The New York-Newark-Jersey City metropolitan area remains the nation’s largest labor market. As of June 2025, the NYC metro area ranked 31st overall in the comprehensive LaborIQ Market Index – which evaluates 150 metropolitan areas across 10 key economic indicators spanning labor markets, industries, demographics, and education.

The NYC metro area demonstrates remarkable resilience with strong job creation and a highly educated workforce, while navigating new regulatory landscapes around pay transparency laws.

New York Metro Area LaborIQ Rankings & Employment Data

The NYC metro area commands the top position nationally for working-age population (7.93 million individuals aged 25–54 years old) and total college degree holders (506,825), reflecting its status as America’s premier talent hub.

The region added 132,700 new jobs in 2024, ranking first nationally for job creation, though moderate 1.3% relative job growth places the metro in the middle of the pack at 64th. This dynamic illustrates the New York metro area’s scale advantage – while percentage growth may appear modest, the sheer volume of opportunities created exceeds most other metropolitan areas combined.

The New York metro area wage data reveals key trends for HR professionals, including competitive pay levels and slowing wage growth. Average wages of $38.70 per hour rank 13th nationally in the LaborIQ Market Index, indicating competitive compensation levels, though 1.8% wage growth (95th rank) suggests tightening margins amid inflationary pressures. Educational attainment at 37.5% (18th rank) underscores the market’s knowledge-worker orientation, creating both talent advantages and wage premium expectations for employers.

New York Metro Area Pay Transparency Requirements 2025

The regulatory environment has fundamentally shifted with comprehensive pay transparency legislation across the NYC metro.

NYC’s Salary Transparency Law became effective November 1, 2022, requiring employers to include good faith pay ranges in all job advertisements, while New York state’s broader law took effect September 17, 2023, mandating employers with four or more employees include salary ranges in job postings for positions performed at least partially in New York.

New Jersey completed the regional transformation when Governor Phil Murphy signed SB2310 into law on November 18, 2024, with an effective date of June 1, 2025. This New Jersey pay transparency law requires employers with at least 10 employees to disclose the wage or salary range and a general description of benefits for advertised positions. The New Jersey law applies to employers with at least 10 employees over 20 calendar weeks, covering both internal and external job postings.

These pay transparency regulations represent more than compliance requirements – they’re reshaping talent acquisition strategies across the entire metropolitan area. HR leaders report increased candidate expectations around compensation discussions, compressed negotiation cycles, and internal equity pressures as employees gain visibility into role-based pay ranges.

HR teams must navigate three separate pay transparency laws across NYC, New York State, and New Jersey, each with its own employee threshold and effective date. (NYC: any employees, NY State: 4+ employees, NJ: 10+ employees)

