This week, we are breaking down the latest “First Friday” jobs report. I’m writing from Telluride, Colorado in the Rocky Mountains, and the stunning scenery could not provide a greater contrast to this not-so-pretty labor market update.

For months, I have been writing that the jobs report didn’t match what HR leaders and job seekers are experiencing in the labor market. Unfortunately, the headline numbers in July’s jobs report now show the weakness many have felt. There’s not a lot of good news – nearly all headline numbers came in on the downside of expectations.

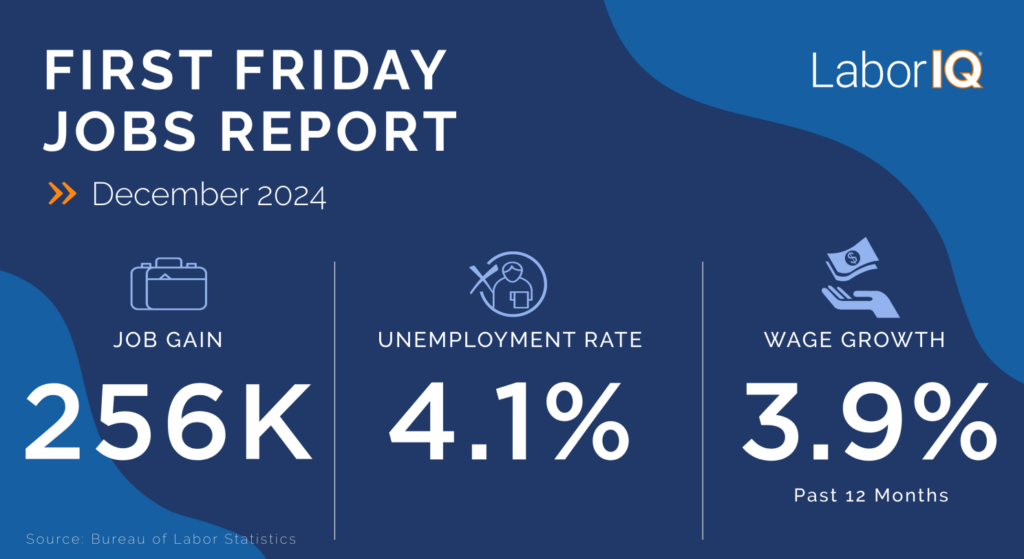

U.S. businesses added 114,000 new jobs in July, well below projections of 175,000. On the surface, this total shows a labor market that’s gradually cooling. But there’s more in this report pointing to an economy that’s a little more sluggish. The unemployment rate jumped to 4.3%, the highest level since 2021. The labor market is not adding jobs at a pace to keep up with even low levels of layoffs. Wage growth moderated to 3.6%, the lowest annual growth rate since 2021.

Here’s the stat that tells the main story of this report: The top five industries combined to add 142,000 jobs in July. That means the other industries combined to lose 28k jobs. When you do the math, most industries are treading water – not experiencing big layoffs or job losses but not expanding.

While it’s still true there’s not a lot of good news in this report, the one upside is expectations have skyrocketed that the Fed will lower interest rates in September. And it’s looking even more likely that there will be multiple rate cuts this year.

For HR and recruiters, the active talent pool is growing because there are more unemployed workers, unfortunately. But with hiring volumes much lower it can take longer to fill open roles, and there’s more competition for each open position.

Job gains | Slower growth continues

The 114,000 new jobs added by U.S. businesses in July points to a cooling labor market. Aside from April’s 108,000 job gains, this month’s total is the lowest since there were 243,000 jobs lost during a pandemic surge in December 2020.

On the surface, July’s hiring total isn’t a major cause for concern. But digging into industry growth (or lack of growth for most sectors) paints a different picture.

Industries | Most sectors treading water

Government (+17,000) and Healthcare (+55,000) accounted for nearly two-thirds of all new job gains. Yet again, private-sector growth is quite slow.

However, there were some other bright spots worth mentioning. Construction added 25,000 new jobs, with all subsectors looking strong despite headwinds from high interest rates.

Other strong performers in July were the Trade, Transportation, and Utilities and Leisure and Hospitality sectors, each adding over 20,000 jobs. Both of these industries power vacation towns (like Telluride, Colorado ️).

The big, glaring weak spot in July was Information, which lost 20,000 jobs. The Information industry includes tech companies (web search portals, computing infrastructure, and data providers) as well as entertainment (motion picture recording) and media (publishing and broadcasting). All Information subsectors lost jobs last month.

Unemployment rate | Continuing to rise

Unemployment increased to 4.3%, the highest since October 2021.

In July, the increase in unemployment was caused by job losses from temporary layoffs. Hurricane Beryl, which hit Houston last month, could be driving some of this increase in unemployment due to temporary layoffs. We will be watching whether these job losses are in fact temporary, and those workers return to their jobs.

Over the past several months, unemployment has ticked largely because hiring volumes weren’t enough to keep up with new entrants to the labor force.

The 0.5% increase in the unemployment rate since March of this year triggers a recession indicator called the Sahm rule, named after economist Claudia Sahm. The Sahm rule states that a recession may be on the horizon if the current unemployment rate exceeds the lowest unemployment rate over the past 12 months by 0.5 percentage points or more.

