The Chicago-Naperville-Elgin metropolitan area presents a complex labor market landscape for HR professionals and business leaders. With a working-age population of 3.7 million and a LaborIQ composite ranking of 125 out of 150 U.S. metropolitan areas, Chicago demonstrates both significant opportunities and notable challenges for talent acquisition and retention strategies.

Market Position and Demographics

Chicago ranks as the third-largest metropolitan area by working-age population nationally, providing access to a vast talent pool. However, the region faces headwinds with a -0.60% population growth rate (ranking 142nd) and net outmigration of 51,632 residents (ranking 149th). Declining population growth and outmigration are creating talent shortages and intensifying competition for skilled workers.

Despite population challenges, recent Census data shows renewed growth momentum. The Chicago metropolitan area experienced its ninth-largest numeric growth nationally in 2024, gaining 70,762 residents. This reversal of previous decline trends suggests stabilizing market conditions for HR planning.

Hiring Landscape and Job Market Dynamics

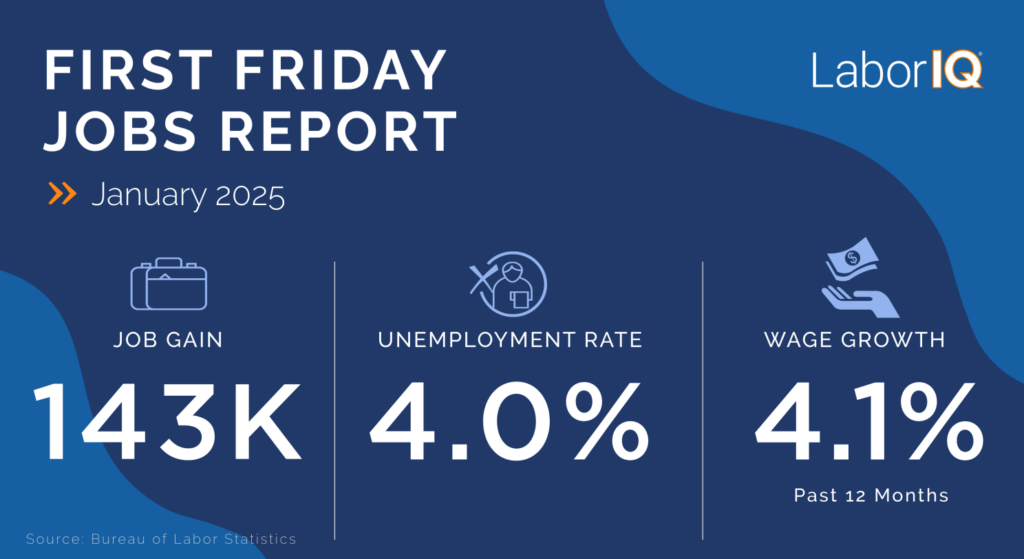

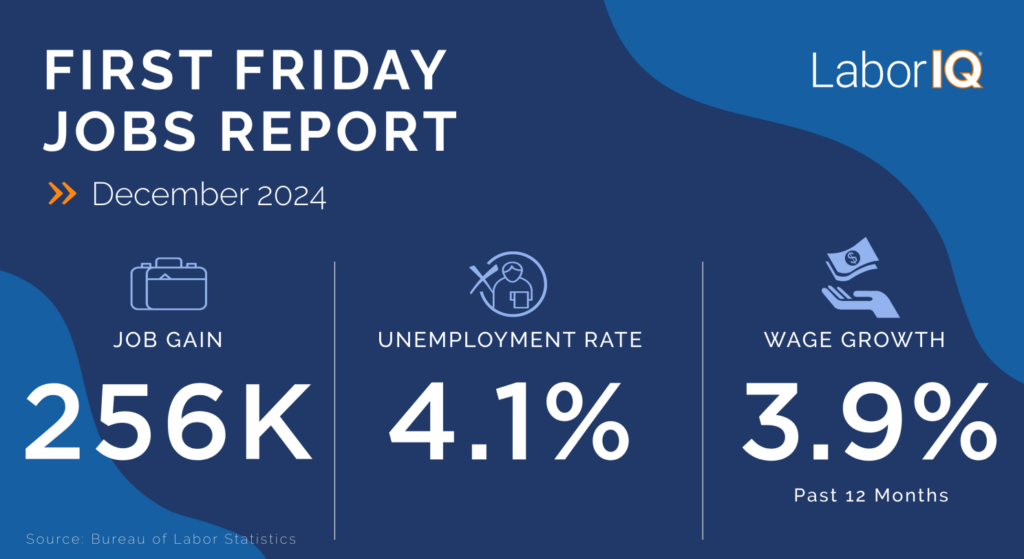

The Chicago job market presents mixed signals for HR professionals. The region generated 1,500 new jobs (ranking 119th) with flat 0.00% job growth (ranking 136th), indicating a stable but not expanding employment base. However, forward-looking indicators are more promising.

Recent business surveys reveal optimistic hiring intentions for 2025. KPMG research shows 84% of Chicago business leaders expect increased hiring this year, with 71% planning to expand office footprints. This positive sentiment contrasts with the region’s modest job creation metrics, suggesting pent-up demand for talent acquisition.

The sectors driving growth include government, private education and health services, and leisure and hospitality. Professional and business services experienced notable contractions, creating both challenges and opportunities for HR professionals managing workforce transitions.

Wage Growth and Compensation Trends

Chicago’s wage landscape offers competitive advantages for talent retention. The region’s median wage of $34.84 ranks 38th nationally, while wage growth of 2.40% (ranking 91st) demonstrates solid compensation progression. Total compensation costs for private industry workers increased 3.2% year-over-year through March 2025, indicating robust wage growth supporting talent retention efforts.

Chicago’s steady wage growth supports compensation strategies that help HR professionals attract and retain talent in a stable market, particularly when compared to national inflation rates. The city’s minimum wage will reach $16.60 per hour for employers with four or more employees by July 2025, establishing a competitive baseline for entry-level positions.

