The competition for skilled accounting professionals is intensifying, prompting HR and talent acquisition leaders to reassess compensation strategies and modernize recruitment approaches. As organizations navigate complex financial landscapes and evolving regulatory requirements, understanding which accounting roles present the greatest hiring challenges—and why—has become essential for building resilient finance teams.

The Current State of Accounting Talent Acquisition

The accounting profession faces a perfect storm of competitive pressures. According to the American Institute of CPAs (AICPA), the profession is experiencing significant talent shortages, with fewer graduates entering the field while demand continues to climb. This supply-demand imbalance has fundamentally altered the hiring landscape, requiring HR leaders to develop more sophisticated approaches to compensation market data analysis and competitive positioning.

The Bureau of Labor Statistics projects steady growth for accounting occupations, but this growth masks the intense competition for specific specialized roles. Organizations that neglect regular salary benchmarking and market rate analysis risk losing top candidates to competitors with stronger compensation alignment.

Most Competitive Accounting Roles from a Hiring Perspective

The following accounting roles will be most difficult to fill for most businesses. Talent attraction strategies will require competitive compensation and benefits packages.

Accounting Managers and Senior Accountants

Senior accountants and accounting managers consistently rank among the most difficult positions to fill. These mid-career professionals possess the technical expertise to handle complex accounting operations while providing crucial oversight and mentorship to junior staff. Demand for these roles has intensified as organizations seek professionals who can navigate hybrid work environments while maintaining rigorous financial controls.

The competitive advantage goes to employers who implement robust market salary benchmarking practices. These roles require professionals with 5-10 years of experience, CPA credentials, and often industry-specific knowledge – a combination that commands premium compensation in today’s market.

Accounting Manager Compensation Across the U.S.

- National: $129,290

- Boston-Cambridge-Nashua, MA-NH: $136,167

- Dallas-Fort Worth-Arlington, TX: $133,728

- Los Angeles-Long Beach-Anaheim, CA: $145,760

- New York-Newark-Jersey City, NY-NJ-PA: $168,445

- St. Louis, MO-IL: $118,545

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $146,384

Source: LaborIQ

Note: Salaries reflect recommended compensation based on a bachelor’s degree and 2–4 years of experience in role in October 2025.

Financial Analysts with Accounting Backgrounds

The convergence of accounting and financial analysis has created exceptional demand for professionals who bridge both disciplines. These hybrid roles require traditional accounting skills combined with advanced analytical capabilities, data visualization expertise, and business intelligence acumen. SHRM research indicates that organizations struggle to fill these positions because candidates must demonstrate both technical accounting proficiency and strategic business thinking.

Successful hiring for these roles requires careful compensation structure design that reflects both the accounting foundation and the analytical premium these professionals command. HR leaders must recognize that these candidates often field multiple offers simultaneously, making competitive total compensation packages essential.

Financial Analyst Compensation Across the U.S.

- National: $104,801

- Boston-Cambridge-Nashua, MA-NH: $90,764

- Dallas-Fort Worth-Arlington, TX: $100,566

- Los Angeles-Long Beach-Anaheim, CA: $99,028

- New York-Newark-Jersey City, NY-NJ-PA: $119,853

- St. Louis, MO-IL: $90,084

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $108,209

Source: LaborIQ

Note: Salaries reflect recommended compensation based on a bachelor’s degree and 2–4 years of experience in role in October 2025.

Tax Specialists and Tax Managers

Tax professionals, particularly those with expertise in multi-state taxation, international tax compliance, or specialized areas like transfer pricing, remain extraordinarily difficult to recruit. The National Association of Tax Professionals notes that the complexity of modern tax codes, combined with ongoing regulatory changes, has elevated the value of experienced tax specialists significantly.

Organizations competing for these professionals must leverage comprehensive compensation market data to understand regional variations in tax specialist compensation. Markets with complex state tax environments or high concentrations of multinational corporations often see even more intense competition for these roles, requiring premium compensation strategies.

Tax Specialist Compensation Across the U.S.

- National: $81,768

- Boston-Cambridge-Nashua, MA-NH: $79,822

- Dallas-Fort Worth-Arlington, TX: $88,889

- Los Angeles-Long Beach-Anaheim, CA: $86,565

- New York-Newark-Jersey City, NY-NJ-PA: $98,163

- St. Louis, MO-IL: $85,207

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $96,353

Source: LaborIQ

Note: Salaries reflect recommended compensation based on a bachelor’s degree and 2–4 years of experience in role in October 2025.

Forensic Accountants and Fraud Examiners

The growing emphasis on fraud prevention and detection has made forensic accountants increasingly valuable. According to the Association of Certified Fraud Examiners, these specialists combine accounting expertise with investigative skills, making them particularly scarce in the talent market. Their unique skill set commands significant compensation premiums, especially in industries with heightened fraud risks or regulatory scrutiny.

Forensic Accountant Compensation Across the U.S.

- National: $102,546

- Boston-Cambridge-Nashua, MA-NH: $101,063

- Dallas-Fort Worth-Arlington, TX: $103,551

- Los Angeles-Long Beach-Anaheim, CA: $112,304

- New York-Newark-Jersey City, NY-NJ-PA: $123,553

- St. Louis, MO-IL: $95,561

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $121,328

Source: LaborIQ

Note: Salaries reflect recommended compensation based on a bachelor’s degree and 2–4 years of experience in role in October 2025.

Accounting Directors and Controllers

Controllers and assistant controllers represent critical leadership positions that require extensive technical knowledge, management capabilities, and strategic vision. Research from Financial Executives International demonstrates that these roles have become harder to fill as organizations seek candidates who can modernize accounting operations, implement new technologies, and provide strategic guidance to executive leadership.

