The Los Angeles-Long Beach-Anaheim metropolitan statistical area stands as America’s second-largest labor market, presenting both tremendous opportunities and unique challenges for HR professionals and employers. The LA Metro has demonstrated resilience despite facing headwinds in population growth and net migration patterns.

Labor Market Position and Performance

According to the June 2025 LaborIQ Index analysis of 150 top U.S. metropolitan areas, the Los Angeles Metro ranks 62nd. The LaborIQ Index measures performance across ten key economic indicators, helping HR leaders evaluate labor market strength, industry trends, and workforce demographics. This positioning reflects a complex labor market characterized by strength in absolute numbers but facing demographic and economic pressures that require strategic HR consideration.

The metro area’s working-age population of 5,500,898 ranks second nationally, providing employers with an enormous talent pool. However, the region’s 12-month working age population growth rate of just 0.20% (ranking 71st) and negative net migration of -45,007 (ranking 148th) signal important demographic shifts that HR leaders must address in their talent acquisition strategies.

Job Market Dynamics and Growth Opportunities

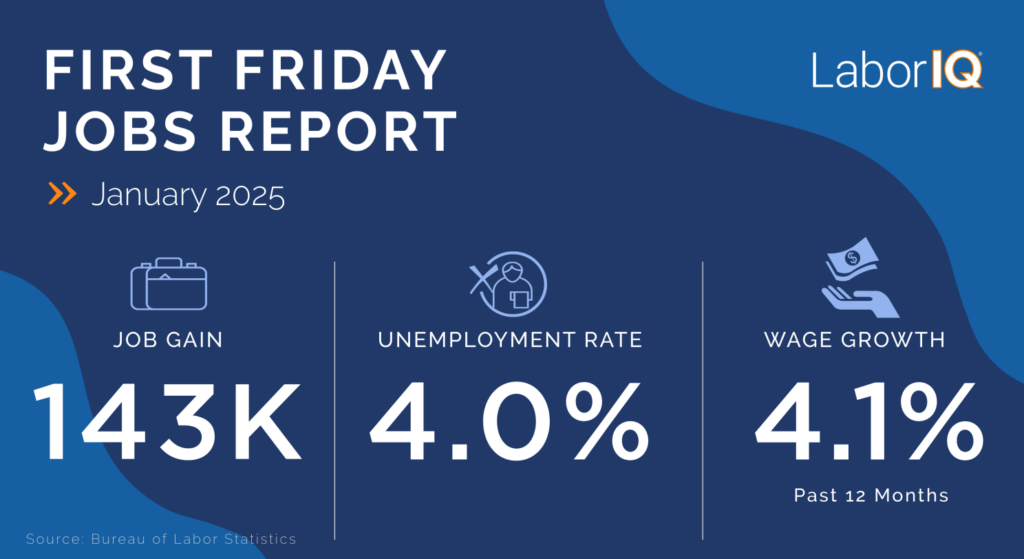

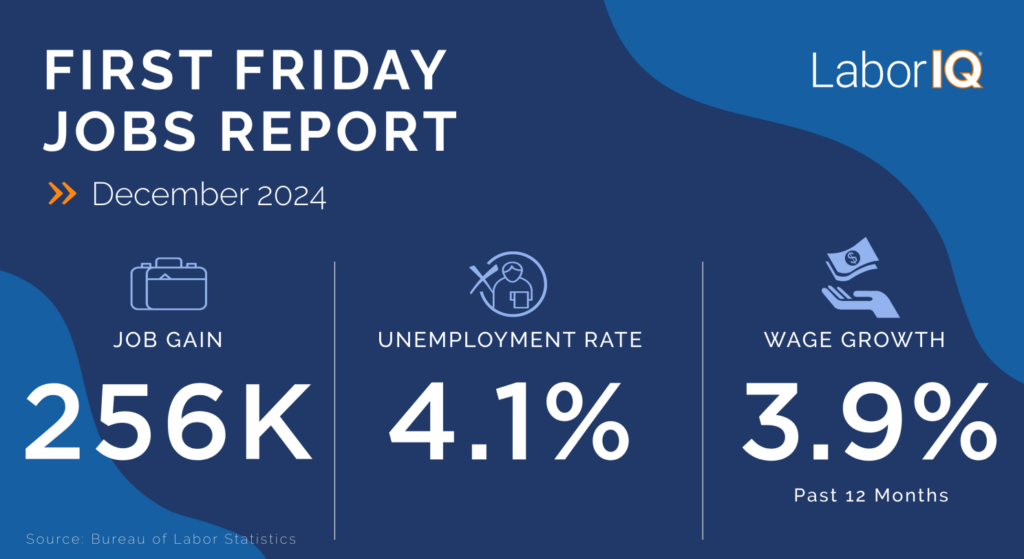

Despite demographic challenges, Los Angeles demonstrates robust job creation capabilities with 57,100 new jobs added, ranking 4th nationally in absolute job gains. The metro’s job growth rate of 0.90% (86th ranking) indicates steady but not exceptional expansion relative to other major markets.