Educational Attainment and Talent Quality

Chicago’s educational profile represents a significant competitive advantage. With 35.10% of residents holding college degrees (ranking 26th nationally) and 238,883 total degree holders (ranking 3rd), the region offers access to highly skilled talent pools. Graduation growth of 3.80% (ranking 93rd) indicates steady pipeline development for knowledge-based industries.

This educational foundation supports HR strategies focused on high-skill, high-value positions across technology, finance, healthcare, and professional services sectors. The concentration of educational institutions and corporate headquarters creates a self-reinforcing talent ecosystem.

Migration Patterns and Workforce Dynamics

The region’s migration patterns present both challenges and opportunities for HR professionals. While experiencing net outmigration overall, Chicago is gaining high-earning residents while losing population in other segments. This selective migration creates a bifurcated talent market where skilled professionals are increasingly concentrated while entry-level talent may become scarcer.

Immigration continues to drive population growth, with international migration offsetting domestic outmigration. This dynamic creates opportunities for HR professionals to tap into diverse, globally-minded talent pools while requiring cultural competency and inclusive hiring practices.

Strategic HR Recommendations

Success requires balancing retention efforts with selective recruitment, leveraging educational advantages while addressing migration challenges, and positioning for recovery while preparing for future growth.

- Talent Retention Focus: With limited job growth and ongoing outmigration, prioritize retention strategies including competitive compensation, career development, and workplace flexibility.

- Selective Recruitment: Leverage the region’s educational advantages by targeting high-skill positions while developing creative strategies for entry-level talent acquisition.

- Wage Competitiveness: Utilize favorable wage growth trends to attract talent from other markets while maintaining cost-effectiveness.

- Diversity and Inclusion: Capitalize on immigration-driven growth by implementing inclusive hiring practices that attract international talent.

- Recovery Positioning: With 100% recovery percentage (ranking 123rd), Chicago offers stability for long-term workforce planning while maintaining flexibility for growth opportunities.

Conclusion

Chicago’s labor market requires clear, data-driven HR strategies to address shifting demographics and evolving workforce needs. While demographic headwinds create challenges, the region’s educational assets, wage competitiveness, and business optimism provide substantial opportunities for organizations willing to adapt their talent strategies.