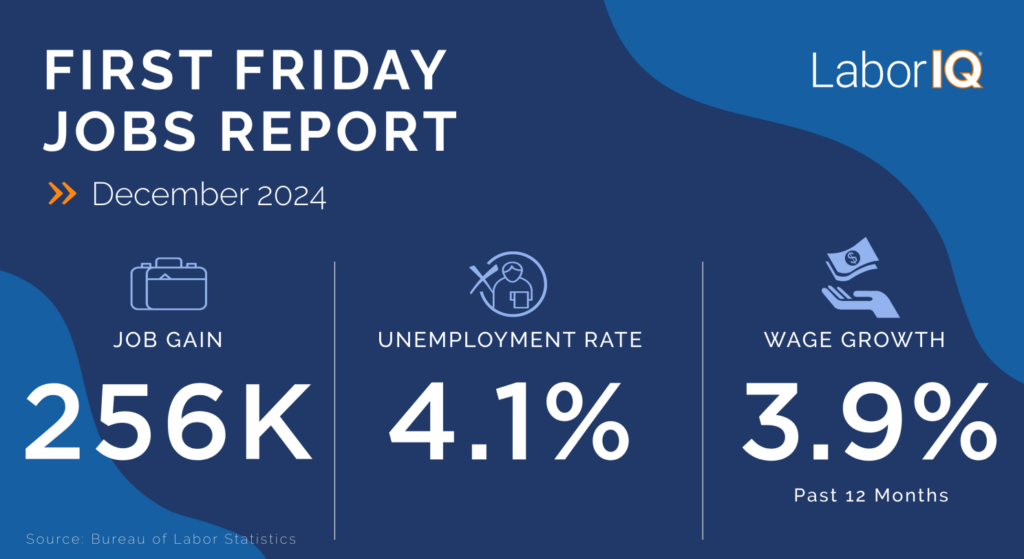

This week, we are breaking down the latest “First Friday” jobs report. The August jobs report was marginally better than July’s report, but the labor market continues to move in the wrong direction.

U.S. businesses added 142,000 jobs in August, just below expectations of around 160,000. The unemployment rate ticked down to 4.2% from 4.3% in July, and 12-month wage growth increased to 3.8%.

This jobs report provides yet another set of data points indicating that the labor market is cooling but not falling off a cliff.

Businesses are in a bind from the dual challenges of robust wage growth and a more sluggish economy. Slower economic growth puts pressure on budgets and creates uncertainty heading into 2025. However, competition for talent remains strong, and businesses not keeping up with compensation trends face the risk of losing top talent.

Job gains | Cooling continues

The 142,000 jobs added by U.S. businesses last month is not concerning on the surface. August’s modest total brings annual job gains to about 1.5 million, or an average of 184,000 new jobs per month through the first eight months of the year. Putting the average monthly gains into context, 2024’s job creation is in line with historic periods of moderate – and even relatively strong – growth.

However, revisions to June and July’s hiring totals show the labor market was even weaker than we thought over the past couple of months. The economy added 86,000 fewer jobs than originally reported.

Revisions are common, but the recent downward revisions are consistent with an economy that’s clearly in a period of slower growth. Over the long term, downward revisions are about as common as upward revisions. But during periods of economic slowdown, downward revisions tend to be more common.

Industries | Private-sector growth remains slow

Once again I feel like a broken record. Job gains were concentrated in just a few industries in August. Government, healthcare, and leisure and hospitality, along with construction, accounted for 135,000 job gains – 95% of all jobs added last month.

Private-sector job growth is sluggish.

The largest job losses were in information (-7,000) and manufacturing (-24,000). All other sectors added jobs at a modest pace.

Unemployment rate | Ticking down

The unemployment rate fell to 4.2% last month, largely due to workers impacted by temporary layoffs being recalled back to their jobs. Last month, I mentioned the impact of Hurricane Beryl in Houston on July’s jobs report, noting a large increase in unemployment due to temporary layoffs. Thankfully, it appears that those workers were able to return to their jobs.

Right now, the challenge with unemployment is not that layoffs are increasing but that the pace of hiring can’t keep up with even modest increases in unemployed workers.

The current state of unemployment and hiring present challenges to job seekers and talent acquisition leaders, alike. For job seekers, it’s more difficult to find a job because there are fewer open roles and more competition for each opportunity. And for talent acquisition professionals, a hiring slowdown means fewer placements.

Wages and compensation | Good news for workers

On an annual basis, wages grew by 3.8% in August, up from 3.6% in July. Wage growth has outpaced inflation since early 2023.

While hiring has slowed considerably in 2024, wage growth has remained robust. For businesses that are hiring, there’s still a lot of competition for top talent. As we head into budget and merit planning season, compensation will remain an important part of talent attraction and retention strategies.

What’s in store for 2025?

This year brought a cooling economy, along with slower hiring and more uncertainty. The one thing most agree on is that the Fed will begin cutting interest rates at its next meeting from September 17-18, 2024. But what will that mean for 2025 hiring and economic growth?

Stay for our LaborIQ 2025 outlook to understand what the next year has in store for your industry and region.