Recent labor market data reveals encouraging signs for 2025. Los Angeles County added over 45,000 jobs between December 2023-2024, representing 1% growth. Current job availability remains strong, with over 64,000 positions posted across various sectors including technology, healthcare, entertainment, and professional services.

The technology sector continues expanding, with numerous startups and established companies actively hiring. Entertainment and media production, while recovering from recent industry strikes, maintains its position as a key economic driver despite employment levels remaining below pandemic peaks.

Wage Growth and Compensation Trends

Employers in the LA Metro must prioritize compensation strategy and salary benchmarking to remain competitive in a market with rising costs and moderate wage growth. The region’s average wage of $38.65 per hour ranks 14th nationally, demonstrating the market’s ability to offer competitive compensation packages. However, wage growth of 2.00% (ranking 93rd) lags behind many other major metropolitan areas, presenting challenges for talent retention.

The median salary in Los Angeles is projected at approximately $65,000 annually for 2025, though this varies significantly by industry and experience level. The cost of doing business in Los Angeles remains approximately 20% higher than the national average, requiring employers to adjust compensation strategies accordingly.

Local minimum wage regulations add complexity to compensation planning. Los Angeles city minimum wage increased to $17.28 per hour effective July 2024, significantly above state and federal minimums, impacting entry-level hiring strategies across all sectors.

Educational Attainment and Talent Pipeline

The region’s educational profile presents both opportunities and challenges for HR professionals. With 31% educational attainment (ranking 53rd) and 421,180 college degree holders (ranking 2nd nationally), Los Angeles offers access to a highly educated workforce. The graduation growth rate of 4.3% (ranking 48th) indicates steady improvement in the talent pipeline.

Local community college consortiums are actively addressing workforce development, with 19 Los Angeles County community colleges focusing on upskilling programs for adult, disenfranchised, and incumbent workers. This infrastructure supports both employee development initiatives and creates pathways for recruiting skilled candidates.

Migration Patterns and Talent Acquisition Implications

The negative net migration of -45,007 represents one of Los Angeles Metro’s most significant HR challenges. This outflow suggests that despite job opportunities and competitive wages, other factors—including cost of living, housing affordability, and quality of life considerations—are driving talent to other markets.

HR leaders must develop comprehensive talent attraction strategies that address these broader lifestyle factors. This includes enhanced remote work options, comprehensive benefits packages that address housing costs, and workplace culture initiatives that emphasize the unique advantages of the Los Angeles market.

Strategic HR Recommendations

The region’s diverse economic base—spanning entertainment, technology, international trade, aerospace, and healthcare—provides resilience against sector-specific downturns. However, HR professionals must remain agile in responding to industry-specific challenges, particularly in entertainment and film production sectors still recovering from recent labor disputes.

- Talent Acquisition Strategy: Focus on highlighting Los Angeles’ unique industry clusters, cultural amenities, and career advancement opportunities. Develop targeted recruitment campaigns for specific skill sets rather than relying solely on population-driven talent availability.

- Compensation Competitiveness: While wage growth lags, total compensation packages can emphasize benefits that address local cost-of-living challenges, including housing assistance, transportation benefits, and flexible work arrangements.

- Retention Initiatives: Given negative migration trends, employee retention becomes critical. Implement comprehensive career development programs, mentorship opportunities, and workplace flexibility to reduce turnover costs.

- Partnership Development: Leverage the region’s extensive educational infrastructure for talent pipeline development. Collaborate with local colleges and universities for internship programs, continuing education, and upskilling initiatives.

Conclusion

Los Angeles Metro presents a complex but opportunity-rich environment for HR professionals. While facing challenges in population growth and migration patterns, the region’s massive talent pool, competitive wages, and diverse economic base create substantial opportunities for organizations with strategic HR approaches. Success requires acknowledging demographic headwinds while leveraging the market’s fundamental strengths in talent availability, educational infrastructure, and economic diversity.

Organizations that can address cost-of-living concerns, provide compelling career advancement opportunities, and offer flexible work arrangements will be best positioned to attract and retain talent in this dynamic metropolitan market.