The Dallas-Fort Worth-Arlington metropolitan area has emerged as America’s premier destination for business growth, talent acquisition, and corporate relocations. According to the LaborIQ Index ranking of 150 top U.S. metropolitan areas, Dallas-Fort Worth holds the #1 composite ranking across 10 key economic indicators spanning labor markets, demographics, industries, and educational infrastructure. This comprehensive analysis reveals why DFW continues to dominate migration patterns and offers unparalleled opportunities for HR professionals and business leaders.

Migration Trends Driving DFW’s Unprecedented Growth

International Migration Leading Population Surge

Most of the 127,252 people who moved to D-FW between July 1, 2023, and July 1, 2024, are from another country, per U.S. Census Bureau figures. This international migration pattern represents a significant shift in DFW’s growth dynamics, bringing diverse skill sets and entrepreneurial energy to the region’s economy.

Domestic Migration: America’s Top Interstate Destination

Dallas-Fort Worth consistently ranks as the nation’s leading destination for domestic migration. Dallas-Fort Worth was the greatest beneficiary of this domestic migration, adding nearly 59,000 domestic movers in 2017, followed by Phoenix (51,000) and Tampa (41,000). North Texas is by far the most popular landing place for people who move to the Lone Star State.

Key migration sources include high-cost metropolitan areas where professionals seek better value propositions. Most of the relocations to D-FW in 2020 came from Houston, Los Angeles, Austin and New York City. Migration from San Francisco to North Texas jumped by more than 34%, highlighting the “California exodus” trend favoring Texas markets.

Fort Worth Milestone: Population Exceeds 1 Million

Fort Worth population in 2024 was 1,008,016 as of July 2024, marking a historic milestone that underscores the region’s sustained growth trajectory and expanding talent pool.

LaborIQ Market Ranking: Dallas-Fort Worth’s #1 Performance Metrics

Population and Growth Dynamics

- Total Population: 3.52 million (4th nationally)

- Population Growth Rate: 1.80% annually (6th nationally)

- Net Migration: 77,739 annually (1st nationally)

- Composite Ranking: #1 among 150 U.S. metropolitan areas

Labor Market Excellence

- Job Creation: 74,800 jobs annually (2nd nationally)

- Job Growth Rate: 1.70% (42nd nationally)

- Recovery Percentage: 112.4% (13th nationally)

- Current Job Availability: 109,956 active job postings on Indeed.com

Educational Infrastructure and Talent Pipeline

- Educational Attainment: 31.6% college degree holders (50th nationally)

- Annual Graduates: 163,522 new degree holders (7th nationally)

- Graduation Growth: 3.4% annually (113th nationally)

Wage Growth and Compensation Analysis for HR Professionals

Dallas-Fort Worth offers a compelling compensation landscape for both employers and employees:

- Average Hourly Wages: $35.51 (28th nationally)

- Wage Growth Rate: 3.4% annually (70th nationally)

This wage profile positions DFW as a cost-effective alternative to traditional high-cost markets while maintaining competitive compensation levels. The moderate wage growth rate indicates market stability rather than unsustainable inflation, creating predictable budgeting conditions for HR departments.

