The Houston-The Woodlands-Sugar Land metropolitan area stands as one of America’s most dynamic labor markets, ranking 10th nationally in the LaborIQ Index among 150 top U.S. metropolitan areas. With a robust working-age population of over 3.1 million and exceptional job growth momentum, Houston offers a strategic advantage for HR teams planning workforce expansion, with a growing talent pool and business-friendly environment.

Labor Market Performance and LaborIQ Rankings

Houston’s composite ranking of 10th place reflects strong performance across multiple economic indicators. The metro area demonstrates particular strength in population dynamics, ranking 5th nationally for working-age population size and 2nd for net migration with 65,260 new residents annually. This influx of talent creates a continuously refreshed labor pool that supports business growth initiatives.

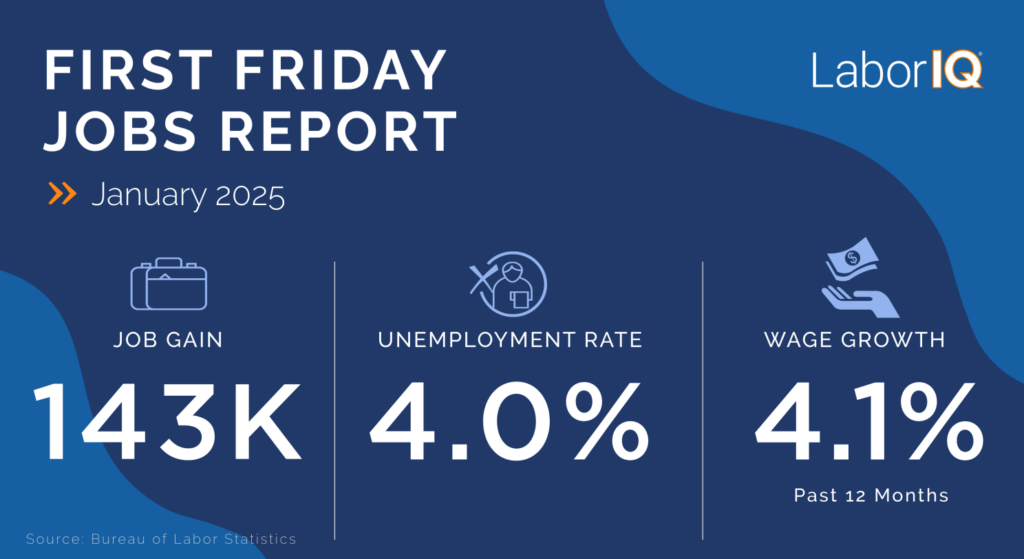

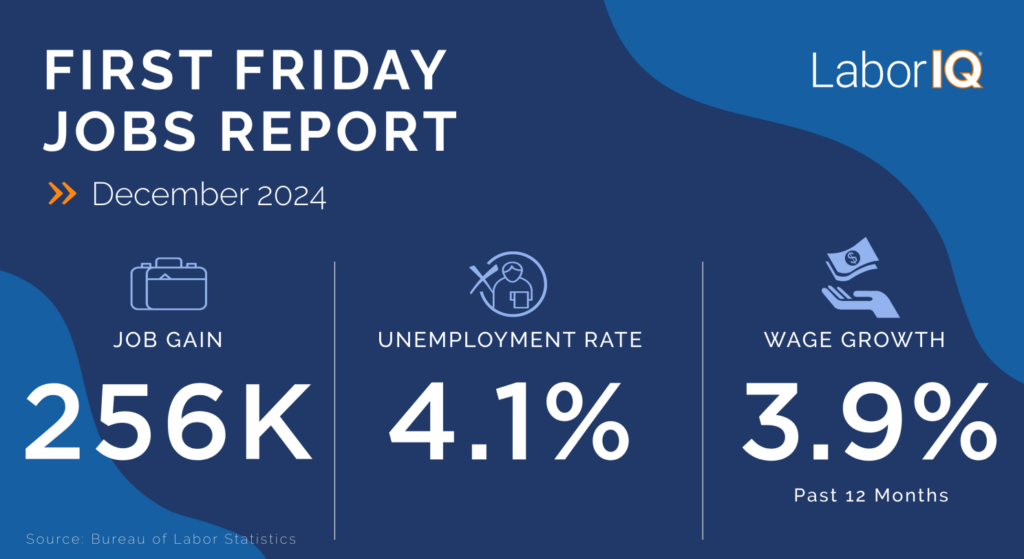

The region’s job creation engine remains highly productive, with 60,200 new jobs added recently and maintaining consistent 1.8% job growth rates. While wage growth has faced recent headwinds with a -1.2% decline, the metro area’s average wage of $34.22 positions it competitively within the national landscape. Recent data indicates compensation costs for private industry workers increased 7.5% in early 2025, suggesting a potential reversal of previous wage trends.

Migration Patterns and Talent Flow

Houston’s exceptional net migration ranking of 2nd nationally highlights its magnetic appeal for skilled professionals. This migration strength stems from several factors: Texas’s favorable business climate, Houston’s industry diversity, and the metro area’s lower cost of living compared to coastal markets. The region benefits from being cited as part of the number one state for relocations for six of the past eight years, creating a consistent talent pipeline for employers.

The educational foundation supports this migration trend, with 29.7% of residents holding college degrees and over 104,000 degree holders contributing to the skilled workforce. The 3.8% graduation growth rate ensures continuous development of local talent complementing in-migration.

Industry Diversity and Growth Sectors

Houston’s economic resilience stems from its diversified industry base spanning energy, healthcare, aerospace, manufacturing, and professional services. Healthcare and government sectors have led recent job growth, adding 9,800 and 6,900 positions respectively since April 2024. The Greater Houston Partnership forecasts 71,200-75,000 new jobs for 2025, with key growth drivers including healthcare, energy, logistics, and manufacturing.

