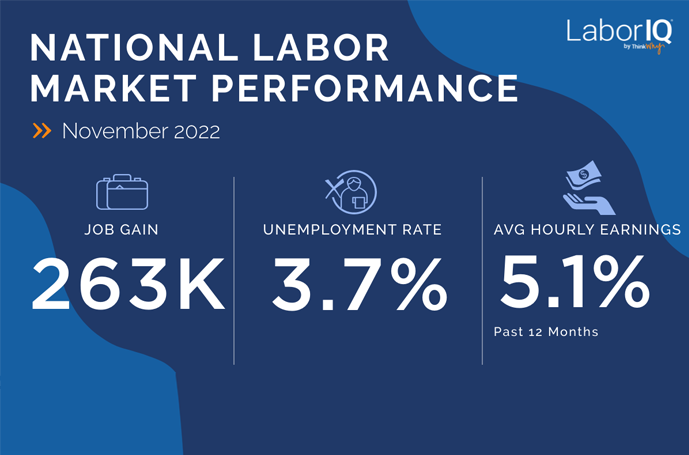

The economy added a solid 263,000 jobs in November, above economists’ expectations of around 200,000. The labor market continues to add jobs at a very robust pace. And, despite expectations of a slowdown and overall uncertainty in the broader economy, it looks like we’ll be waiting until 2023 for signs that the labor market is really cooling off, at least related to job gains.

November’s 263,000 job gains suggest the labor market has not gotten the memo about broader uncertainty and recession expectations. While the last four months show a more moderate pace of growth, compared to earlier this year, November’s net job gains are still well above the pre-pandemic average of 200,000 jobs added per month. (And numbers for September and October were revised downward by a modest 23,000.)

This month’s job gains bring the total for 2022 to just over 4.3 million, an average of 392,000 jobs added per month – more than double the pre-pandemic average job gains. Hiring remains strong and the labor market is still tight – a trend that’s unlikely to let up any time soon. The competition for talent is remains fierce and employers should focus on employee retention.

Demand for Talent

Job openings are a key indicator of labor demand, and October’s job openings reported earlier this week showed a steady decline by 353,000 to 10.3 million, still well-above pre-pandemic levels.

As things cool off, job openings should continue to normalize, falling from historic levels reached earlier this year. For 2023, LaborIQ projects an average of around 9 million job openings per month, still much higher than the 2015 to 2019 average of 6.4 million monthly job openings.

Hiring & Layoffs

Hiring is starting to moderate, but layoffs have not increased at the pace we could expect going into a slowdown. And while there have been many high-profile layoffs, the number ticked up only slightly month-over-month to 1.4 million per month in October – still near historic lows – compared to around 1.9 million monthly layoffs before the pandemic.

One factor that has limited the impact of layoffs so far is that labor demand remains strong. Even before there were widespread expectations of a recession or slowdown, most businesses struggled to hire and retain talent. Because of strong labor demand and the unfilled vacancies that piled up over the past couple of years, many businesses are able to hire workers who have been laid off.

What’s happening with wages?

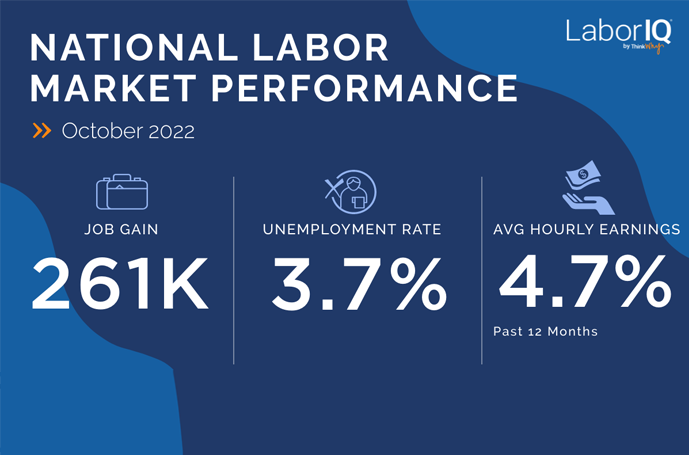

As demand for workers starts to moderate, we’d expect record wage growth to ease. November’s jobs report shows 12-month wage growth hitting 5.1%, up from 4.9% in October. After hovering near 5% since 2022, LaborIQ® forecasts that wage growth will moderate substantially in 2023, with annual growth below 2.5%.

The Outlook

Projections show 2023 looking like a more “normal” year with the potential for a deeper slowdown or recession. LaborIQ® forecast scenarios for 2023 range from around 600,000 total jobs lost to 1.2 million net job gains.

While there are broader economic challenges and uncertainty, 2022 will still close out one of the strongest years for hiring in history.