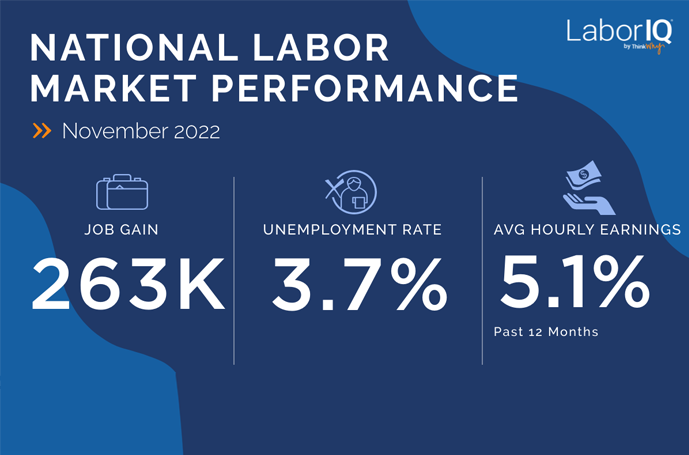

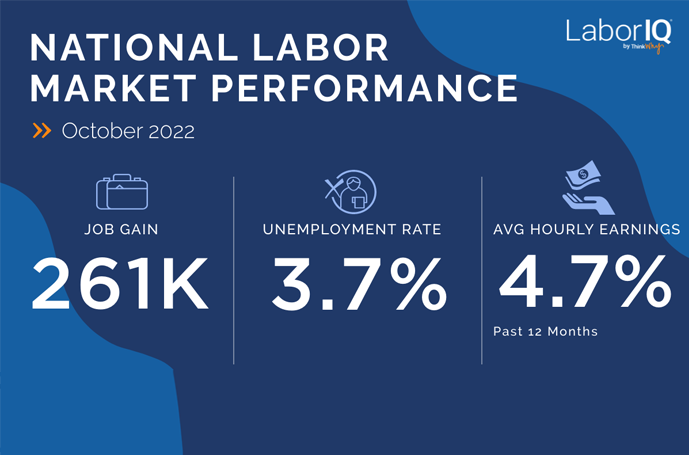

In March, the economy added jobs at a surprisingly strong pace. The unemployment rate edged down, marking the longest period of sub-4% unemployment rates since the 1960s. Wage growth remains cooled somewhat in March, a welcome sign for those hoping the Fed lowers interest rates this year.

No Slowdown in Hiring

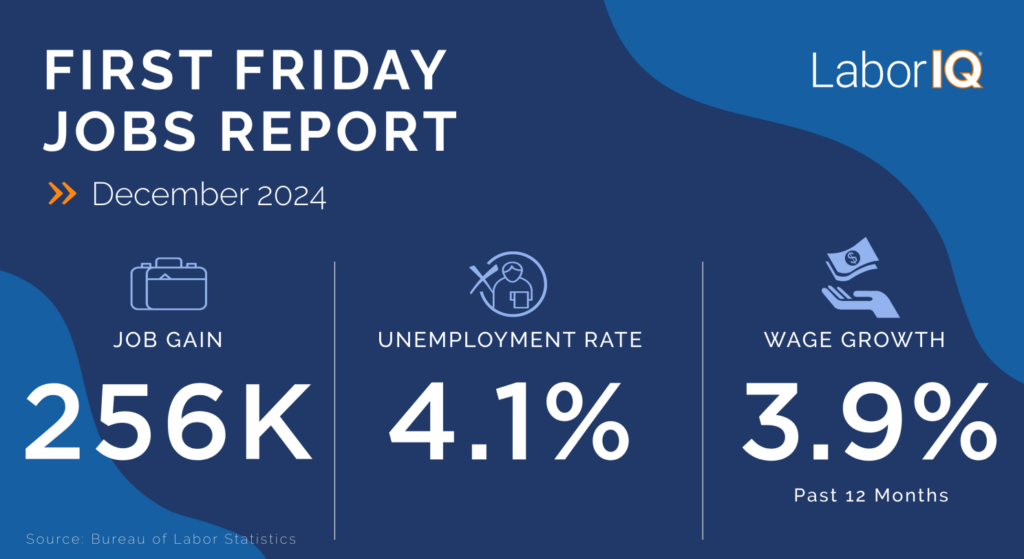

U.S. businesses added 303,000 jobs in March, surpassing expectations of around 200,000 net job gains. Contrary to what we’ve grown accustomed to in previous months, revisions indicate the economy added 22,000 jobs more than originally thought in January and February. March’s net job gains are the highest total since January of 2023 and match the 303,000 jobs added last May.

