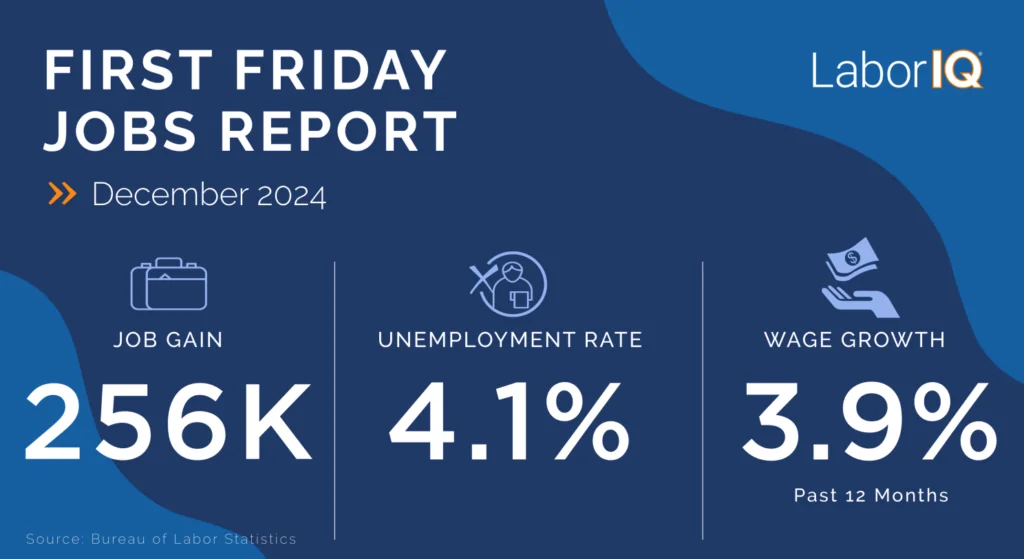

Today’s December jobs report was the final report for 2023. Job gains came in above expectations, and wage growth was unchanged in December, once again showing the resiliency of the U.S. job market. The unemployment rate remains near historic lows.

December’s jobs report caps off a year where the labor market constantly defied expectations. There was a cooling from the hot labor market of 2021 and 2022, and not all industries are feeling the positive news. However, kicking off 2024 with a labor market and economy showing resilience and sustained growth is good news for U.S. businesses.

2023: A year that some economists got it really wrong

U.S. businesses added 216,000 new jobs in December, beating economists’ projections of 175,000.

While the economy and labor market cooled in 2023, we defied expectations and avoided a recession that was all but assumed when we began the year. The labor market is heading for a soft landing, which is good news for businesses and job seekers.

⚠️2023 recap (with some caveats)

This month’s report shows the economy added 2.7 million jobs in 2023. That marks a decline from the 4.8 million jobs added in 2022 and 7.2 million in 2021, but this year’s total beats the 2015–2019 annual average of 2.3 million jobs added.

As with every jobs report, we should expect some revisions over the next couple of months. But even substantial downward revisions (which have become the norm recently) won’t meaningfully change the theme of a robust labor market in 2023.

One challenge over the past year is that the headline numbers mask a lot of industry trends. Throughout 2023, job gains have been concentrated in a handful of industries. To some extent, this helps explain why actual experiences in the labor market have varied for businesses and employees.

Government, Healthcare, and Leisure and Hospitality accounted for three out of every four jobs added in 2023. While those industries do have some of the highest employment levels, their growth is still impressive on a relative basis. Hiring in many sectors has been static, with slower or negative growth in the second half of 2023.

Labor market and hiring activity have cooled, but the good news is that there is enough growth in some sectors that we haven’t seen an increase in the unemployment rate or widespread job losses.

Why was 2023 so tough for economists to get right?

This phrase has been overused in recent years, but we really were (and are) in “unprecedented” times.

Some economists had been predicting a recession years before the pandemic under the belief that the years of growth following the Great Recession had to come to an end at some point. The pandemic turbocharged a recession. That turmoil was followed by a swift and unprecedentedly strong, albeit uneven, recovery for the labor market.

Supply chains and wage growth spurred inflation, which led the Fed to raise interest rates at an unprecedented pace. The goal of rate hikes was to stall demand, and the logic was that this was likely to cause a recession based on historical precedent. Even industries that tend to slow with rate hikes, like Construction, Real Estate, and Finance) didn’t suffer the catastrophic losses many predicted.

There really isn’t a good explanation, but a couple of important factors persist. Business’ demand remains strong. While not all industries are hiring at a rapid pace, there haven’t been widespread job losses either. And the labor force isn’t growing fast enough to keep up with the demand. There are fewer young Gen Z workers to replace retiring Baby Boomers. Because demand has remained elevated, there have been opportunities for workers who want a job even though things have cooled down.

Headline numbers have been strong, but the uneven (and unpredictable) recovery has been challenging for many workers and businesses.

Job gains

The 216,000 job gains in December highlight the resilience of the U.S. labor market. We averaged 225,000 new jobs added per month in 2023, and December’s robust total caps off three straight years (36 months) of growth.

Looking back on 2023, the consistent pace of job gains indicates the labor market has stabilized. Following January’s massive increase of more than 400,000 jobs, we’ve ranged from 105,000 to 281,000 net jobs gains over the past 11 months.