Forensic Accountant Compensation Across the U.S.

- National: $102,546

- Boston-Cambridge-Nashua, MA-NH: $101,063

- Dallas-Fort Worth-Arlington, TX: $103,551

- Los Angeles-Long Beach-Anaheim, CA: $112,304

- New York-Newark-Jersey City, NY-NJ-PA: $123,553

- St. Louis, MO-IL: $95,561

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $121,328

Source: LaborIQ

Note: Salaries reflect recommended compensation based on a bachelor’s degree and 2–4 years of experience in role in October 2025.

Strategic Implications for HR Leaders

Successfully competing for top accounting talent requires HR and talent acquisition leaders to adopt several critical practices:

Embrace Compensation Transparency: Forward-thinking organizations increasingly adopt compensation transparency practices, including clear salary ranges in job postings. This approach builds trust with candidates while streamlining the recruitment process by attracting applicants whose salary expectations align with organizational budgets.

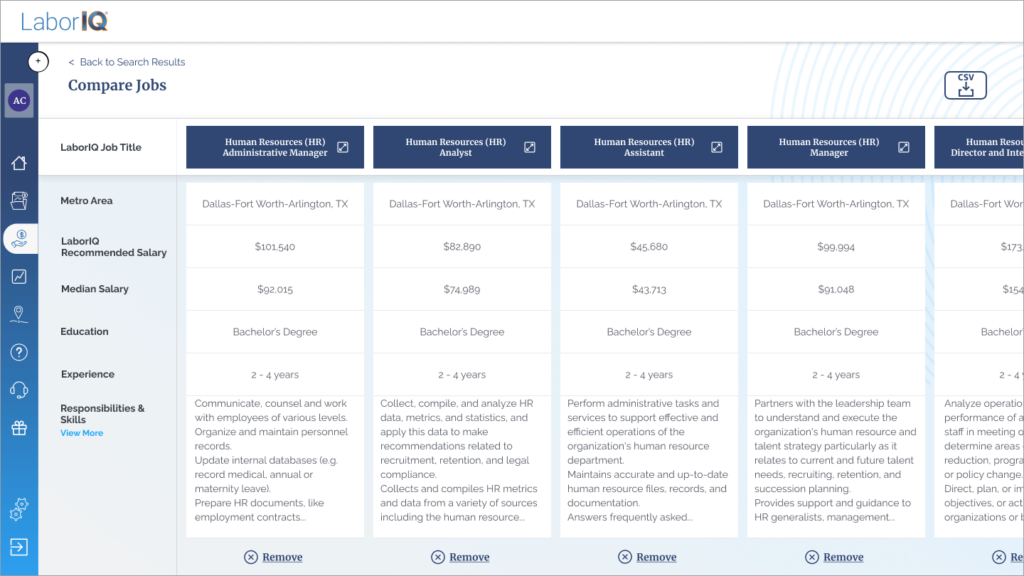

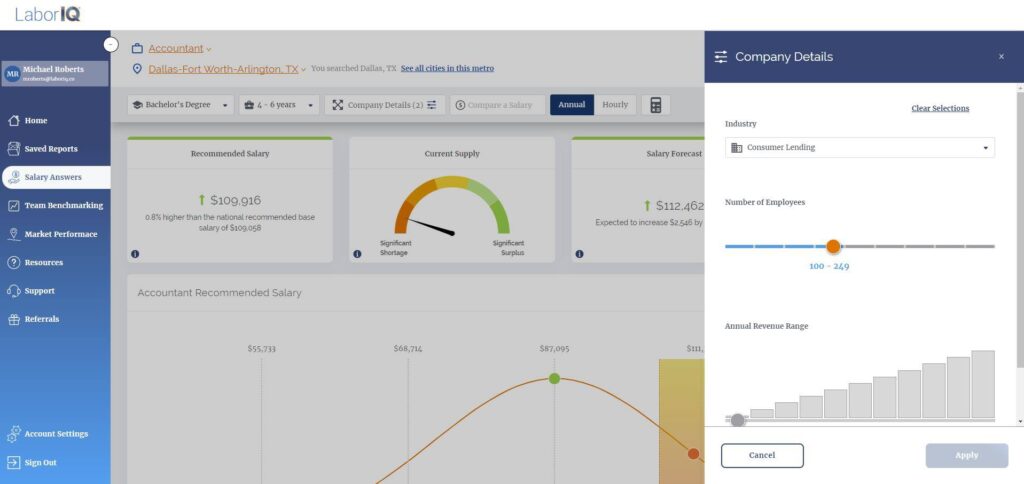

Implement Data-Driven Compensation Strategies: Regular market salary benchmarking using reliable, real-time data ensures compensation packages remain competitive. Organizations using platforms like LaborIQ gain access to comprehensive compensation market data that enables precise, localized salary recommendations for accounting roles across all U.S. markets.

Design Flexible Compensation Structures: Modern compensation structure design must account for the full spectrum of total rewards, including remote work flexibility, professional development opportunities, and clear advancement pathways. These elements have become as important as base salary for many accounting professionals.

Develop Proactive Talent Pipelines: The most successful organizations don’t wait for positions to open before engaging with potential candidates. Building relationships with accounting professionals through industry associations, continuing education programs, and professional networks creates competitive advantages when hiring needs arise.

Conclusion

The competition for skilled accounting professionals will likely intensify as organizations continue recognizing the strategic value these roles provide. HR leaders who invest in robust compensation data analytics, embrace transparency, and design competitive total rewards packages will position their organizations to attract and retain the accounting talent needed for long-term success.