Manufacturing shows particular promise as a growth engine, especially with reshoring initiatives, though trade policy uncertainties may influence momentum. The aerospace and advanced manufacturing sectors continue expanding Houston’s high-skill job opportunities, while the energy sector’s traditional strength provides economic stability.

Current Business Climate and Hiring Trends

Recent employment data reveals Houston’s strong recovery trajectory, with the metro area achieving 108.7% recovery rates and maintaining 3.9% unemployment. The region added 40,400 jobs over the past twelve months, with most sectors experiencing growth. Total nonfarm employment reached 3,474,200 by April 2025, representing continued expansion from previous records.

Professional services, healthcare, government, real estate, and manufacturing emerge as the five leading growth drivers. Industry diversity in Houston supports hiring across entry-level, technical, and professional roles, giving HR leaders flexibility in workforce planning.

Strategic HR Implications

For HR professionals, Houston presents unique advantages including access to a large, growing talent pool supported by continuous in-migration. The metro area’s educational infrastructure, combined with its industry diversity, creates opportunities for both entry-level hiring and experienced professional recruitment.

The recent wage growth challenges, while concerning, appear to be stabilizing with 7.5% compensation cost increases in early 2025. This environment may present opportunities for competitive recruitment strategies while maintaining reasonable labor costs compared to higher-wage coastal markets.

Houston’s ranking metrics suggest a balanced labor market with strong fundamentals: substantial working-age population, positive migration trends, consistent job creation, and educational capacity. These factors position the metro area as an attractive location for business expansion and talent acquisition strategies.

Conclusion

Houston’s 10th place LaborIQ ranking reflects genuine economic strength across multiple dimensions. The combination of population growth, job creation, educational capacity, and industry diversity creates a compelling case for HR investment. While wage growth presents near-term challenges, the metro area’s fundamental talent attraction and retention capabilities remain robust, supported by Texas’s broader business-friendly environment and Houston’s unique position as a global energy and logistics hub.

For organizations considering Houston for expansion or talent acquisition, compensation data supports the narrative it has a strong foundation, growing opportunities, and competitive positioning within the national landscape.