The economy added an unexpected 517,000 jobs in January, completely smashing economists’ expectations of 187,000. January’s job gains are puzzling given the headlines and expectations of a slowdown in hiring. Not only is this well-above recent months’ job gains, but it’s the highest since July 2022.

Those hoping this report would be evidence for the Federal Reserve to pause interest rate hikes are likely to be extremely disappointed.

The 517,000 jobs added by employers in January is head-scratching, as all indications were that the labor market was beginning to cool. The labor market has proven resilient – if not overheated. Not only are companies backfilling roles as employees leave for other opportunities, but many businesses seem confident enough to be adding new positions as well. January’s net job gains are considerably higher than last year’s 400,000 monthly average, and they’re more than double the pre-pandemic average of 200,000 jobs added per month.

The first jobs report of the new year also includes revisions to employment totals for 2022. These revisions indicate employment was over 800,000 more than initially reported.

Demand for Workers Remains Strong

The Federal Reserve has increased interest rates at an unprecedented pace in an attempt to lower labor demand and stem record inflation, but this January’s report indicates that businesses are still hiring at an accelerated pace. The labor market is among the tightest in history, and the competition for talent remains fierce.

Job openings are a key indicator of labor demand. And December’s job openings reported earlier this week, showed no signs that companies are letting up on hiring. Job openings held steady at 11 million, much higher than the 2015 to 2019 average of 6.4 million monthly job openings.

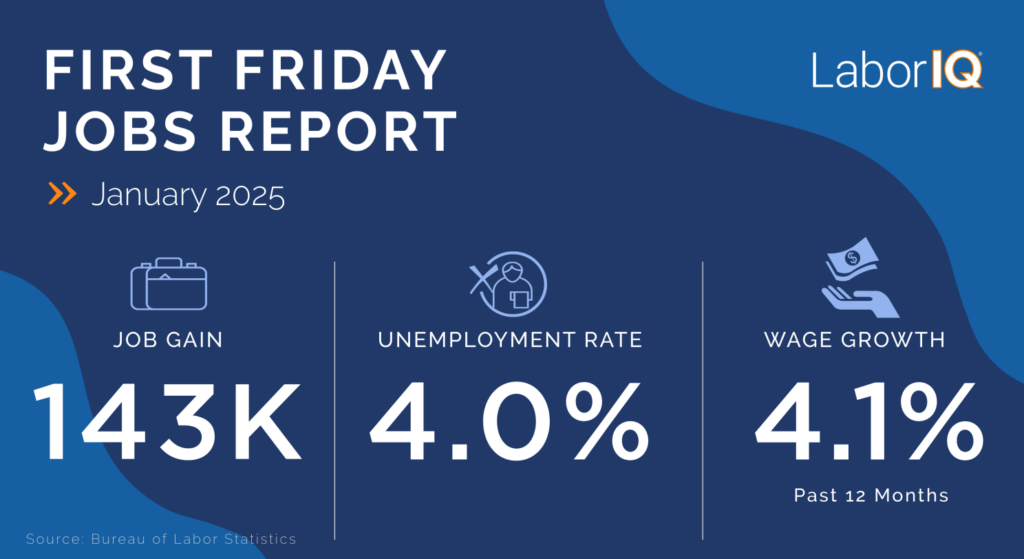

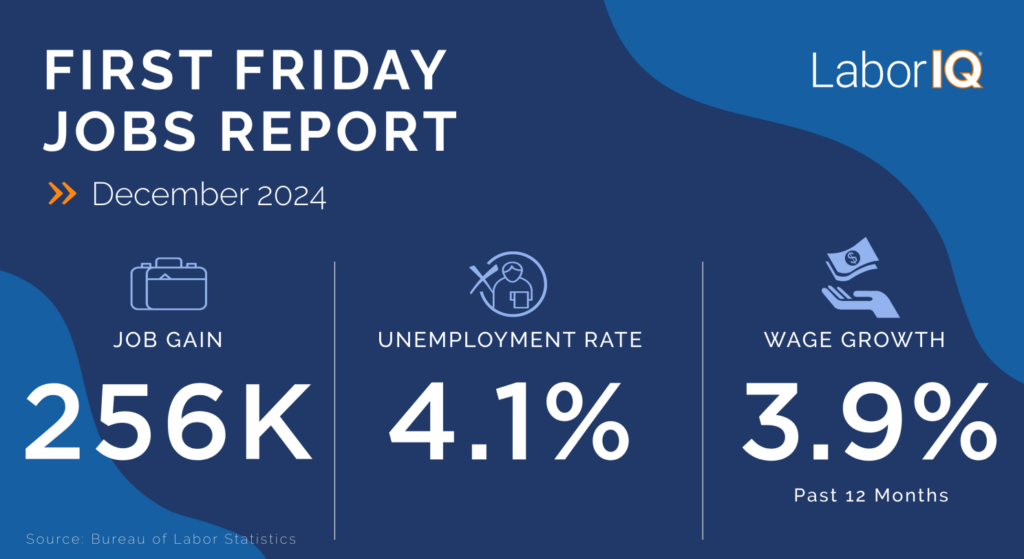

As demand for workers starts to moderate, we’d expect record wage growth to ease. January’s jobs report shows 12-month wage growth decreased to 4.4%, a silver lining for those hoping the Fed may slow interest rate increases. Wage growth has been slowing gradually since March 2022, when the Fed began raising rates, and our expectation is that this will continue through early 2023.

Layoffs Remain Near Historic Lows

Hiring is still strong and layoffs have not increased at the pace we could expect going into a slowdown. While there have been many high-profile layoffs, the number was essentially unchanged month-over-month at 1.5 million per month in November – still near historic lows – compared to around 1.9 million monthly layoffs before the pandemic.

The unemployment rate ticked down to 3.4% – another historic low. With 11 million job openings but fewer than 5.7 million unemployed workers available to fill those open roles, there are nearly two open jobs for each unemployed worker.

2023 Outlook

Our prediction for 2023 is moderation to historic norms. Are January’s job gains an outlier or a sign that the labor market is hotter than many thought?

LaborIQ® forecast scenarios for 2023 range from around 600,000 total jobs lost to 1.2 million net job gains. After hovering near 5% since 2022, LaborIQ® forecasts that wage growth will moderate substantially in 2023, with annual growth around 2.5%.

Companies will need to watch the labor market and track compensation trends closely this year.