Each city’s employment conditions vary, depending on its unique economic factors and demographics. These aspects significantly impact the existing talent supply and the number of people willing to move to the area. They are also interdependent. A healthy local economy can spur job creation, increase the talent supply via population growth and ultimately boost demand for recruiting firms. Below, we explore how a location’s economic condition and population affect recruitment and hiring.

Economic Market Performance

A location’s key economic performance indicators provide insight into how much hiring will be needed, as well as whether there is enough local talent to fill the roles. Metros with low levels of unemployment and high levels of job growth translate into a shortage of local talent. Recruiters will be in high demand because finding the right candidate takes focused effort and often, requires seeking talent from other geographic areas.

In the current climate, where many U.S. businesses and industries have taken an economic hit, a metro’s proximity to its pre-pandemic employment level is a key indicator. As business revenues were impacted, expenses were cut, which often meant lowering business headcounts. A metro closer to its employment level from early 2020 suggests businesses there are navigating through the pandemic better than businesses in other metros and will likely transition from recovery to expansion mode faster than other locations.

Healthiest Cities

As of the date of this publication, the healthiest metros by this measure are within 5% of their employment levels from February 2020. This prestigious list includes Tucson, Arizona; Indianapolis; Austin, Texas; Kansas City, Missouri/Kansas and Phoenix. As these metros continue to improve, their talent supplies will tighten faster and make filling roles more challenging without a dedicated focus on recruitment, whether the recruitment resources are internal or external.

On the other hand, metros such as New York, Las Vegas, Los Angeles and Raleigh, North Carolina are currently off more than 10% from their previous employment levels. In many cases, recruiters and hiring managers will be more challenged sorting through a flood of resumes due to higher unemployment levels. Additionally, as employers begin to refill roles, they will often try to reconnect with former employees that already know the company and the role, rather than look for new talent.

One of the biggest determinants of economic progress has been those industries that contribute most to a metro’s local economy. For instance, metros that have a large dependence on tourism and entertainment have experienced higher unemployment rates and lower job growth than locations reliant on industries not as impacted by COVID-19. Local restrictions related to the virus also play a major role.

Even with the pandemic’s impact, wage growth has remained strong, especially for those switching jobs. Strong wage growth in a metro can help recruiters lure talent from one company or metro to another. This is especially true if the candidate has been in a role where compensation growth has not kept pace with the market. As the outlook improves and confidence rises, people will be more willing to move locations, especially if the role includes a healthy increase in salary.

Demographics and Diversity Impact the Available Talent Supply

As stated above, a location’s ability to create jobs and increase wages will impact its ability to attract people with highly marketable skills. Metros with a large and growing share of prime-working-age residents, 24 to 54 years of age, are ideal for recruiters. The larger the share of this group, the more talent will be available for sourcing candidates.

Matching skills and education levels to employers’ needs is also critical for recruiters. For industries and companies dependent on knowledge workers, metros with high levels of educational attainment is a must to fill open positions. Metros with an abundance of college-educated professionals, such as Washington D.C., Raleigh, Denver and Austin, are hot spots for recruitment for roles in financial services, technology, and professional and business services.

When a metro consistently attracts new jobs, it can result in a more diverse population. This diversity then transforms the local workforce. Even for organizations without diversity initiatives, recruiters will see more women and candidates of various races/ethnicities, religions, and sexual orientations in the available talent pool. This is especially true of large metros, which tend to have high levels of population growth. However, as affordability and cost of living become more important, mid-sized cities in the South and Midwest will likely see more of this diversity in their demographics.

Related: Purposefully Creating Diversity in the Workplace

Why Economics and Population Matter

From 2010-2019, metros in the South and West accounted for 90% of the nation’s population growth, and the economic and demographic factors mentioned above played a major role in that trend. Ultimately, it led to a larger talent supply to fill the hiring needs of companies.