A soft landing appears likely, but March’s surprising job gain total points to a labor market that’s still flying high – no landing in sight.

A resilient labor market is very good news for U.S. workers and businesses but not without challenges. Each month where the labor market is hotter than expected pushes expectations of a Fed rate reduction further into the future.

High interest rates’ impact to businesses:

- Investment and Spending. With borrowing costs higher than any time in the past quarter century, and uncertainty of when those costs will come down, businesses may pause plans for expansion or R&D efforts.

- Housing Market. Hiring remains strong, but worker relocation is a challenge for homeowners locked into low interest rate mortgages.

- Return-to-Office. If workers can’t affordably relocate for new opportunities, businesses may need to pause or alter RTO plans.

Job gains | Blowing past forecast expectations

Job gains exceeded expectations, yet again. The 303,000 jobs added by U.S. employers in March is well-above the 231,000 average over the previous 12 months.

2024 was supposed to be the year of normalization for the labor market, but after the first three months things are anything but.

We’ve averaged 276,000 monthly job gains so far in 2024. If we were to keep that pace through the end of the year, we’d end 2024 adding 3.3 million new jobs. That would equate to the third highest annual hiring total ever.

So far, we’ve added 829,000 total jobs in the first quarter of 2024. How does that compare to labor market forecasts?

- In January, economists surveyed by The Wall Street Journal projected around 800,000 jobs would be added in 2024 – we’ve already surpassed that total.

- If we keep adding jobs at this pace, we’ll eclipse LaborIQ’s annual forecast of 1.4 million jobs added by June.

Industries | Job gains concentrated to a few industries… again

Over half of all jobs created so far in 2024 have been in three industries – Government, Healthcare, and Leisure & Hospitality. Since mid-2023, these three industries have continually led the pack in terms of job gains and growth. There are a few reasons for these trends:

- Government, Healthcare, and Leisure & Hospitality are some of the largest industries in terms of total employment, so they will naturally add more jobs compared to smaller industries.

- These industries faced unique challenges and lagged recoveries following the pandemic. So, some of the job gains we see now are the result of the delayed recovery.

- Healthcare, unlike Government and Leisure & Hospitality, has long-term tailwinds that will propel the industry in the coming decades. Our aging population creates demand for healthcare workers.

The good news in March’s jobs report was not limited to three industries:

Construction added 39,000 jobs in March. Despite headwinds from high interest rates, all subsectors added jobs last month. The specialty trade contractor subsector, which includes pouring concrete, site preparation, plumbing, painting, and electrical work, accounted for the majority of construction jobs added.

Information employment, which includes entertainment and tech companies, was static in March. The good news in Information is for the tech industry – specifically computing infrastructure providers – which has faced challenges and high-profile layoffs over the past two years.

Unemployment rate | Labor market remains tight

The unemployment rate fell to 3.8%, continuing a stretch of 27 months with an unemployment rate below 4% going back to December 2021. The last time we had unemployment rates this low for this long was from February 1966 through January 1970.

The unemployment rate has edged up in recent months, making it a tougher market for job seekers. However, the unemployment rate remains low by historical standards, and the labor market remains tight. The competition for talent remains fierce, keeping compensation and retention a top focus for U.S. businesses.

