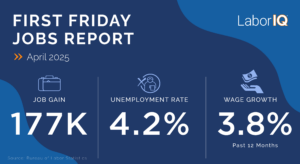

April’s jobs report paints a picture of a solid U.S. labor market. Businesses added 177,000 new jobs in April, just above expectations of around 140,000. The unemployment rate held steady at 4.2%, and 12-month was also unchanged at 3.8%.

The Labor Market is a Bright Spot amid Growing Uncertainty

Once again, the jobs report and other headlines about the economy are out of sync.

The good news is that the U.S. labor market is showing strength and has proven to be incredibly resilient in the face of uncertainty and policy changes. However, there are more looming downside risks than there are potential bright spots.

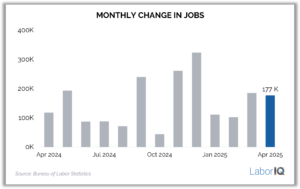

The 177,000 jobs added by U.S. employers in April represents solid growth, bringing 2025 average monthly job gains to 155,000. As is common in a cooling labor market, downward revisions indicate the labor market added 58,000 fewer jobs in February and March than initially reported. Don’t be surprised if April’s numbers are also revised downward to reflect more modest growth.

Can the labor market’s underlying strength overcome policy uncertainty?

The big question heading into the April jobs report was around the extent to which tariffs would impact hiring. So far, the effect seems muted, but it could take weeks or months to see and feel any negative impacts of trade policy.

Alternatively, the labor market could continue on this path of resilience despite the challenges and uncertainty.

Job gains | Resilience continues but uncertainty persists

The 177,000 jobs added in April came in above expectations. Over the last 12 months, the U.S. economy has added more than 1.8 million new jobs – a solid trend. Uncertainty around trade policy and its impact on businesses and consumers are driving pessimism about the trajectory of the labor market through the end of 2025.

Industries | Anticipating tariff impacts

Healthcare (+51,000) continues to dominate.

Notably, construction (+11,000) and trade, transportation, and utilities (+32,000) added jobs despite headwinds from interest rates and trade policy, respectively. Trade, transportation, and utilities will be an industry to watch going forward. The hiring spike in April is likely the result of stockpiling products and imports in anticipation of tariffs. In addition, UPS announced plans to lay off 20,000 workers in the coming months, which could slow potential job gains in the industry going forward.

Manufacturing (-1,000) and Federal government (-9,000) were two weak spots in an otherwise solid report. For manufacturing, one month of data does not make a trend, but it is an industry that’s among the most vulnerable to trade policy.

Since January, the Federal government workforce has decreased by nearly 30,000 workers, a total that doesn’t include those who are on leave. Estimates of anticipated Federal workforce cuts range from 50,000 to 150,000.

Unemployment rate | Stable but concerns grow for college grads

The unemployment rate held steady at 4.2% in April. Despite a slowdown in hiring, the labor market remains tight by historical standards. One area for concern is the unemployment rate among 20–24-year-old workers, which increased from 7.5% in March to 8.2% in April.

The combination of an increase in layoffs among transportation, manufacturing and Federal workers, along with new graduates entering the market this May, could drive an increase in unemployment rates and the time it takes to find a new role for unemployed workers. For businesses, this means an increase in the supply of talent.

Wage growth | Holding steady

Annual wage growth for U.S. worker has held steady at 3.8% despite a slowdown in hiring, uptick in layoffs, and business uncertainty. This continues to be good news for workers who have been crunched by inflation. However, businesses will need to balance budgets amid continued uncertainty and compensation trends that are not returning to pre-pandemic levels.

LaborIQ provides HR teams and business leaders with market-competitive compensation benchmarks. In an evolving job market, you need to know what salaries to offer to retain employees and fill open positions faster.

Want to hear about how LaborIQ can help your HR team? Learn more

Insights Newsletter

Stay up to date on employment conditions, workforce trends and growth strategies