As the world begins to come out on the other side of the COVID-19 pandemic, many industries are experiencing a slow but steady recovery.

However, some sectors were hit particularly hard, so now they face an even more challenging recovery path.

However, despite their obstacles, many businesses in these industries are finding ways to adapt and thrive in the post-pandemic landscape.

Here, we’ll explore how slow-recovery industries are reviving and navigating the unique challenges and opportunities presented to them.

Industries That Had It the Worst

To compound the astonishing recovery of the industries we’re looking at today, it’s essential to get a sense of how they were impacted during the height of the pandemic. For these purposes, we’ll refer to the economic observatory.

More specifically, we’ll turn our attention to three industries deemed some of the worst impacted:

- Hospitality and travel

- Retail and sales

- Food services

Let’s take a gander at each:

Hospitality and Travel

Before the COVID-19 pandemic, the hospitality and travel industry was thriving, with millions of people traveling daily for leisure and business.

However, the pandemic led to the closure of borders, grounding of flights, and lockdowns, resulting in a massive decline in the hospitality and travel industry.

Hotels, airlines, and cruise lines experienced huge losses due to decreased bookings and cancellations. To put this perspective, research shows US hotels lost an excess of $46 billion, and in the EU, hotel occupancy fell by 34%.

However, as the world has adapted to living with COVID, the hospitality and travel industry has started to recover. With the introduction of vaccination programs and the easing of travel restrictions, people are beginning to book vacations and business trips again.

In addition, many hotels and airlines have also implemented more rigorous health and safety measures in an attempt to reassure customers—for example, increased cleaning, access to hand sanitizer pumps, and contactless check-in.

As a result, the industry is seeing an increase in bookings and a return to pre-pandemic levels. In fact, insurance broker Hub International now reports that wages in this industry are up by 18%, consumer interest in sustainable travel has now reached 87%, and a forecast by PWC expects that by the end of 2023, revenue will be back to 85% to 98% of pre-pandemic levels.

Retail and Sales

Retail Research explains that the pandemic forced many brick-and-mortar stores to shut their doors temporarily, resulting in significant revenue losses. Couple this with fewer people going out to shop thanks to lockdowns; it’s no marvel that retail was hit particularly hard. NLC reported that retail job losses during the pandemic were even worse than the great recession of 2008, with the peak of the pandemic recording almost 13 million job losses in retail in just a year.

In response to the pandemic, many retailers shifted their focus online to cash in on the increased demand for home delivery services. This adaptability helped many businesses stay afloat during the pandemic.

For many in-person retailers, eCommerce was the turnaround they needed to survive. For instance, we see Insider Intelligence report that online retail growth sat at 26.7% during the pandemic, while regular retail sales fell to -2.6%.

As we move into 2023, a Deloitte report shows that the top 250 retailers worldwide report an 8.5% year-on-year growth. Moreover, many businesses have adjusted their strategy since the pandemic, moving towards more sustainable and digital operations, undoubtedly making their recovery more successful. For instance, if we look at the top ten retailer leaders specifically, the report observes that JD has become one of the fastest-growing retailers due to its 25.1% growth in online retail revenue.

Food Services

The pandemic also heavily impacted the food services sector. With restrictions on indoor dining, temporary closures, and supply chain disruptions (which led to increased prices for ingredients), it’s safe to say this industry faced its fair share of challenges!

Then if you couple all that with the consumer price index hike of 2.1 to 20.4% for various food categories in 2020 and further supply chain disruptions due to the war in Ukraine, it’s no wonder that the food service sector is still recovering.

However, similar to traditional retailers, many restaurants pivoted to offering online ordering and home delivery services. Other restaurants implemented creative solutions, such as setting up outdoor dining areas.

Interestingly, the online food delivery market is expected to reach a massive $39 billion by the end of this year, and as a segment of the food delivery market, it will account for 82% of the total market. Furthermore, if we look at this market’s revenue change, it’s clear that many services traditionally bound to in-person sales have shifted to the online market. For instance, while online food service revenue was just $480(per consumer each year by 2023, this has already gone up to $690, with predictions going up to $1000 by 2027.

But now, many restaurants can operate as they did pre-pandemic, leading to an increase in foot traffic and revenue. The latest 2023 TouchBistro reports that restaurant sales have recovered 75% of pre-pandemic sales volumes.

How Will This Affect Recruitment?

