The economy added 187,000 jobs in August, just above economists’ expectations. But downward revisions for the previous two months bring the 2023 average to a very solid 236,000 jobs added per month, which suggests the Fed’s interest rate hikes are working as intended to cool the labor market.

The 187,000 jobs added by employers in August suggest the labor market is cooling. Job gains have certainly begun to normalize, and August’s total is just below the pre-pandemic average of 200,000 jobs added per month.

Job gains for both June and July were revised downward by a total of 110,000, suggesting the labor market was a bit cooler the past two months than the initial numbers indicated. Downward revisions have become the norm over the past few months.

While a slowdown was inevitable, many businesses remained confident in adding new positions in addition to backfilling open roles. August’s job gains bring the 2023 total to 1.9 million through the first eight months of the year.

Demand for Workers Slowing

Job openings are a key indicator of labor demand. And July’s job openings, reported earlier this week, showed signs that hiring plans have moderated, but the demand for talent is still out there.

Job openings ticked down to 8.8 million. While job openings have declined from last year’s average of just over 11 million per month, they’ve remained persistently higher than the 2015 to 2019 average of 6.4 million monthly job openings.

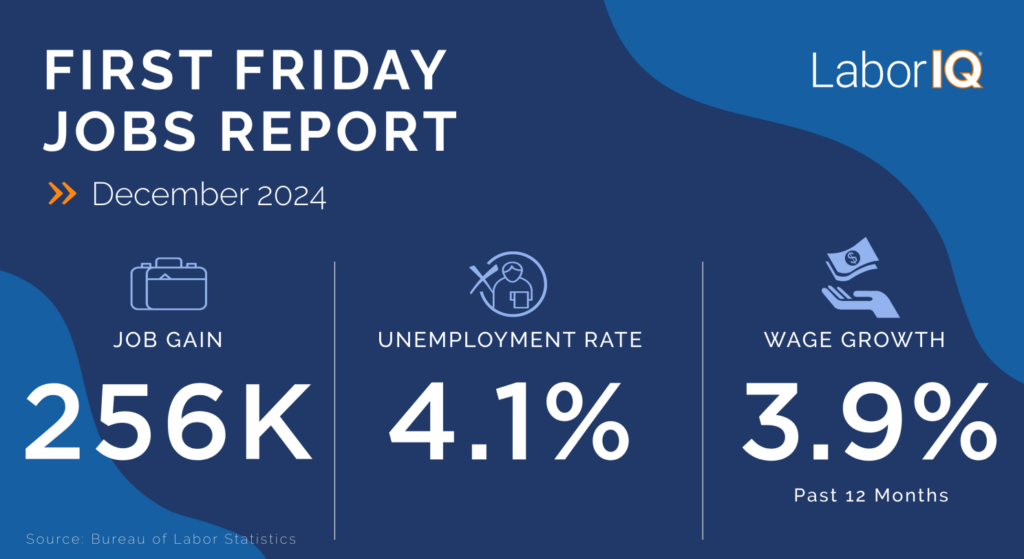

As demand for workers starts to moderate, we’d expect record wage growth to ease, but August’s jobs report shows 12-month wage growth ticked down slightly to 4.3%. Wage growth has hovered in this range all year long and doesn’t seem to be slowing. But with inflation starting to cool, workers should start feeling some relief.

Layoffs Hold Steady as Unemployment Rises

Hiring is still in a healthy range, and layoffs have not increased at the pace many projected. Layoffs held steady in July at 1.6 million, below the 1.9 million monthly average layoffs before the pandemic.

And the unemployment rate increased to 3.8%, the highest since February 2022. This increase is the result of more people joining the labor force. While this is the biggest jump in unemployment in a few months, the unemployment rate remains very low by historic standards. From 2015 through 2019, the unemployment rate averaged 4.4% and reached a high of 5.7%.

With 8.8 million job openings, and 6.4 million unemployed workers available to fill those open roles, there are 1.4 open jobs for each unemployed worker. And while things are easing up, the competition for talent will remain fierce.