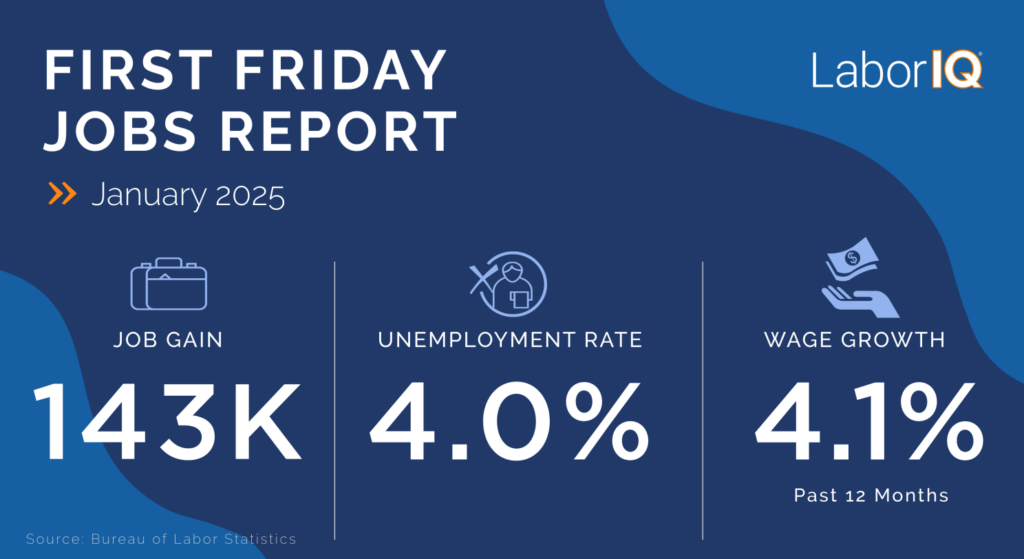

Wages and compensation | Starting to cool

Wages grew 3.6% year-over-year. Since wage growth is one of the big drivers of inflation, this slowdown was expected given the Fed’s high interest rate policy.

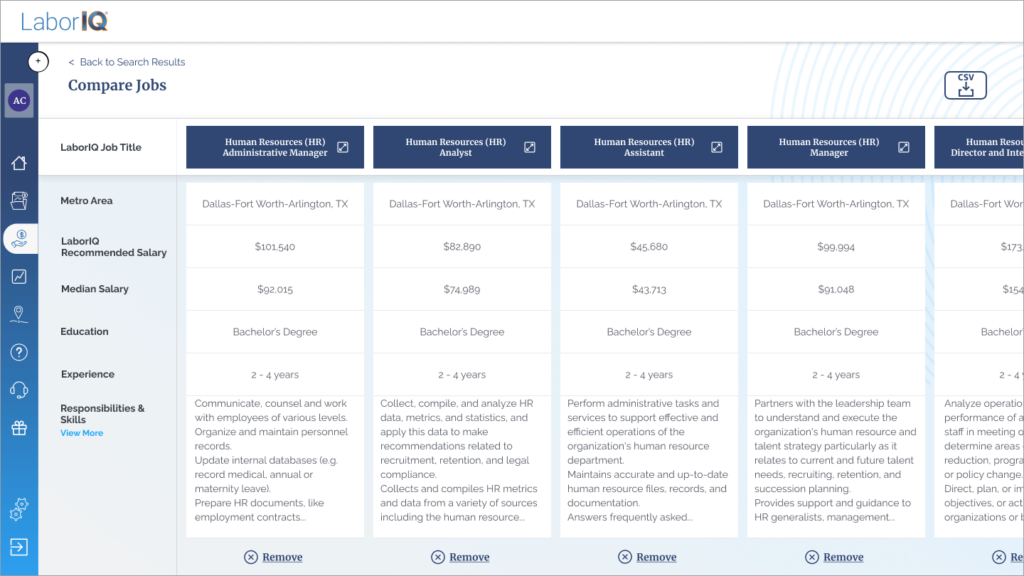

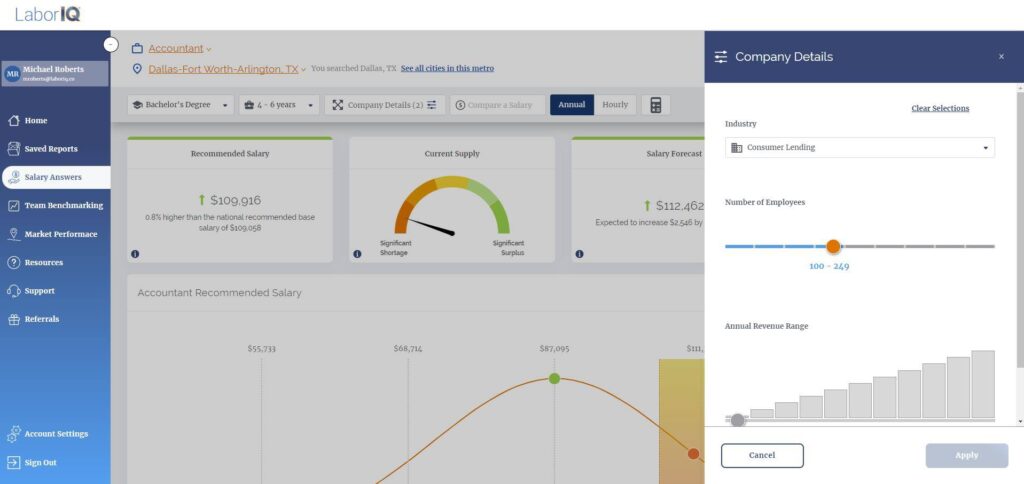

However, from my conversations with hiring managers and recruiters, compensation is still a major challenge in the effort to hire (yes, many businesses are still backfilling and adding new positions) and retain talent. A few years ago, the challenge was keeping up with rising pay demands during the great resignation. This has shifted to a focus on compensation structures, job hierarchies, pay band creation, and compliance with pay transparency, all of which are pivotal to competitiveness given the changes in today’s labor market.