Legal compliance around pay involves multiple layers of federal, state, and local regulations. In the U.S., it’s a growing list of states and localities that require HR teams to be aware of, and navigate carefully.

Let’s break down how this impacts employers.

Federal Wage and Hour Laws

The Fair Labor Standards Act (FLSA) outlines federal requirements for minimum wage, overtime pay, and recordkeeping. HR professionals must ensure proper employee classification and payroll practices to avoid costly compliance issues. HR must classify employees as exempt or non-exempt, ensure overtime is paid at time-and-a-half for non-exempt workers exceeding 40 hours per week, and maintain detailed payroll records. Misclassification can result in significant back-pay liability and penalties.

Equal Pay and Anti-Discrimination Laws

Title VII, the Equal Pay Act, and similar statutes prohibit pay discrimination based on protected characteristics like gender, race, age, or disability. HR must ensure that pay differences are based on legitimate business factors like experience, performance, or market rates rather than discriminatory practices. Conducting regular pay equity audits is now essential as enforcement efforts intensify. These audits help HR leaders ensure compensation decisions align with anti-discrimination laws and pay equity standards.

State and Local Variations

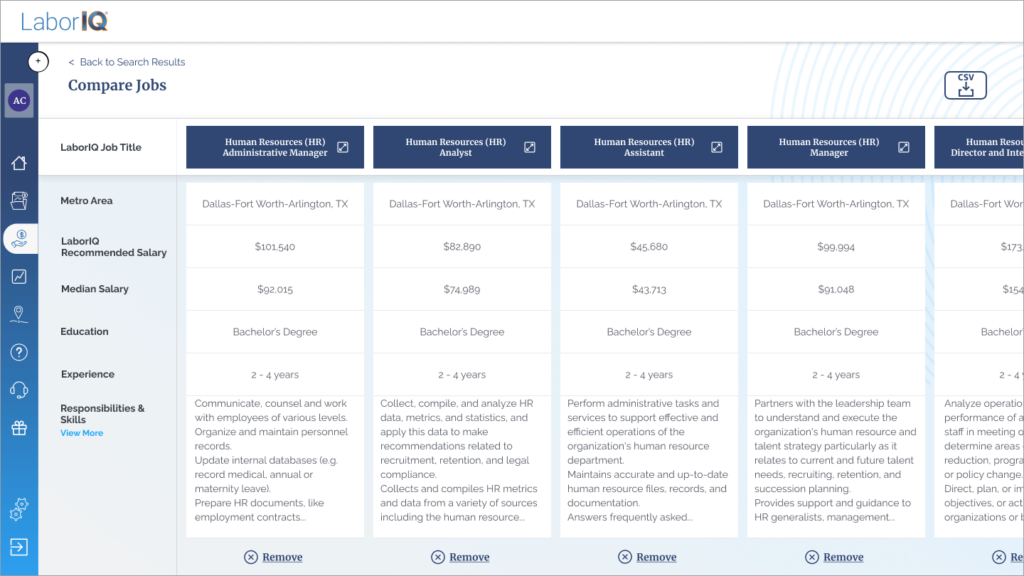

Many states and cities have enacted laws that exceed federal minimums, including higher minimum wages, expanded overtime rules, paid sick leave requirements, and salary history ban laws. Some jurisdictions now require pay transparency, mandating that salary ranges be included in job postings or disclosed upon request.

Contractor vs. Employee Classification

Properly distinguishing between employees and independent contractors is critical, as misclassification can lead to unpaid taxes, benefits, and wage violations. The Department of Labor and IRS have specific tests for determining worker status.

Recordkeeping and Documentation

Employers must maintain detailed payroll records for specific time periods and be able to demonstrate compliance during audits or investigations. Poor documentation can make defending against wage claims extremely difficult.

Non-compliance can lead to Department of Labor investigations, lawsuits, and substantial financial penalties—including back pay, damages, and legal fees. For many employers, these risks pose a serious threat to business stability.