Labor Market Analysis: 2025 Trends and 2026 Forecast for U.S. Employment

In this month’s newsletter, we dig into the important events in the U.S. labor market:

- High-profile layoffs impact to unemployment

- Labor market “balance” might not be a good thing

- Government shutdown update

- 2026 compensation and labor market forecast preview

High-Profile Layoffs and Unemployment: What Labor Market Analysis Reveals

Over the past couple of years, we hear a new announcement almost weekly about high-profile layoffs at a major U.S. corporation. One question that inevitably comes up in every conversation with business leaders or presentation about the labor market is “how does [most recent high-profile layoff announcement] impact unemployment?”

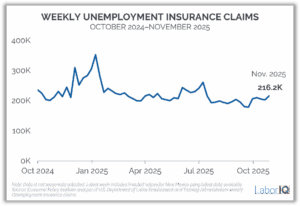

Even following the initial round of tech layoffs in 2022, there has not been an observable impact of high-profile layoffs on key measures of unemployment in the U.S. – the unemployment rate and initial unemployment insurance claims. Because of the Federal government shutdown, we do not have data on the unemployment rate, but we do have data on weekly unemployment insurance (UI) claims. While there have been fluctuations over the past year, recent UI claims data show little change from a year ago.

Understanding Labor Market Balance: Talent Supply and Demand Analysis for 2025

Typically, when something is described as being balanced it’s a positive thing – whether the flavors in a meal, someone’s temperament, or a household budget. Other times balance is more like walking a tight rope, and that is where the labor market is right now.

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers.

This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

– Jerome Powell, chair of the Board of Governors of the Federal Reserve System, on August 2, 2025 in Jackson Hole, Wyoming

Supply and demand are currently in near perfect balance (a curious kind of balance) keeping the unemployment rate near historic lows – a low hiring, low firing environment. Current hiring volumes, combined with low labor force growth, are just enough to keep unemployment from rising substantially because the volume of layoffs is so low.

Even moderate shifts in either hiring or layoffs could have substantial impacts on unemployment.

2026 Labor Market Analysis, Compensation Trends and Employment Outlook

While 2025 has been characterized by uncertainty, 2026 could bring a bit more stability – or at least more clarity and preparedness around the uncertainty to come – for U.S. businesses.

Six Key Trends That Shaped U.S. Employment in 2025

Before looking ahead to 2026, it’s important to understand the current labor market and economic landscape as we close out 2025. Below are my insights into the six most important labor market events from the past year.

- DOGE and changes to the Federal workforce. Estimates suggest that as many as 300,000 employees could leave the Federal workforce by the end of the year.

- Tariff and trade policy shifts present uncertainty. In the first part of the year, announcements of changes to tariff policy, as well as continued changes and updates to those policies, contributing to substantial uncertainty for U.S. businesses.

- Inflation is not going away. See previous bullet. The most recent inflation reading showed prices grew by 3% month-over-month in September 2025 and could be the only Federal data reported during the shutdown. Notably, the persistence of inflation was driven largely by energy costs and food prices.

- Migration shifts exacerbate U.S. demographic trends, talent shortage. Businesses can only hire employees or job seekers that exist in the country. Hiring volumes are currently low amid a broader cooling of the labor market and economy. However, when the environment shifts, hiring will be limited by low population (and labor force) growth.

- AI jobs (and layoffs?) on the rise. The presence of AI in the labor market – and every aspect of life right now – is undeniable. But the overall impacts to hiring and layoffs are still up for debate.

- Longest Federal government shutdown in U.S. history. The distinction of the longest shutdown was earned the first week in November, with no end in sight as of this writing (November 7, 2025).

2026 Labor Market Analysis Forecast: Hiring, Unemployment, and Wage Growth

We are still putting the finishing touches on our 2026 outlook, which will be published later this month.

Here is a preview of what to expect – the labor market will continue at this slower pace, negative risks outweigh positive ones, and the labor market balance could be easily disrupted.

62 Million Hires

LaborIQ forecasts 62 million total hires by U.S. businesses in 2026. This figure includes new job creation as well as labor market churn through backfilling open roles.

1 Million New Jobs Added

For 2026, LaborIQ expects around 1–1.4 million new jobs added, up from what will likely be fewer than 1 million in 2025. This forecast is slightly more optimistic than others in the market, driven by expectations that uncertainty will subside, tariffs will largely be reversed, and international migration should normalize somewhat.