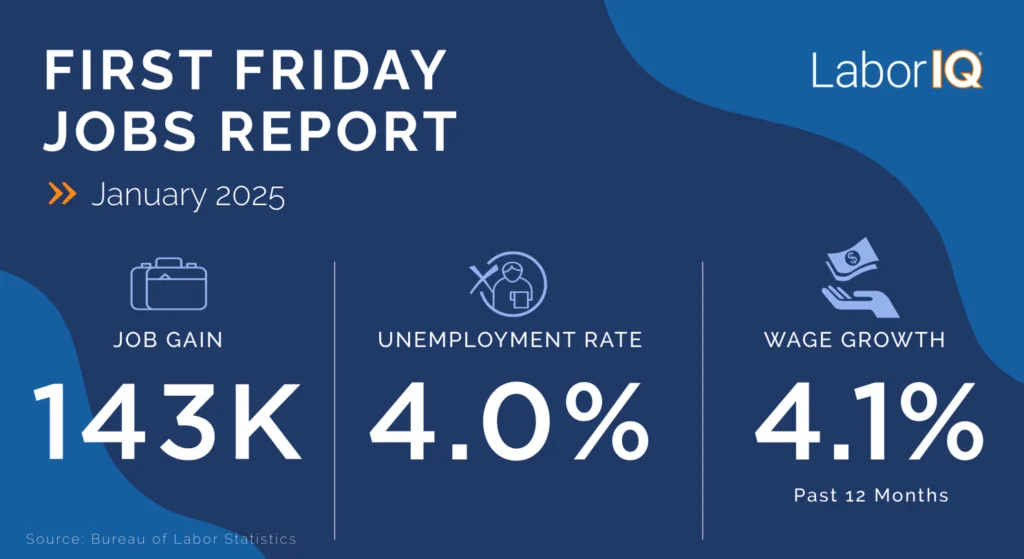

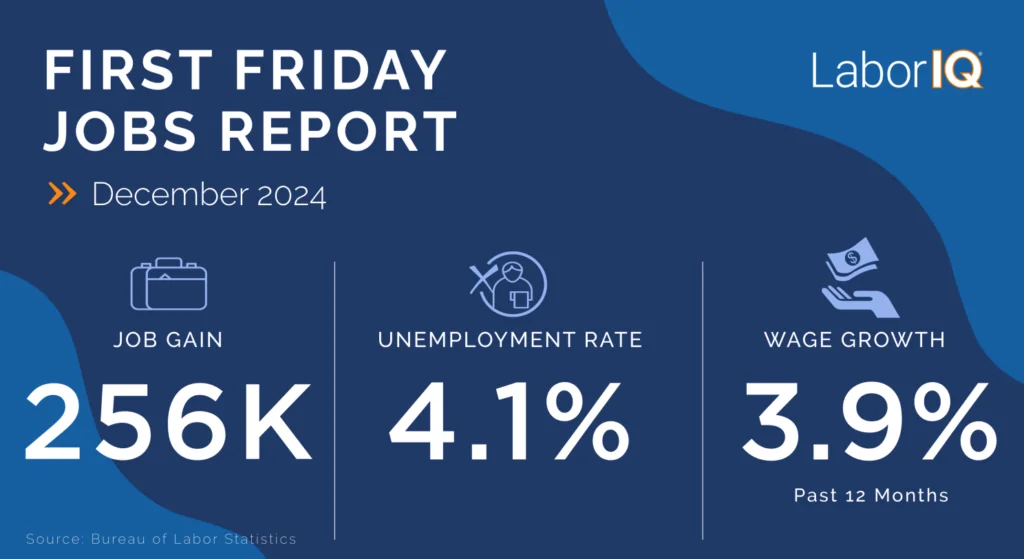

Recent Labor Market Performance

Total nonfarm employment for the Dallas-Fort Worth-Arlington, TX, metropolitan area increased by 53,600 over the year in February, demonstrating continued job market strength and opportunity for strategic hiring initiatives.

Corporate Headquarters Migration: Business Confidence Indicator

Dallas-Fort Worth’s appeal extends beyond individual professionals to Fortune 500 companies and emerging businesses. Dallas has been named the top city for corporate headquarters relocations in the United States, according to a recent survey by Site Selection Magazine. Dallas-Fort Worth gained 100 corporate relocations between 2018 and 2024, the highest of any metro area in the country.

High-Quality Job Creation Examples

Recent corporate relocations demonstrate the caliber of opportunities being created. Koya Medical Inc.’s headquarters relocation to Dallas plans to create approximately 220 new positions with an average annual wage of $62,400, exemplifying the quality job creation occurring across healthcare, technology, and professional services sectors.

Strategic Advantages for HR and Talent Management

Talent Acquisition Benefits

- Largest Net Migration Pool: The #1 net migration ranking provides access to diverse, motivated talent actively choosing DFW

- Educational Pipeline: 163,522 annual graduates create sustainable talent sourcing opportunities

- Interstate Migration: Proven track record attracting professionals from high-cost markets brings experienced talent

- International Diversity: Growing international migration adds global perspectives and language capabilities

Cost-Effective Operations

- Competitive wages without West Coast premiums

- Lower cost of living enhances compensation value

- Stable wage growth environment supports budget planning

- Business-friendly regulatory environment reduces operational complexity

Market Stability Indicators

- 112.4% recovery percentage demonstrates economic resilience

- Sustainable job growth rates indicate long-term market health

- The steady stream of headquarters relocations reflects strong business confidence and supports HR decision-making for long-term workforce planning.

- Diverse industry base provides economic stability across sectors

Future Growth Projections and Planning Considerations

Official population projections by state agencies indicate that Texas will become the most populous state by 2050, with Dallas-Fort Worth positioned to potentially surpass Los Angeles as America’s second-largest metropolitan area. This trajectory creates exceptional long-term opportunities for strategic workforce planning and business expansion.

Steady population growth helps ensure long-term workforce demand and allows HR and business leaders to plan with greater confidence.

Competitive Analysis: DFW vs. Other Major Markets

Dallas-Fort Worth was one of the top 5 fast-growing metro areas in the U.S., consistently outperforming traditional business centers in key metrics:

- Migration Leadership: Outpaces Phoenix, Tampa, and Austin in domestic migration

- Job Creation: Second only to major markets in absolute job creation numbers

- Corporate Confidence: Leads all markets in headquarters relocations

- Cost Advantage: Competitive positioning against California and Northeast markets

Actionable Insights for HR Professionals

Recruitment Strategy Optimization

- Target High-Cost Markets: Focus recruiting efforts on California, New York, and Illinois where migration patterns favor DFW

- Leverage Educational Partnerships: Develop relationships with local universities producing 163,522+ annual graduates

- International Talent Acquisition: Capitalize on growing international migration trends

- Quality-of-Life Messaging: Emphasize cost-of-living advantages in talent attraction campaigns

Retention and Development Planning

- Career Path Development: Leverage corporate headquarters concentration for internal mobility opportunities

- Compensation Strategy: Utilize moderate wage growth environment for sustainable compensation planning

- Diversity Initiatives: Embrace international and domestic migration for enhanced workforce diversity

Conclusion: Dallas-Fort Worth’s Unmatched Competitive Position

Dallas-Fort Worth’s #1 LaborIQ ranking reflects comprehensive excellence across all factors driving business success in 2025. The convergence of record-breaking migration, corporate headquarters relocations, educational infrastructure, and cost-competitive operations creates an unparalleled environment for HR professionals and business leaders.

The metropolitan area’s position as America’s fastest-growing major business center, combined with sustainable growth metrics and business-friendly policies, establishes Dallas-Fort Worth as the premier destination for organizations seeking competitive advantage through strategic talent management and long-term business planning.

For HR professionals evaluating expansion opportunities, talent acquisition strategies, or operational optimization, Dallas-Fort Worth offers the ideal combination of talent availability, cost efficiency, growth potential, and market stability that defines successful business markets in the modern economy.