2023 Outlook

Our prediction for the second half of 2023 is that the labor market will continue moderating to historic norms. But with a labor force that’s not growing as fast as demand and an unemployment rate near historic lows, the labor market will remain incredibly tight and competition for talent is unlikely to let up.

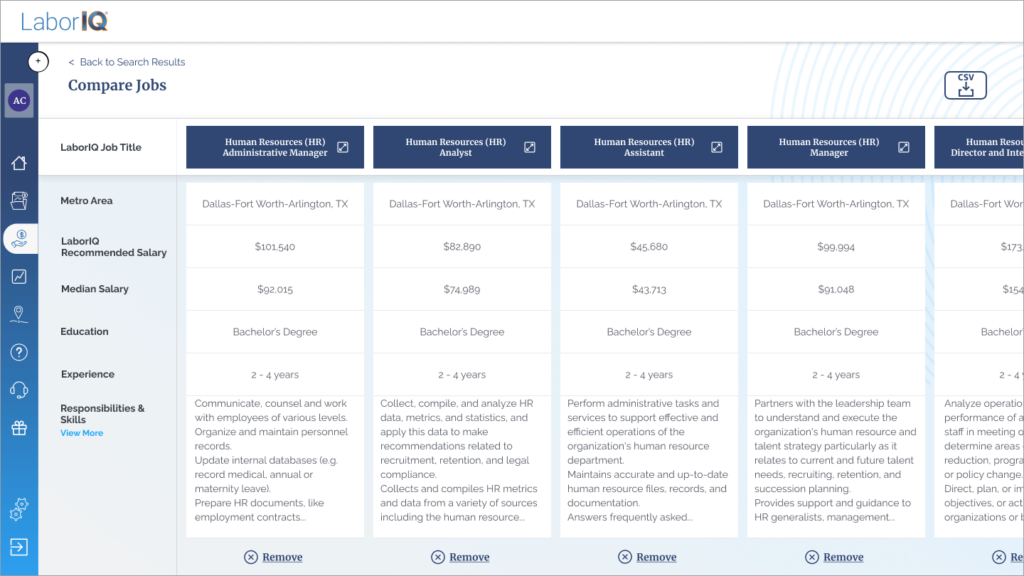

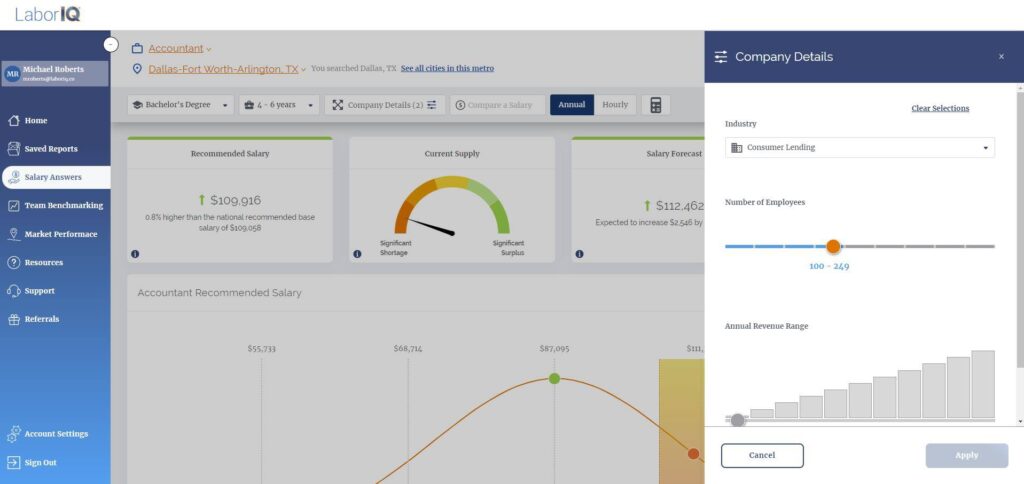

Companies will need to watch the labor market and track compensation trends closely this year to stay competitive.