4.4% Unemployment Rate

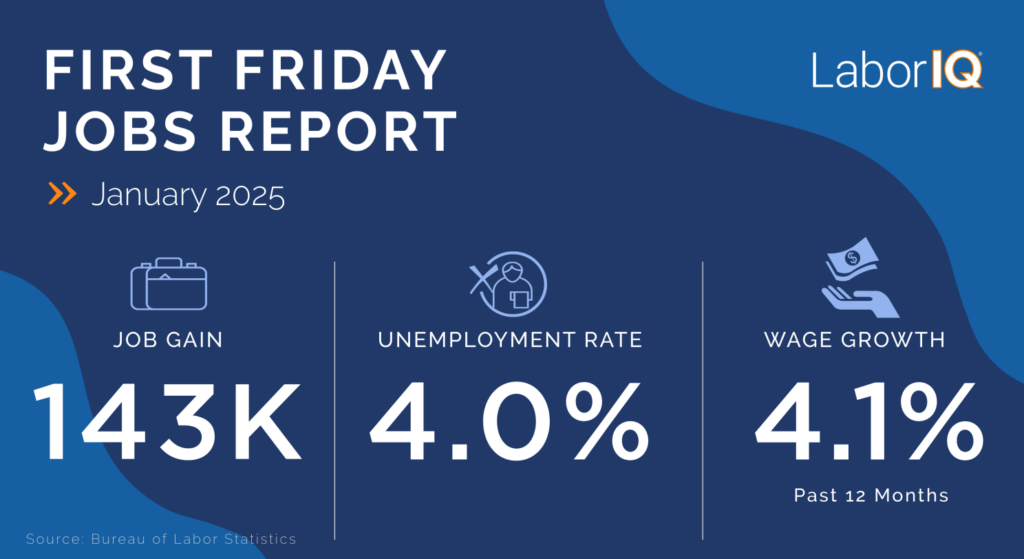

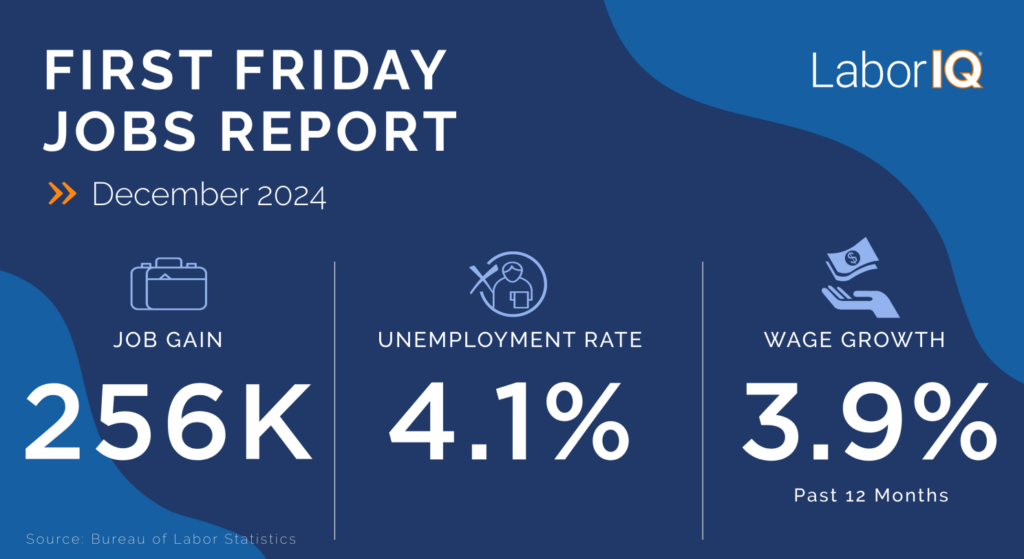

The unemployment rate is likely to tick up to 4.5% in 2026, representing an increase from the current rate of 4.3% (as of August 2025) and 4% in December 2025.

3.4% Wage Growth

Median and average wages are forecasted to grow by 3.4% and 3.8%, respectively, in 2026. This distinction means that most wage growth is likely to be driven by a relatively small number of workers receiving pay bumps over 4%, with at least half of workers receiving pay increases of 3.4% or lower.

Conclusion

When it comes to labor market analysis over the past few years, only a couple of things have been predictable – uncertainty and overperforming expectations.

The U.S. labor market in 2025 presents a complex landscape of competing challenges and opportunities that will shape workforce dynamics well into 2026.

Migration shifts continue to exacerbate demographic trends, limiting the available talent pool just as businesses prepare for future hiring needs, a constraint that could become particularly acute when economic conditions improve.

Meanwhile, wage growth projections of 3.4% reflect a cooling but competitive compensation environment, although this modest increase may struggle to keep pace with persistent inflation and rising costs of living.

These interconnected issues create a precarious balance where employers must navigate talent scarcity and retention challenges while workers face affordability pressures that could reshape traditional career trajectories and geographic flexibility in the years ahead.