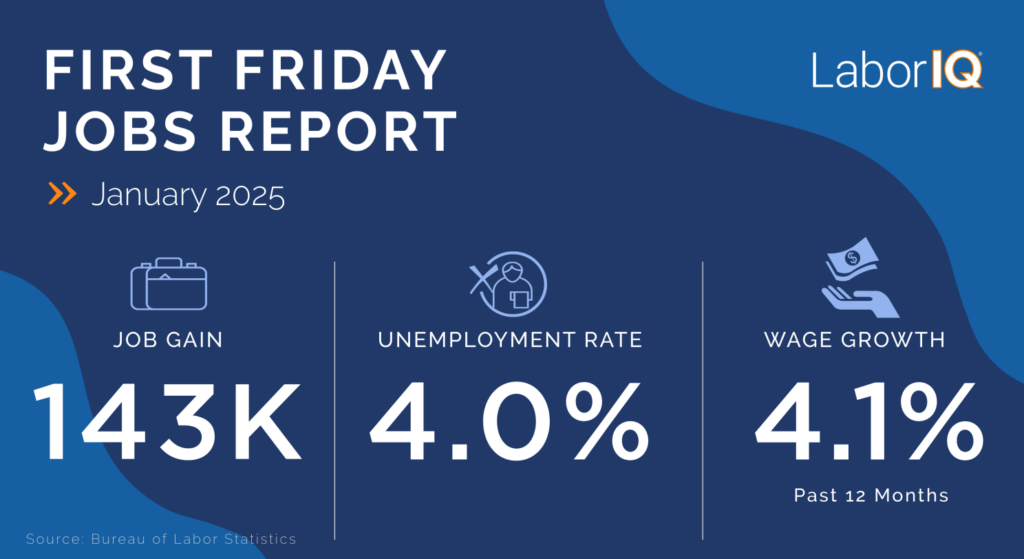

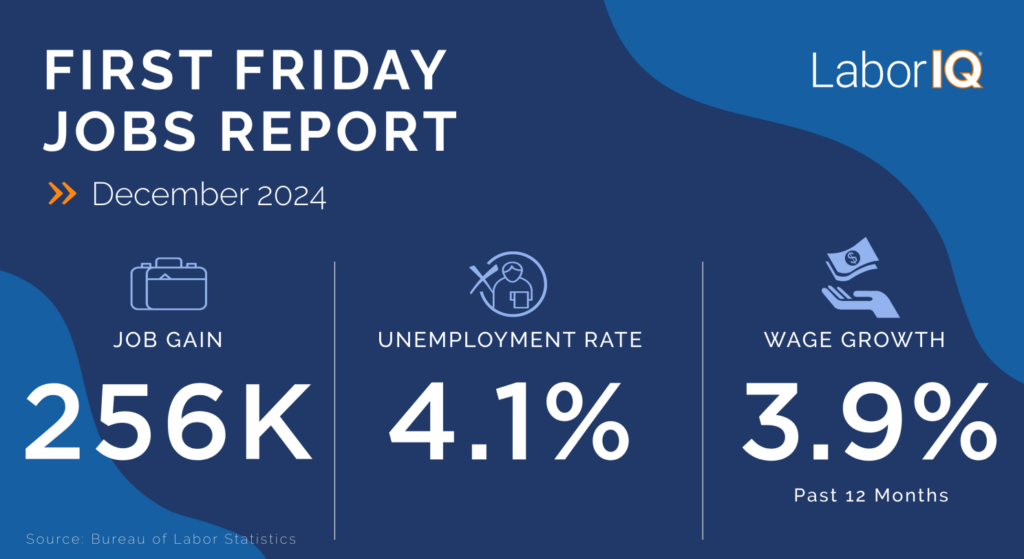

It’s clear that many slow-recovery industries have found new and innovative ways to adapt and thrive, and this trend is expected to continue. This will likely profoundly affect the labor market as businesses reboot their recruitment drives to bolster their post-pandemic recovery. According to recent employment data, a few industries walloped by the pandemic are starting to see job gains.

For example, BLS reports that the US government plans to add 8.3 million jobs to the economy in the next ten years; of those, 23.1% (equivalent to 1.9 million) jobs will be in the hospitality industry.

However, while the job market may be improving in some sectors, it’s important to note that the labor market as a whole is still competitive. Not least because there’s a shortage of skilled workers in some industries. For instance, 97% of restaurants still say they’re short on at least one crucial position, with the average number of shortages at five per restaurant.

This shows that even as slow-recovery industries create more job opportunities, competition for top talent will remain fierce.