Wages and compensation | Still top of mind for businesses and employees

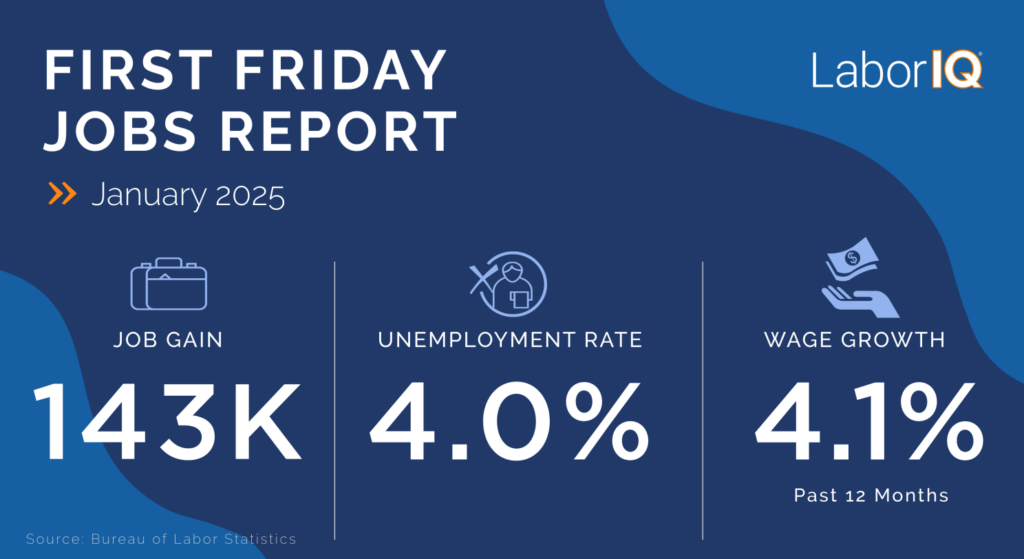

Annual wage growth ticked down to 4.1% in March from 4.3% in February. While wages may be growing at a rate faster than the Fed would like to see, March’s rate is lowest in almost three years back to June 2021.

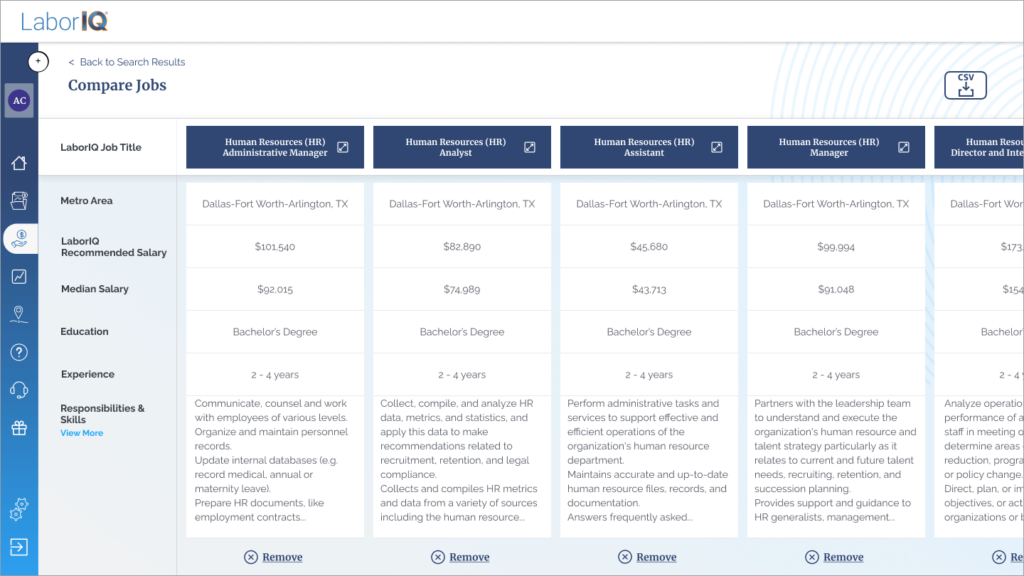

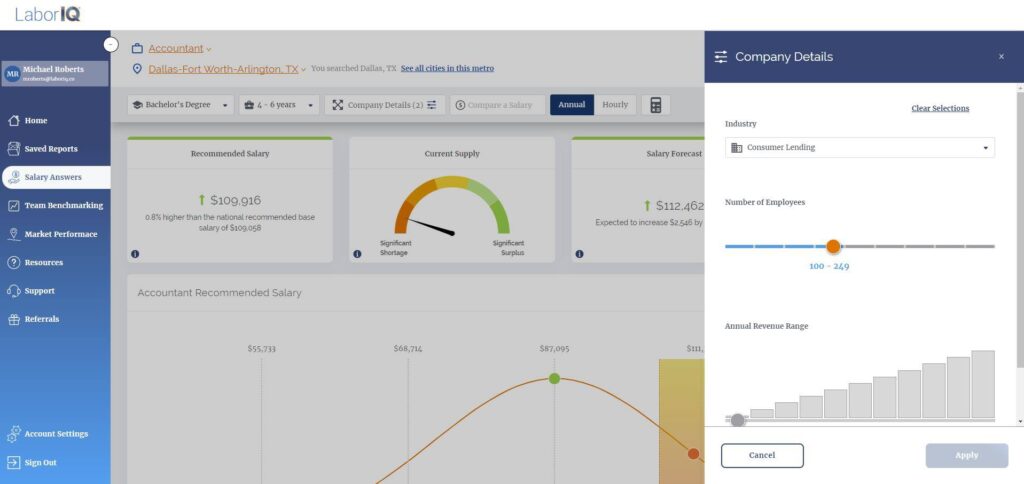

LaborIQ provides HR teams and business leaders with market-competitive compensation benchmarks. In an evolving job market, you need to know what salaries to offer to retain employees and fill open positions faster.

Want to hear about how LaborIQ can help your HR team? Learn more