Industries

In December, two out of every three jobs added were in Government, Healthcare, or Leisure and Hospitality. Only two major sectors – Mining and Logging and Other Services – lost jobs in December.

If we dig deeper into industry and subsector performance, there were some additional challenges in December. Transportation and Warehousing suffered the biggest job loss in December due to a decline in the employment of Couriers and Messengers by 32,000.

While growth slowed for many industries in the second half of 2023, nearly all major industries added jobs last year. The exception is Information, which lost 69,000 jobs or 2.2% of its workforce.

Information includes technology companies (computing infrastructure and web search portals), that had high-profile layoffs throughout the year, as well as entertainment and movie production companies with striking workers toward the end of 2023.

Unemployment rate

The unemployment rate held steady at 3.7%, marking 23 months below 4%.

Today’s low unemployment rate shows how tight the labor market remains even by historical standards. For context, the unemployment rate averaged 4.4% from 2015 through 2019, when the economy was quite strong.

The unemployment rate has ticked up from historic lows reached in January and April of 2023, when unemployment reached 3.4% for the first time since 1969.

So far, even a softening in the labor market hasn’t led to large increases in unemployment.

Wages and compensation

Annual wage growth ticked up to 4.1% in December. While not a substantial increase, the consensus among economists is that we’d end the year with 12-month wage growth below 4%.

For businesses in annual merit or budget planning, don’t expect a major decrease in wage growth for 2024. To remain competitive, 3.5–4% wage growth will be the minimum of what’s needed to retain and attract talent.

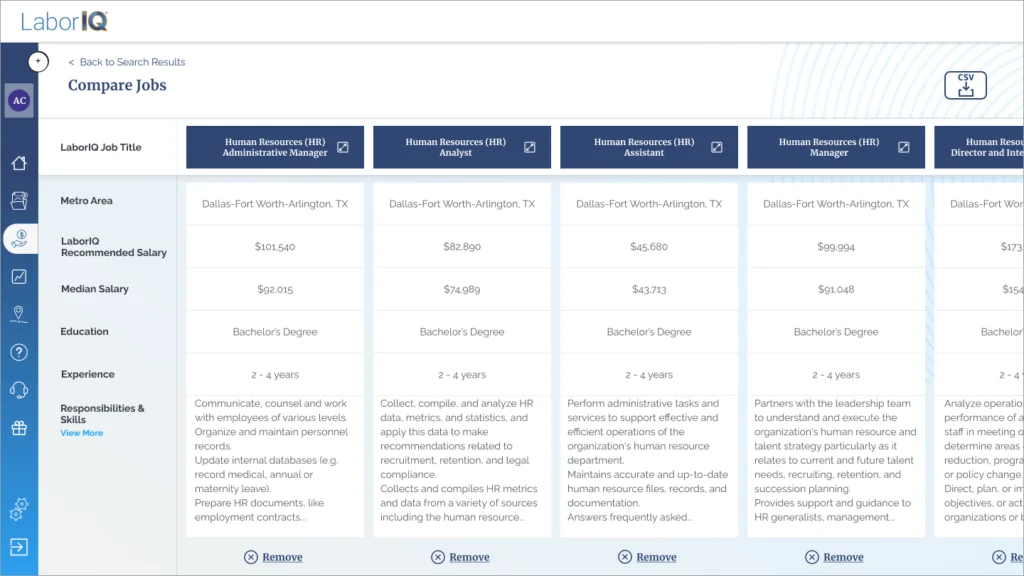

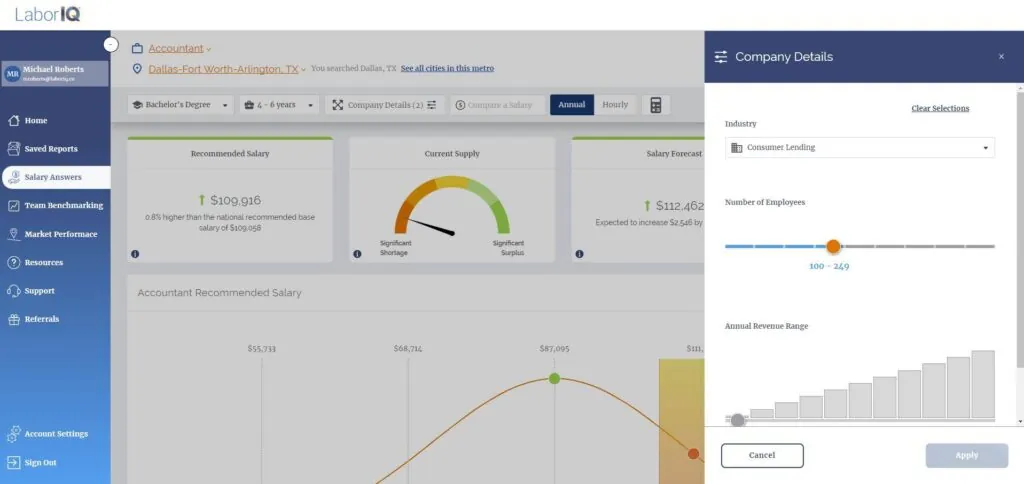

LaborIQ provides HR teams and business leaders with market-competitive compensation benchmarks. In an evolving job market, you need to know what salaries to offer to retain employees and fill open positions faster.

Want to hear about how LaborIQ can help your HR team? Learn more