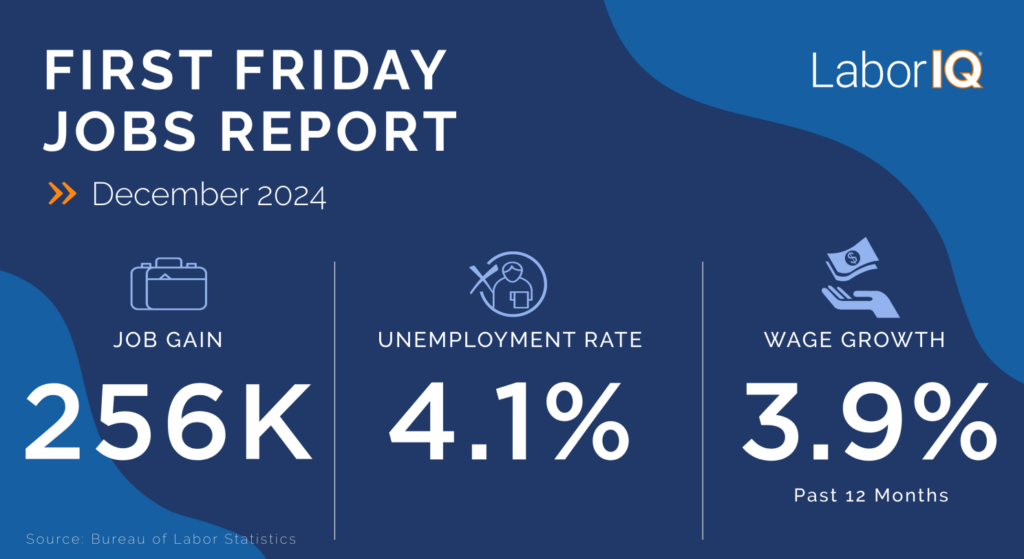

Job gains | Hiring continues to cool

U.S. businesses added 206,000 jobs in June, just beating expectations of around 200,000. On the surface, 206,000 net job gains represents a fairly solid month of growth, consistent with a really strong labor market. However, hiring totals for April and May were revised downward, and the labor market added 111,000 fewer jobs over the past two months than original estimates suggested.

Industries | Job gains concentrated to certain industries

A theme of the labor market over the past year or so is that job gains have been concentrated to a few industries. And June was no exception.

Just three sectors – Government, Healthcare, and Social Assistance – accounted for nearly 75% of new jobs added. Private-sector hiring has slowed considerably.

This is why the labor market feels sluggish for many businesses. Their industries aren’t adding jobs at a pace consistent with expansion.

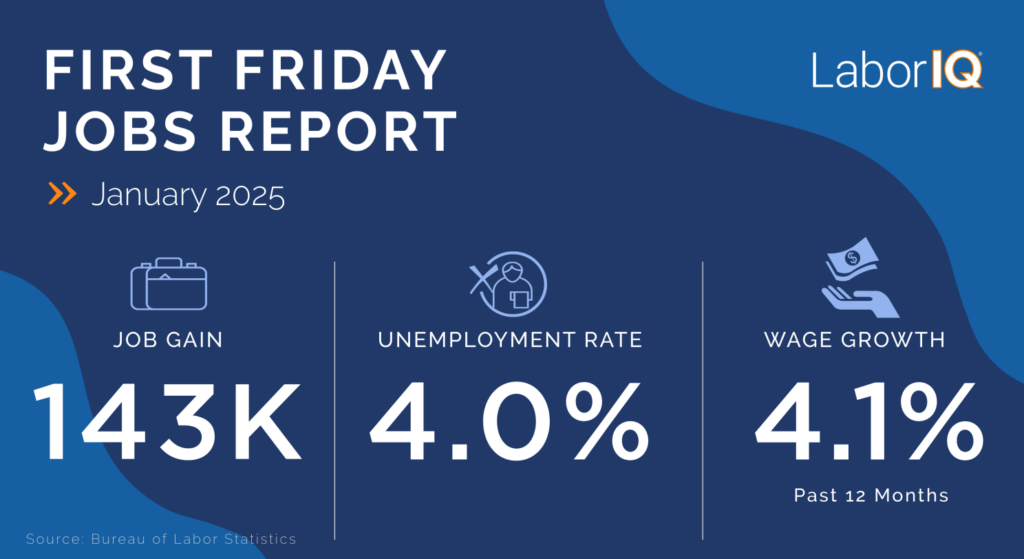

Unemployment rate | Unemployment up despite low layoffs

The unemployment rate ticked up to 4.1% in June. While relatively low by historical standards, it’s the first time we’ve seen unemployment above 4% since November 2021.

An increase in the unemployment rate isn’t always bad news, and this time it’s mixed. The uptick in unemployment was not driven by an increase in layoffs but rather new, unemployed entrants to the labor force. Since hiring has cooled substantially, it’s taking longer for those entering the labor force – like new college grads – to find work.

Wages and compensation | Slower wage growth but retention risks remain

Annual wage growth edged down to 3.9% in June from 4.1% in May. This means 12-month wage growth has been below 4% in two of the past three months, with June’s total marking the lowest growth rate since May 2021. Turnover has been one of the drivers of wage growth over the past couple of years. While quits have returned to pre-pandemic levels, wage growth has remained near 4%.

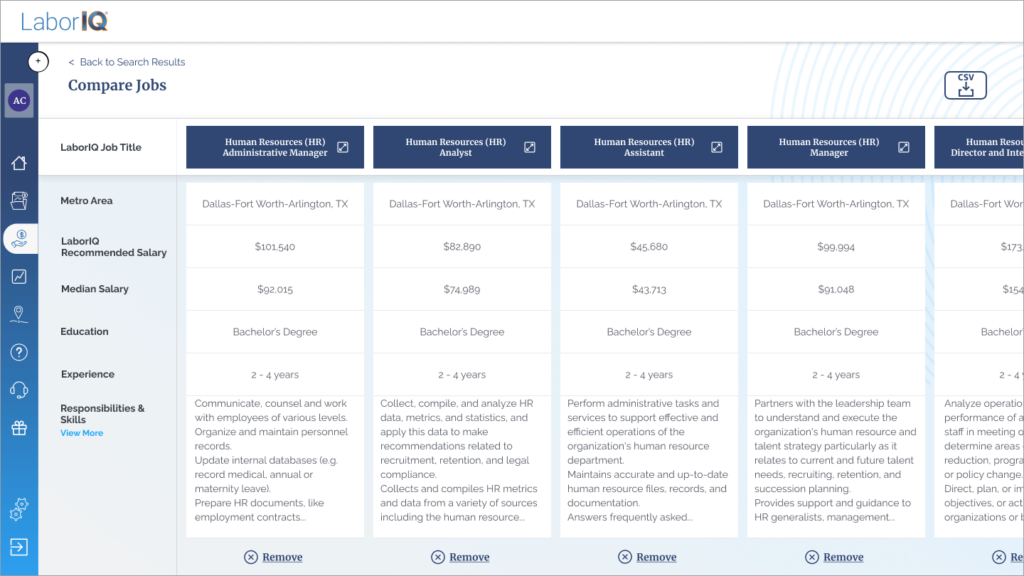

Businesses not keeping up with compensation trends still face a challenge with retaining talent. Stay up to date by joining our series on how to build competitive and compliant pay bands.