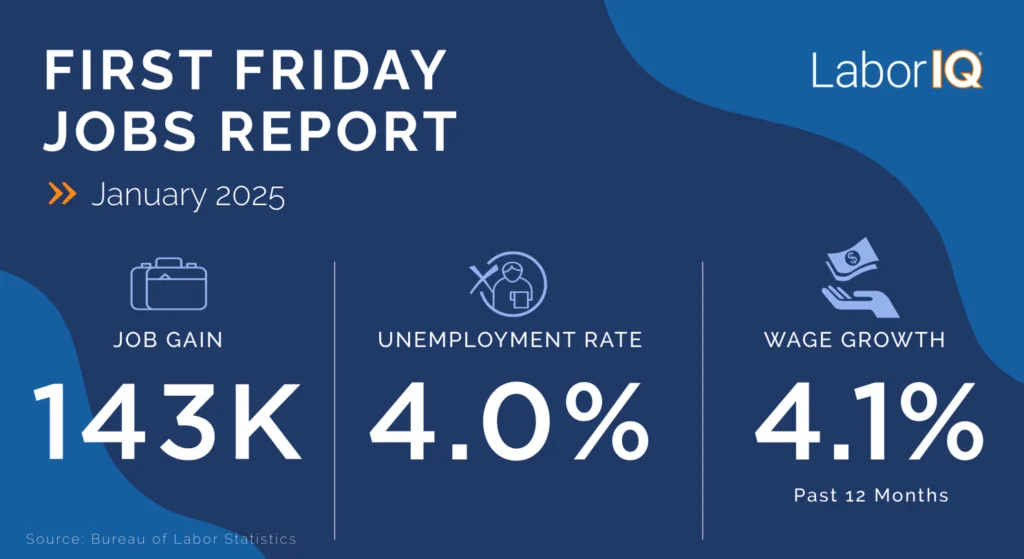

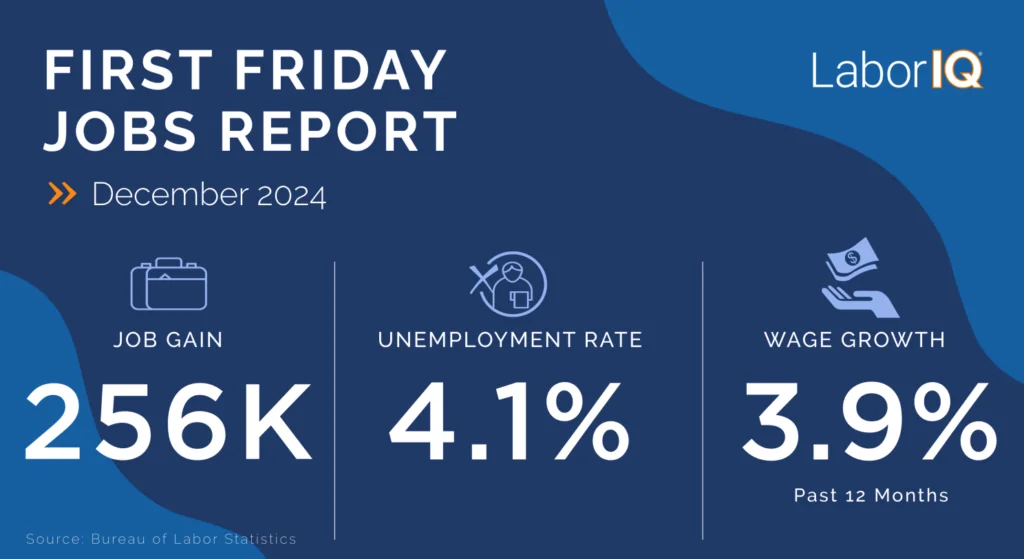

Current Labor Market Dynamics and Employment Statistics 2024-2025

Recent employment data reveals continued momentum in the New York metro area despite broader economic uncertainties. Total nonfarm employment increased by 139,200 over the year in November 2024, demonstrating sustained job creation in the region. However, job openings stood at 437,000 in February 2025, with a 4.2 percent rate and unemployed-per-job-opening ratio of 1.0, indicating a more balanced labor market compared to the extreme tightness of recent years.

This equilibrium presents strategic opportunities for HR professionals in the New York metro area. Recruitment timelines may normalize, allowing for more thorough candidate evaluation processes. However, the region’s competitive talent landscape demands differentiated employer value propositions beyond traditional compensation packages to attract top talent.

Strategic HR Implications

The metro area’s demographic challenges cannot be ignored within the broader LaborIQ framework. Population growth of just 0.1% (83rd rank) and net out-migration of 92,045 residents (150th rank) signal underlying retention issues that impact multiple index categories. The LaborIQ methodology’s strength lies in revealing how these demographic headwinds interact with other factors – while individual metrics like population growth appear concerning, the region’s dominance in educational attainment and absolute job creation demonstrates why single-factor analysis proves insufficient for market assessment.

Recovery metrics show the New York metro area at 102% of pre-pandemic employment levels, though ranking 101st nationally suggests slower normalization compared to other markets. This creates both challenges and opportunities as organizations restructure for post-pandemic operations while competing for available talent in the region.

HR Strategy Recommendations for New York Metro Area 2025

Thriving in the New York metro labor market requires a strong compensation strategy and clear processes for pay transparency compliance. With New Jersey’s pay transparency law taking effect June 1, 2025, organizations must develop comprehensive compliance frameworks addressing three distinct jurisdictions with different employee thresholds and timing requirements. Compensation strategies must balance regulatory compliance with competitive positioning, utilizing pay transparency as a recruitment advantage rather than merely a compliance burden.

Talent acquisition in the New York metro area should emphasize the region’s unique advantages – industry diversity, career advancement opportunities, and cultural richness – while addressing cost-of-living concerns through innovative benefit packages. The requirement to disclose both salary ranges and general benefits descriptions creates opportunities to differentiate through comprehensive total rewards communication.

Organizations should invest in retention strategies, acknowledging outmigration pressures, including flexible work arrangements, professional development programs, and quality-of-life initiatives. The highly educated workforce (37.5% college attainment) demands sophisticated career pathing and skill development opportunities to remain competitive in the New York metro area talent market.

Conclusion: New York Metro Area Labor Market Outlook

The New York-Newark-Jersey City metro area remains a premier talent market. While population and wage growth lag other regions, the absolute scale of opportunities, educated workforce, and recent employment gains create substantial advantages for organizations willing to navigate regulatory complexity and competitive dynamics.

HR professionals who embrace pay transparency requirements, develop comprehensive retention and compensation strategies, and leverage the region’s unique strengths will find significant opportunities for organizational success and talent acquisition excellence in 2025 and beyond.

The tri-state area’s position as the nation’s largest labor market, combined with evolving pay transparency regulations across New York City, New York State, and New Jersey, creates a unique environment requiring sophisticated HR strategies. Organizations that successfully adapt to these changes while capitalizing on the metro area’s educational advantages and job creation momentum will be best positioned for sustained success in this competitive but opportunity-rich market.