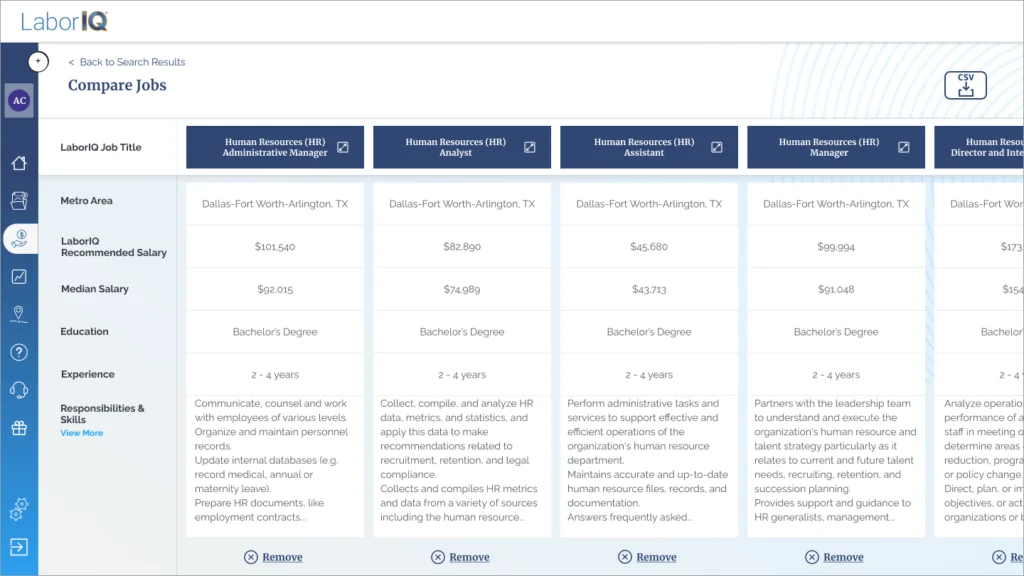

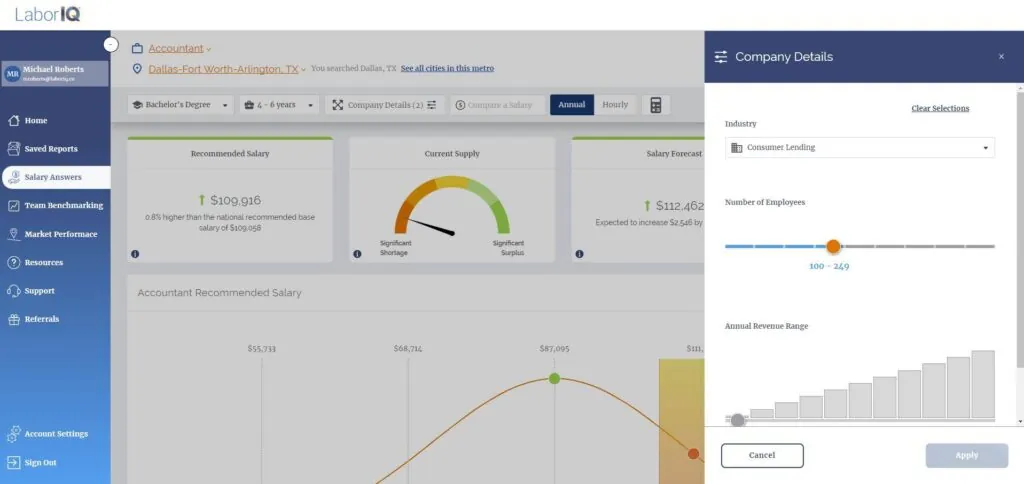

When LaborIQ® by ThinkWhy ranks markets, it weighs these types of factors. Outperforming the rest of the U.S. in many economic performance indicators, the metros that top the current list are Dallas, Austin and Phoenix. While the COVID-19 recession has also slowed growth in these metros compared to the national rates, these three metros have higher rates of job growth and wage growth and a lower unemployment rate.

In the current environment, the type of industries that contribute most to a location’s economy is affecting key factors, like job growth and net migration. This will impact if there is enough talent to recruit from or if a location has enough employment opportunities to support a growing population. While some of these negative economic trends will quickly reverse once the virus can be controlled, it may take some locations – those dependent on travel and tourism, restaurants and entertainment – years longer to fully recover.

LaborIQ by ThinkWhy continuously monitors and forecasts labor data at all levels, measuring its impact on cities, industries, occupations and businesses across the U.S.